Pension hack could help employers avoid 'rising tax costs' from National Insurance raid

Major blow for pensioners as winter fuel cuts will NOT be reversed |

GB NEWS

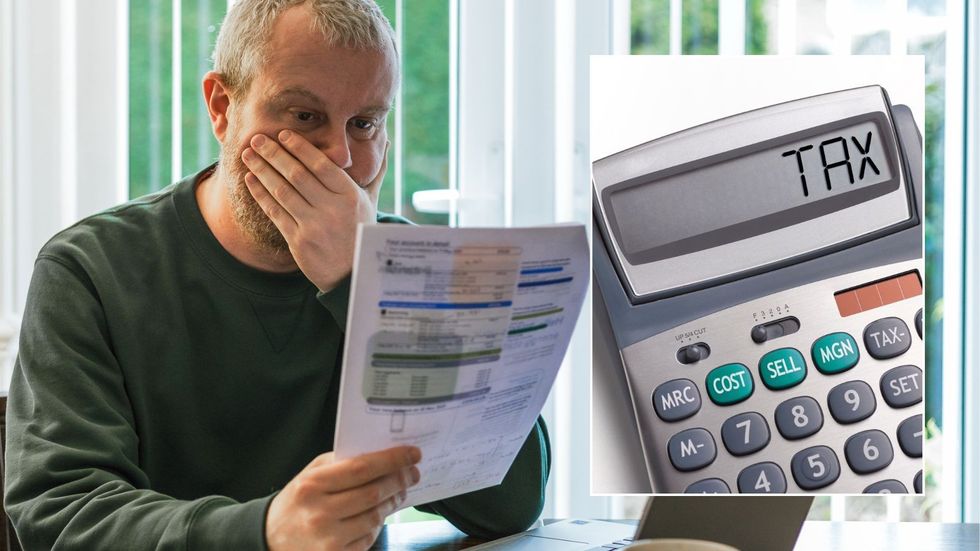

Businesses are looking for ways to sidestep the recent rate hike to National Insurance contributions

