Inheritance tax rakes in £4.4bn for HMRC as 'record-breaking' raid hits families before Rachel Reeves changes

IHT is levied on estates of those who have passed away at a rate of 40 per cent

Don't Miss

Most Read

Latest

HM Revenue and Customs (HMRC) data reveals inheritance tax (IHT) collections reached £4.4billion between April and September ahead of looming changes from Chancellor Rachel Reeves.

The figure represents a £100million increase, prompting speculation about potential tightening of exemptions in the forthcoming fiscal statement. Wealth management professionals warn that current gifting allowances may face restrictions as the Chancellor seeks additional revenue streams.

The existing framework permits tax-free transfers seven years before death, alongside immediate exemptions for regular gifts from surplus income. These provisions now appear vulnerable to reform ahead of the November 26 Budget announcement.

As is stands, the IHT threshold has remained static at £325,000 since 2009, whilst the residence allowance stays fixed at £175,000. This prolonged freeze creates a stealth tax effect as property and investment values climb annually.

Inheritance tax is raking in billions for the Treasury

|GETTY / PA

"With the nil-rate band frozen at £325,000 since 2009 and the residence nil-rate band static at £175,000, fiscal drag is quietly pulling thousands more families into the IHT net as asset values increase year-by-year," explained Ian Dyall, the head of Estate Planning at Evelyn Partners.

He added: "The Treasury is on course for another record-breaking year of revenues from inheritance tax." Further reforms scheduled for April, including changes to agricultural and business property reliefs plus pension inclusion in estates, will intensify the burden.

Middle-income households increasingly discover themselves liable for substantial death duties despite considering their wealth unremarkable, economists warn.

Investment professionals highlight particular concerns about extending the current seven-year rule to a full decade.

Britons are looking for ways to avoid paying inheritance tax

| GETTYNicholas Hyett, the investment manager at Wealth Club, cautioned: "Shifting the seven-year rule to a ten-year rule is one option.

"Gifts made up to ten years before death could be taxed as if they were part of the estate – making one-off gifts to children to help with things like buying a new house potentially problematic, especially for those who die young, piling financial pain on top of personal grief."

Such changes would significantly impact parents assisting offspring with property deposits or other major life expenses.

The Office for Budget Responsibility (OBR) anticipates inheritance tax collections will surpass £9billion within two years, potentially reaching £14billion by decade's end.

A recent survey commissioned by Saltus found that nearly one in five high-net-worth individuals believe IHT is a the "most unreasonable tax" in Britain.

Furthermore, a majority of respondents in the poll believe the levy should either be scrapped entirely or have its threshold raise.

One in three of people polled are actively considering ways to protect their pension savings from being made liable for inheritance tax.

LATEST DEVELOPMENTS:

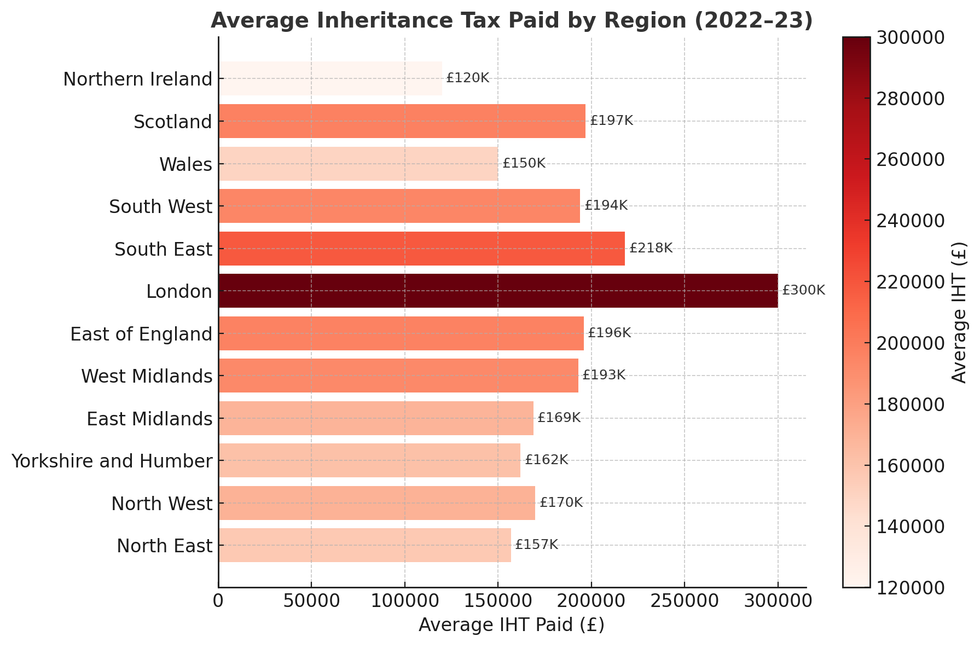

Average Inheritance tax paid by region | CHATGPT/ONS

Average Inheritance tax paid by region | CHATGPT/ONSAlex Pugh, financial planner at wealth manager Saltus, said: "Tax has become one of the biggest sources of uncertainty for clients this year, not just because of what’s been announced, but because of what might come next.

"Inheritance Tax in particular is politically sensitive, and the decision to bring pensions into scope from 2027 has really sharpened focus on long-term planning.

"Many clients are asking whether the rules could change again, and how to prepare without making reactive decisions.

“The most common question I’ve had recently is about tax-free cash. Clients are understandably nervous about whether that could be targeted next. This concern underlines just how much confidence has been shaken by the pace of change."

More From GB News