Inflation forecast to hit 4% this week: What does this mean for interest rates, savings and pensions?

Economist at the Adam Smith Institute, Michell Palmer, says the November budget is ‘not looking good’,

|GB NEWS

Households have been forced to deal with inflation-hiked prices for goods and services in recent years

Don't Miss

Most Read

Latest

The consumer price index (CPI) rate of inflation for the 12 months to September 2025 is forecast to reach four per cent when the Office for Budget Responsibility (OBR) publishes the latest figures later this week.

This would represent the steepest rate in twenty-one months, surpassing the previous peak from early 2024. The ONS will publish the CPI rate figures on Wednesday, October 22.

Economists claim the inflation surge stems from multiple factors including elevated petrol costs, increased airline ticket prices and higher private education expenses.

Several independent schools raised their charges at the beginning of the academic year, passing on costs from the newly implemented 20 per cent VAT levy on tuition fees introduced in January.

Inflation is forecast to rise this week

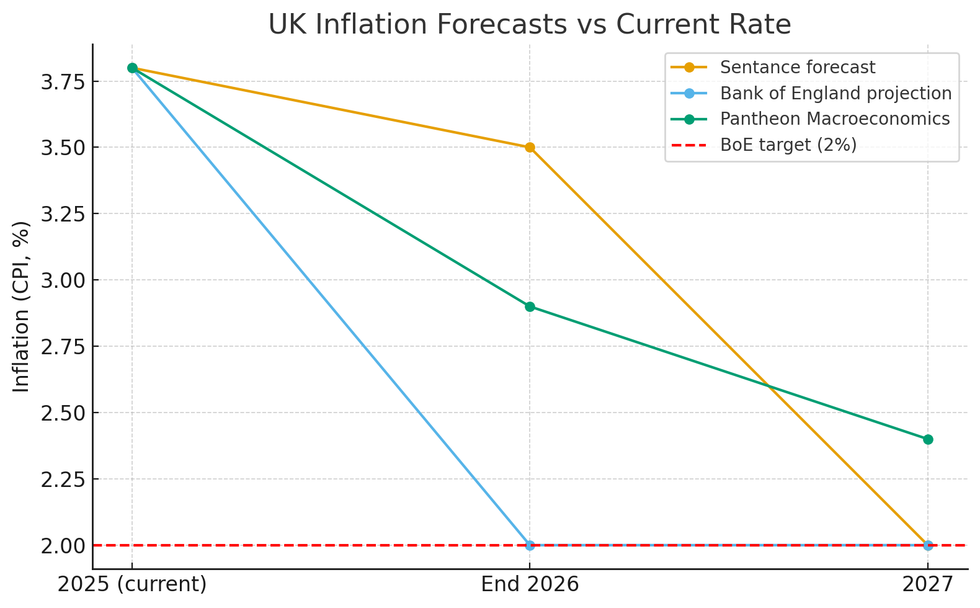

| GETTYPantheon Macroeconomics identified these elements alongside "strong clothes prices" as key contributors to the anticipated rise. The Bank of England's efforts to control price rises face significant obstacles as inflation moves further from its two per cent objective.

Huw Pill, the Bank's chief economist, has called for greater prudence regarding future reductions to borrowing costs, citing worries about persistently elevated inflation.

Rob Wood, the chief economist for the UK at Pantheon Macroeconomics anticipates only modest declines in the coming months, projecting a rate of 3.8 per cent by year-end.

Investec offers a marginally more positive outlook, suggesting September could mark the zenith at 3.9 per cent before subsequent decreases. The timing creates particular difficulties for Chancellor Rachel Reeves, who must present her Autumn Budget on November 26.

The Bank of England base rate has fallen in recent months | CHAT GPT

The Bank of England base rate has fallen in recent months | CHAT GPT Rising prices could force greater Government spending than anticipated, particularly as September's inflation figure traditionally determines adjustments to various welfare payments. Universal Credit, tax credits and disability allowances typically increase in line with September's inflation reading.

