Pension reform calls continue as ‘one in six older people living in poverty’

British public share opinion on state pension age

|GB NEWS

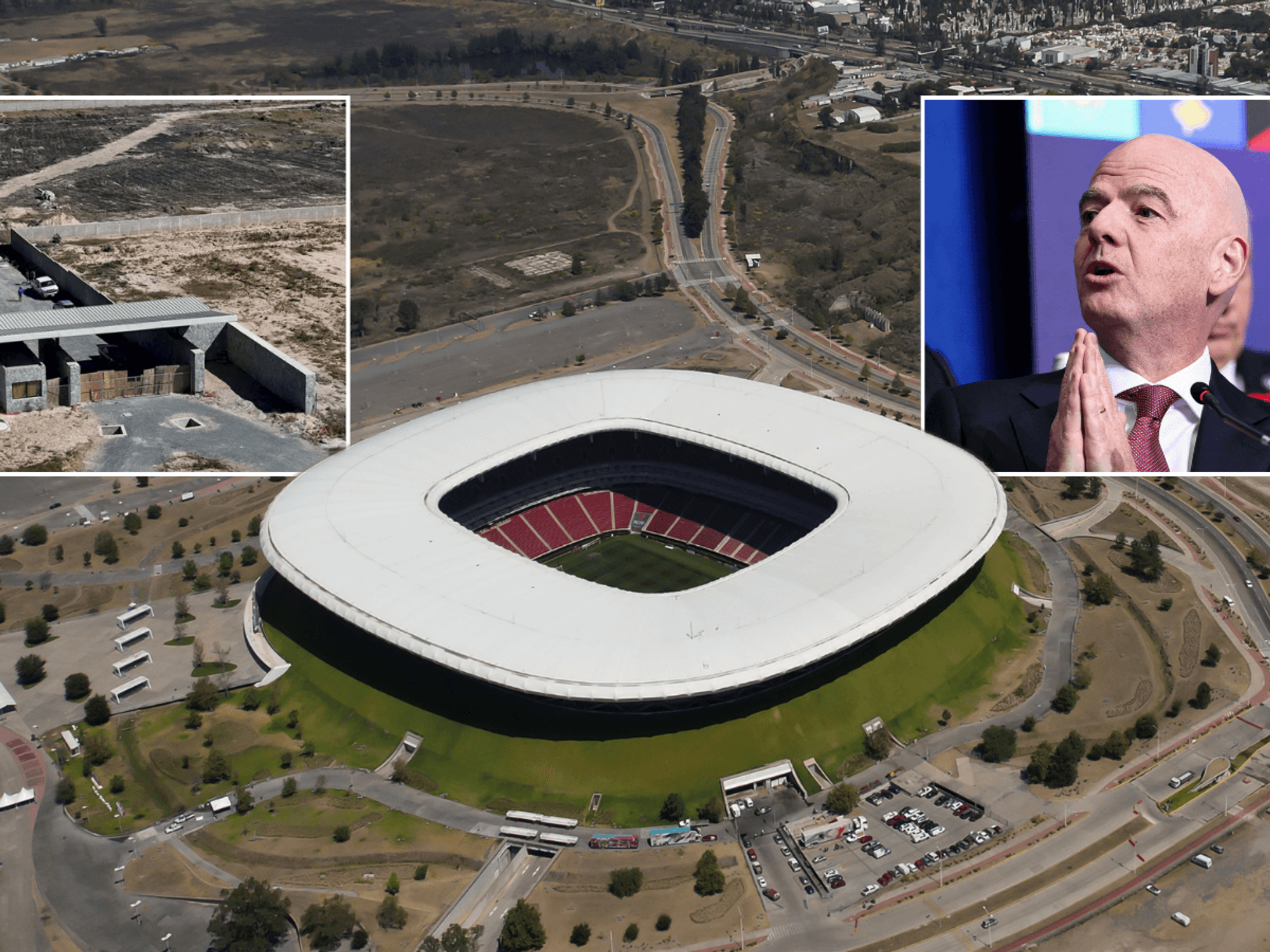

Jeremy Hunt has outlined various changes to the pension system but experts are questioning whether retirement savers are seeing the benefit

Don't Miss

Most Read

Latest

Experts are urging the Government to introduce and communicate pension reform effectively to address the fact that “one in six older people live in poverty” in the UK.

New research from the Get Britain Pension Ready campaign, has revealed that nearly half of Britons are concerned how political instability will impact their retirement savings.

In Chancellor Jeremy Hunt’s Spring Budget, various changes to the pension system were announced which will impact older Britons going forward.

Among the proposed changes from the announcements include the “pot for life” and the commitment to keep the triple lock.

The triple lock is the metric used to determine annual payment hikes to the state pension, while the “pot for life” which could see workers combine their retirement schemes to the one pot.

However, a survey conducted by the Get Britain Ready campaign has highlighted that many people approaching retirement are unsure how these changes will impact them.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Experts are calling for pension reform to be communicated effectively

|GETTY

Some 61 per cent had not heard of the proposed 'pot for life' reform, while 52 per cent said they were confused by the term triple lock.

Furthermore, 63 per cent of survey respondents were not able to correctly identify the three factors in the state pension triple lock pledge.

On top of this, 33 per cent shared that they do not feel confident in understanding their retirement finance options.

Notably, women were found to be almost twice as likely as men to lack confidence (44 per cent compared to 24 per cent, respectively) when it comes to retirement planning.

According to the campaign, how political parties communicate pending state pension reform could have major consequences going forward.

Around 37 per cent of individuals indicated that even just the thought of planning for pensions “fills them with fear and dread”.

Sarah Lloyd, the commercial director at Annuity Ready, noted that pension reform “has been in the spotlight” but Britons are still none the wiser to what is best for them.

She explained: “It’s worrying that so many people feel confused and fearful of pensions and planning for retirement.

“The changes that are due to be decided by the next election will impact people across the country and the uncertainty surrounding these decisions is only creating greater worry for them.

“It is our collective responsibility to make sure the general public understands the terminology and policies being proposed, as these will ultimately impact their income and quality of life in retirement."

LATEST DEVELOPMENTS:

The Government has already outlined the new "pot for life" and committed to the state pension triple lock

| GETTYMorgan Vine, the head of policy and influencing at Independent Age, added: “The pensions system is incredibly complex. Ensuring people feel as informed and supported as possible is vital because not everyone is financially comfortable in later life, and many don’t have large pension pots.

“Currently, one in six older people live in poverty and this increases to one in five for those approaching state pension age. These are huge and unacceptable numbers.

“Everyone deserves the security of knowing they can have their essential needs met in retirement, and while many people are saving into private pensions, it’s vital that there is a strong foundation in the form of the state pension and the social security system.”

The state pension triple lock increase is being applied to retirement benefits from this month.