Pension savers at risk of cash shortfalls due to inheritance tax raid from Rachel Reeves

Bowmore warns commercial assets may be hard to sell after rule change

Don't Miss

Most Read

Pension holders could face a cash shortfall when inheritance tax (IHT) rules change in April 2027, warns Bowmore Financial Planning.

The financial advisory firm said new IHT liabilities could expose families to liquidity problems where pensions hold commercial property.

Financial Conduct Authority (FCA) data shows 54,387 Self-Invested Personal Pension (SIPP) plans currently include commercial property holdings.

Bowmore said these assets can be difficult to sell quickly, which could cause problems once pensions become subject to inheritance tax.

TRENDING

Stories

Videos

Your Say

Under existing rules, inheritance tax is typically payable within six months of death.

According to Bowmore, beneficiaries may struggle to sell commercial property investments within that timeframe.

The firm warned that families could be forced to accept lower prices in order to secure a buyer quickly, which could lead to distressed sales rather than planned disposals.

HM Revenue and Customs (HMRC) can agree payment plans where inheritance tax cannot be paid within six months.

Bowmore said interest continues to accrue on any unpaid tax during this period, and that interest charges add to the financial pressure facing beneficiaries.

The combination of interest costs and administrative requirements could push families towards selling property rapidly, reducing the value ultimately realised from pension assets.

Pension holders could face a cash shortfall when inheritance tax rules change in April 2027

|GETTY

Bowmore said the situation is particularly challenging where commercial property markets are slow-moving.

It said pressure to generate cash can leave families with limited options, highlighting that some SIPP-held properties are even harder to sell.

Its analysis identified 1,357 pension plans holding commercial property located overseas; assets which often take longer to sell due to legal and regulatory complexity.

A further 8,490 SIPP plans were found to contain syndicated commercial property investments.

These arrangements involve multiple investors sharing ownership of a single asset.

Bowmore said syndicated structures can make agreement on a sale more difficult.

LATEST DEVELOPMENTS

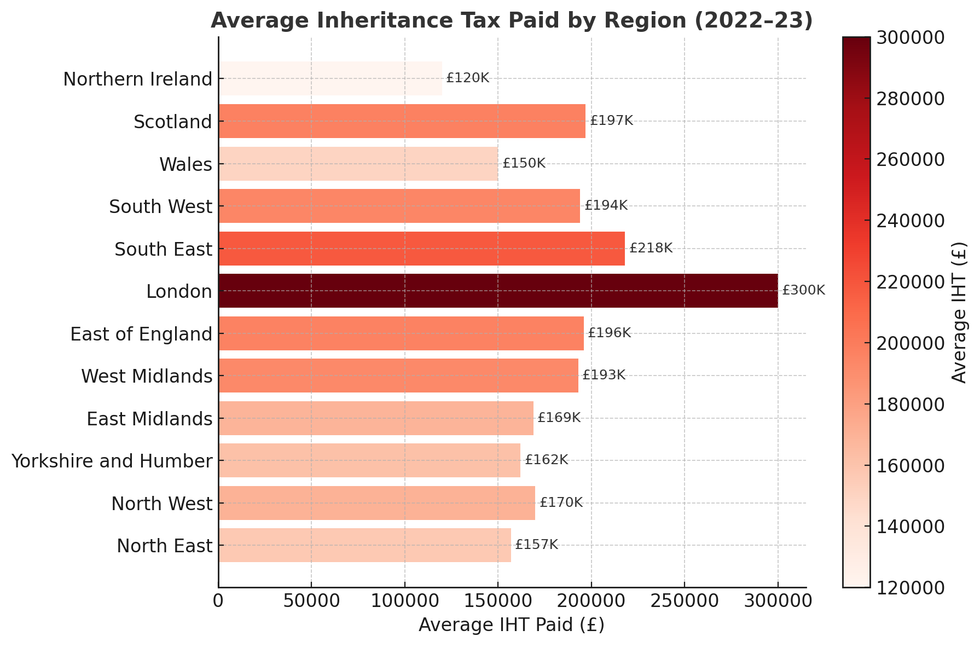

Average Inheritance tax paid by region | CHATGPT/ONS

Average Inheritance tax paid by region | CHATGPT/ONSThe firm said both overseas and syndicated property holdings are typically less liquid than UK property owned outright within a single SIPP.

Bowmore also pointed to structural issues linked to how SIPP property is owned.

It said SIPP providers, rather than individual pension holders, are the legal owners of commercial property assets.

This means additional procedural steps are required before a sale can proceed.

Bowmore said these steps can add further delays to an already lengthy transaction process.

The firm said this could make it harder for families to meet inheritance tax deadlines.

Mark Incledon, chief executive officer at Bowmore Financial Planning, said the rule change represents a major shift for pension holders.

He shared: "Commercial property can be very slow to sell but in the past that has been less of a problem as there was no IHT bill to pay on property held in a pension."

The introduction of inheritance tax on pensions alters the risks associated with holding property in a SIPP.

Mr Incledon said: "Introducing IHT on pensions fundamentally changes the risk profile of holding commercial property inside a SIPP."

He said these assets were not designed to be accessed quickly.

Mr Incledon said families could be left trying to raise large tax bills without readily available cash.

He said: "These assets were never designed to be accessed quickly, and with the changes to IHT rules families could suddenly find themselves trying to raise a six-figure tax bill without the liquidity to do so."

The firm said this could make it harder for families to meet inheritance tax deadlines

| GETTY / PAMr Incledon warned that several factors could combine to create serious difficulties for beneficiaries.

He said: "The combination of SIPP ownership structures, slow-moving commercial property markets and the new inheritance tax rules has the potential to create a perfect storm."

Bowmore said pension holders with illiquid assets should consider how their estate plans will be affected by the changes.

The firm said reviewing pension arrangements ahead of April 2027 could help reduce the risk of future cash pressures.

More From GB News