Pensioner faces £16k council tax bill after reforms: 'I’m punished for being careful with money!'

Labour funding changes allow councils to raise charges above five per cent

Don't Miss

Most Read

A pensioner in London says he could face paying close to £16,000 a year in combined council tax, and mansion tax following changes to local authority funding announced by the Labour Government.

David Crickmore, 67, who owns homes in London and Suffolk, said the reforms could significantly increase his bills over the next two years.

The changes allow six local authorities to raise council tax above the existing five per cent cap without holding a local referendum.

Mr Crickmore said he calculated that his London council tax bill could almost double by 2027 under the new rules.

TRENDING

Stories

Videos

Your Say

"I'm furious it’s just disgusting," he said.

"Just for living in my properties, I would be looking at between £13,000 and £14,000 in extra taxes per year," he added.

Mr Crickmore said the potential increase has affected his retirement planning.

The pensioner said he relies on his state pension and investment income, with limited private pension provision.

He said he believed the reforms unfairly targeted homeowners who had planned for retirement through property ownership.

"I'm from a working-class background," he said.

"I happened to go to university and worked incredibly hard all my life."

"And I thought, 'This is great, I'm building up a couple of properties for my retirement'," he added.

A Wandsworth homeowner says changes to local authority funding under Labour could leave him paying nearly £16,000 a year extra in tax

|GETTY

The funding changes form part of a wider overhaul of how central Government allocates money to councils.

The reforms were overseen by former housing secretary Angela Rayner.

They will redirect funding away from councils in the South of England towards authorities in parts of the Midlands and North with higher levels of deprivation.

Government figures show that around one in 10 councils will see a 24 per cent per head increase in available funding.

Nearly half of local authorities are expected to experience a real-terms reduction in funding.

Six councils facing the largest funding reductions have been granted permission to raise council tax above five per cent for two years without a public vote.

These councils are, Windsor and Maidenhead, and five London authorities: Kensington and Chelsea, Westminster, Hammersmith and Fulham, the City of London and Wandsworth.

Analysis by the Institute for Fiscal Studies (IFS) found that Government modelling assumed council tax increases of up to 75 per cent in some affected areas over the coming years.

LATEST DEVELOPMENTS

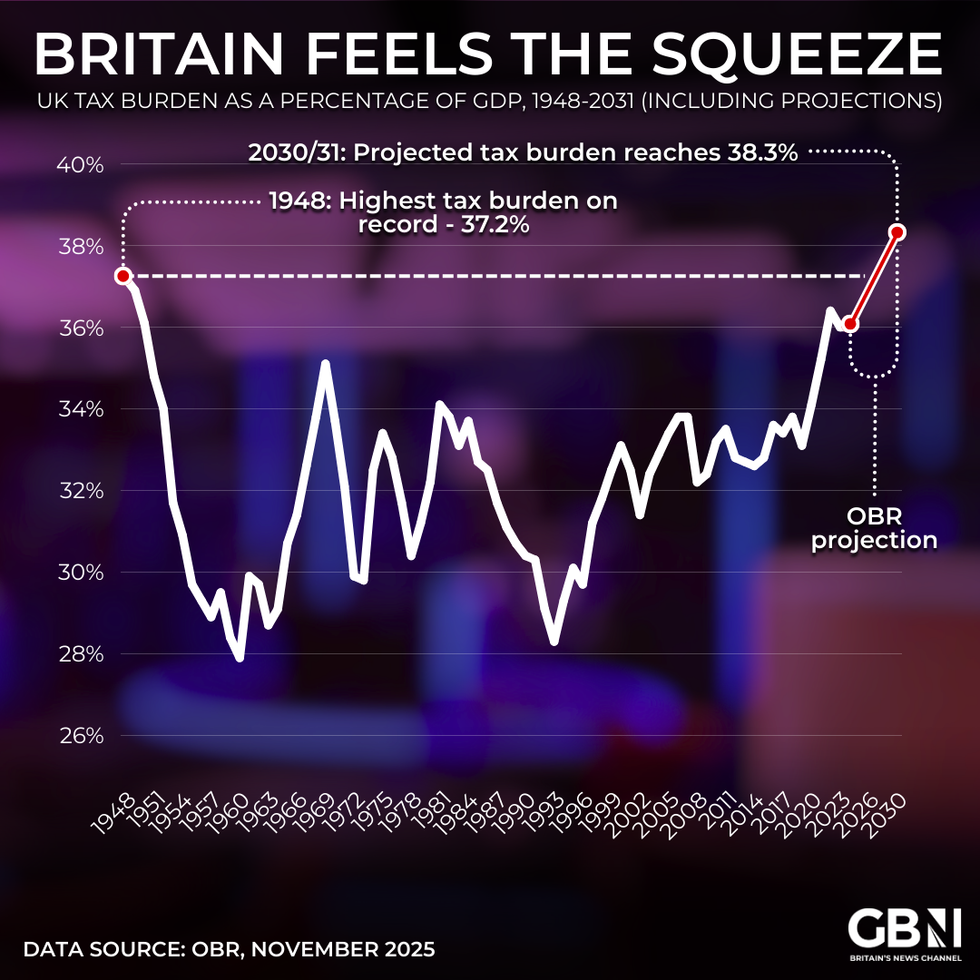

GRAPHED: The UK's tax burden as a percentage of GDP, 1948-2031 | GB NEWS

GRAPHED: The UK's tax burden as a percentage of GDP, 1948-2031 | GB NEWSMr Crickmore bought his semi-detached Wandsworth property for £950,000 in 2011, and has since spent around £600,000 on renovations and extensions.

He said rising council tax costs could force him to sell one of his properties.

"To take £15,000 out of my savings to pay for the properties it will kill my aspirational position because I'll have to sell one," he said.

Mr Crickmore said he did not consider himself wealthy.

He said the reforms reflected what he described as "the politics of envy", and feared that higher property taxes could discourage aspiration.

Opposition figures have also criticised the changes.

Shadow housing minister David Simmonds said the reforms would have serious consequences for homeowners.

"This Labour Government is on a mission to raise council tax across the board," he said.

"People will just end up paying more and getting less," he added.

The Ministry of Housing, Communities and Local Government defended the reforms.

A spokesman said the changes would help ensure fairer funding across the country.

The reforms have been qualified by saying it ensures high-value Westminster mansions won't pay disproportionately low council tax anymore

|GETTY

"We are ensuring everyone gets the services their community deserves, while reforming property taxes so that a £10million Westminster mansion doesn't pay less than a typical family home in England," the spokesman said.

The Government said multi-year funding settlements would restore the link between council funding and levels of deprivation.

Ministers said the reforms would provide local authorities with greater certainty and help rebuild public services.

The full impact of the council tax changes will become clearer as authorities set their budgets for the coming financial years.

More From GB News