The same metric forms part of the pension triple lock calculation,riple lock calculation, though the 4.8 per cent earnings growth figure already established between May and July would take precedence unless inflation unexpectedly exceeds this threshold.

What does an inflation rise mean for interest rates?

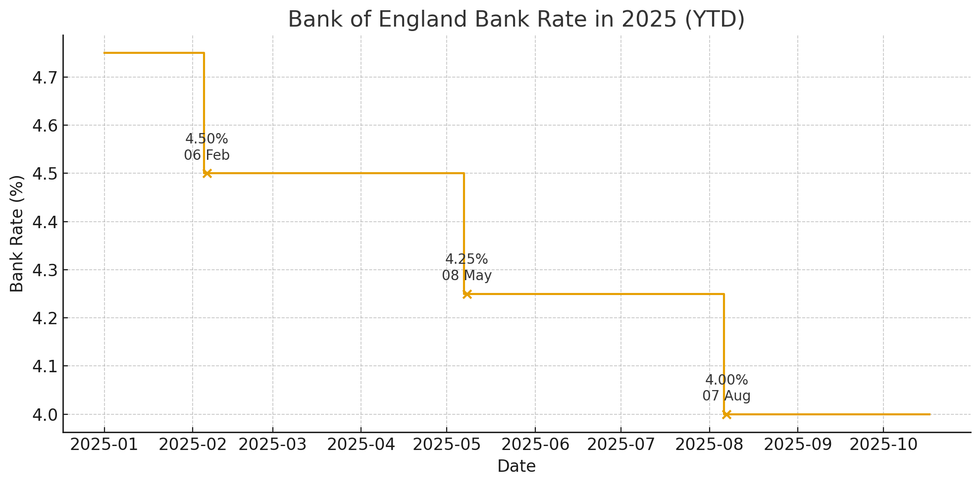

The Bank of England's Monetary Policy Committee (MPC) has hiked the base rate to as high as 5.25 per cent in recent years in an effort to ease inflationary pressures on the economy.

As it stands, the cost of borrowing is sitting at four per cent with some analysts having previously priced in another rate reduction from the central bank before the end of the year. However,

Maike Currie, the vice president of Personal Finance at PensionBee, shared: "Inflation is a ‘Jekyll and Hyde’ character. While it may be good news for borrowers, as it erodes the value of their debts, it has detrimental implications for savers, investors and for retirees."

What does an inflation rise mean for savings?

Savers are expected to likely benefit in the short-term from a jump in the CPI rate due to the Bank of England's likely pause on interest rate cuts for the foreseeable future.

The base rate is passed onto high street banks and building societies, which will be more likely to offer competitively high interest rates on savings accounts and ISAs if the central bank's MPC refuses to take further action this year.

Jenny Ross, Which?'s money editor, previously said: "If you're a saver, now is a good time to review your accounts. Many banks have slashed their savings rates in recent weeks.

Inflation is still well above the Bank of England's two per cent target | GBNEWS

Inflation is still well above the Bank of England's two per cent target | GBNEWS"But, competitive rates are available if you shop around. With rates predicted to drop again in the coming months, consider a fixed-rate account for any cash you won't need in a hurry."

What does an inflation rise mean for pensions?

Lily Megson, the policy director at My Pension Expert, said: "A small uptick in inflation certainly isn’t great news after the long journey back to target levels, but it isn’t devastating either.

"Critically, it should serve as a reminder that we are not yet out of the woods. Until inflation stabilises, things will be challenging for Britain’s retirees and those planning their retirement – particularly following years of their savings facing a walloping from high inflation.

"So, what needs to be done? Frankly, the onus is on our Government to ensure that savers are given the help and support they need to make well-informed financial decisions, even in times of uncertainty. In practice, that looks like enabling access to financial advice, as well as education and guidance on savings and investments."

More From GB News