Don't Miss

Most Read

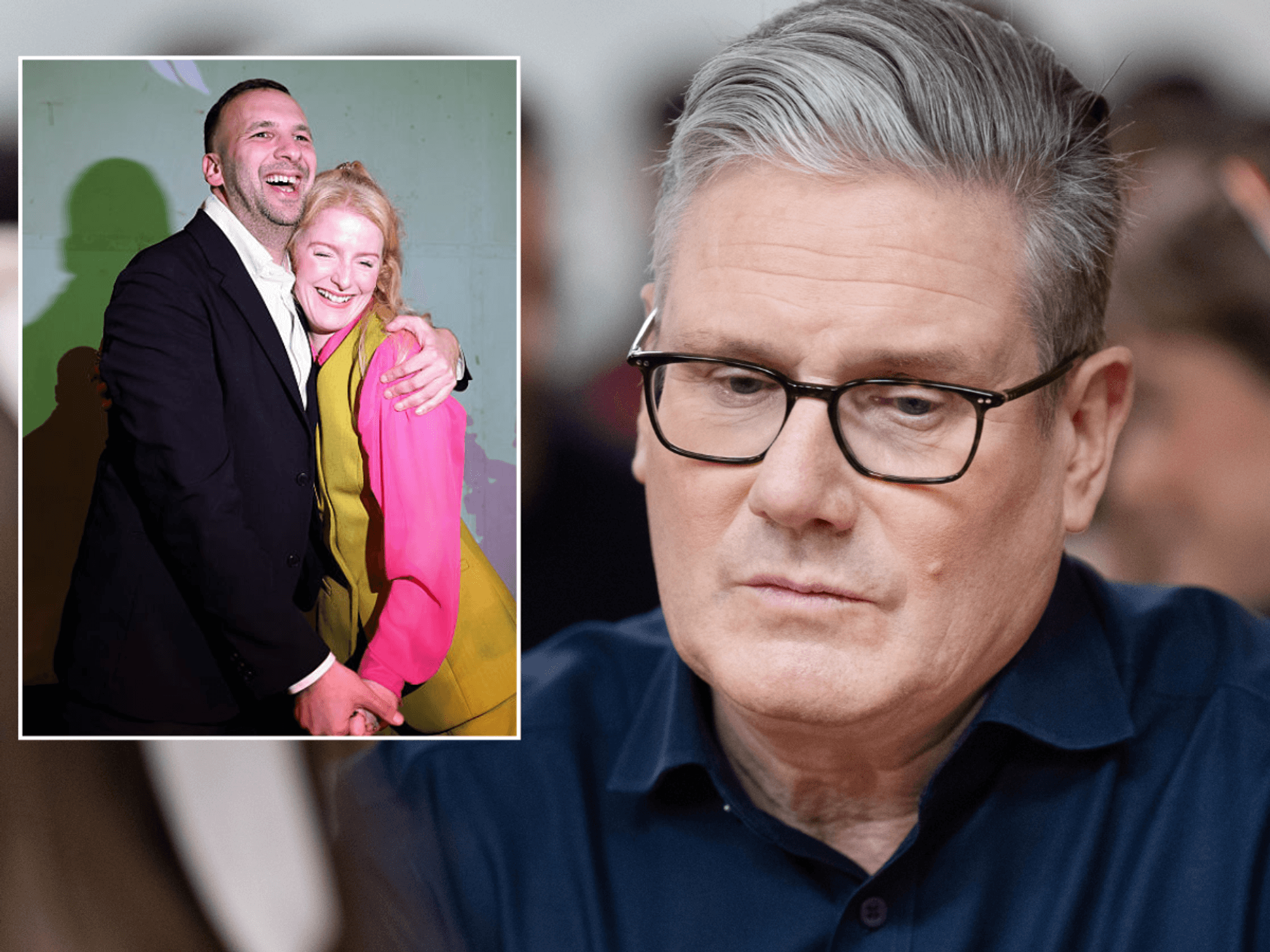

Employers across the UK are facing challenges as hiring falls to record lows amid Labour's tax increases and employment law changes with analysts urging businesses to take advantage of a pension hack to sidestep this National Insurance raid.

New research from the Chartered Institute of Personnel and Development (CIPD) reveals the number of employers planning to recruit staff over the next three months has hit its lowest point since records began.

This comes as firms struggle to cope with a £25billion tax raid on businesses. BDO has also reported that UK employment has plunged to a 12-year low following Chancellor Rachel Reeves' National Insurance hike and minimum wage increase.

The CIPD report shows the overall net employment balance fell from 13 to eight in the first three months of the year. This marks a record low since records began in 2014, excluding the pandemic period.

Employers are being reminded how a pension hack could save them money on National Insurance

|GETTY

Notably, public sector has been hit particularly hard, with the measure plunging from three to minus four. Private sector figures also dropped from 16 to 11. Just one in 10 retailers are planning to take on staff in the next three months.

One in four employers across all industries are planning redundancies in the coming quarter. BDO's analysis paints an equally concerning picture, with its employment index dropping to 94.11 in April – the lowest level in 12 years.

Under Reeves's "tax on jobs", which was implemented last month, the rate of employer National Insurance contributions jumped to 15 per cent alongside a 6.7 per cent minimum wage increase to £12.21 per hour.

A BDO spokesman highlighted the impossible position businesses now face: "It is practically impossible for businesses to plan and invest with so much instability."

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Rachel Reeves's decisions have drawn scorn from businesses

| Parliament TVHowever, amid these challenges, businesses do have options to mitigate the impact of increased National Insurance contributions.

Salary sacrifice schemes offer a proven way to soften the National Insurance hike for employers. This arrangement allows employees to give up part of their salary in exchange for non-cash benefits, particularly pension contributions.

The approach creates tax savings for both parties. Employees save on income tax and their own National Insurance contributions on the sacrificed amount.

Meanwhile, businesses avoid paying the 15 per cent employer rate on the portion of salary sacrificed.

Analysts highlight the this can provide significant relief for companies struggling with the recent tax increases.

Clare Stinton, the head of Workplace Saving Analysis at Hargreaves Lansdown, emphasises the benefits of this approach.

"The rising costs of employing staff will hit some businesses harder than others. However, there is one proven way to soften the National Insurance hike: salary sacrifice," she explained.

LATEST DEVELOPEMNTS:

Recent tax changes have proven to be controversial

| PA"The employee saves both the income tax and employee National Insurance on what they sacrifice into their pension, and the business doesn't have to hand over the 15 per cent employer NI to the taxman on the portion of salary sacrificed."

For employees, this can mean tax savings of 28 per cent to 47 per cent, rising to 62 per cent in some cases.

Stinton suggests businesses can reinvest these savings back into the company or enhance employee benefits packages.

"Any savings made by the employer can be reinvested back into the business, or used to enhance employee pensions or wider benefits packages further," she notes.

"Switching the pension to salary sacrifice is a savvy move – it saves money, enhances employee benefits, and supercharges employee pensions."