Britain faces 'painful tax rises' as Rachel Reeves forecast to break 'self-imposed fiscal rules' for economy

The Chancellor's plan for the economy has come under fire

Don't Miss

Most Read

Latest

Chancellor Rachel Reeves is now forecast to miss her key fiscal rules, increasing the likelihood of tax hikes later this year, according to the National Institute of Economic and Social Research (NIESR).

The economic think tank has warned that weaker than expected gross domestic product (GDP) growth will impact the UK's fiscal outlook.

NIESR has downgraded its growth forecast for the UK economy in 2025 to just 1.2 per cent, down from its previous prediction of 1.5 per cent made in February.

The organisation cited a slowdown in domestic demand and global economic uncertainty as key factors that will hamper growth throughout the year.

Rachel Reeves has been dealt a blow to her fiscal plans

| PAThe think tank predicted that the UK economy will grow by 1.2 per cent in 2025 "amid low business confidence, high uncertainty and rising cost pressures".

This represents a significant reduction from their February forecast of 1.5 per cent. growth.NIESR indicated that the reduced level of growth will result in lower than previously predicted tax receipts.

As a result, NIESR said the Government is now expected to miss its fiscal rules requiring UK national debt as a share of the economy to fall and to be on course for a budget surplus.

In the Government's spring statement, Chancellor Rachel Reeves had claimed state finances were on track to give a headroom worth around £9.9billion by 2029/30.

Rachel Reeves's decisions have drawn scorn from pub landlords | Parliament TV

Rachel Reeves's decisions have drawn scorn from pub landlords | Parliament TVHowever, NIESR's forecasts suggest this could now be set for a shortfall of £62.9billion over this time frame which suggest the Treasury could need to look at more spending cuts or tax increases to achieve a surplus.

Stephen Millard, NIESR interim director, said: "The Chancellor's self-imposed and arbitrary fiscal rules have led to a situation where twice a year the Chancellor has to either find further departmental savings or announce politically unpalatable tax rises.

"The uncertainty created by this leads to low investment and lower growth, the precise reverse of what the Government wants to achieve. We have to rethink the fiscal framework."

The organisation's fiscal outlook also pointed towards rising inflation for the year, which it expects to average 3.3 per cent in 2025.

This is significantly higher than NIESR's previous prediction of 2.4 per cent for the year, with a peak of 3.2 per cent. NIESR is the latest body to trim back the UK's economic growth forecasts amid pressure from changes to US tariff policies.

Last month, the International Monetary Fund (IMF) cut its UK growth forecast by 0.5 percentage points to 1.1 per cent for this year.

LATEST DEVELOPMENTS:

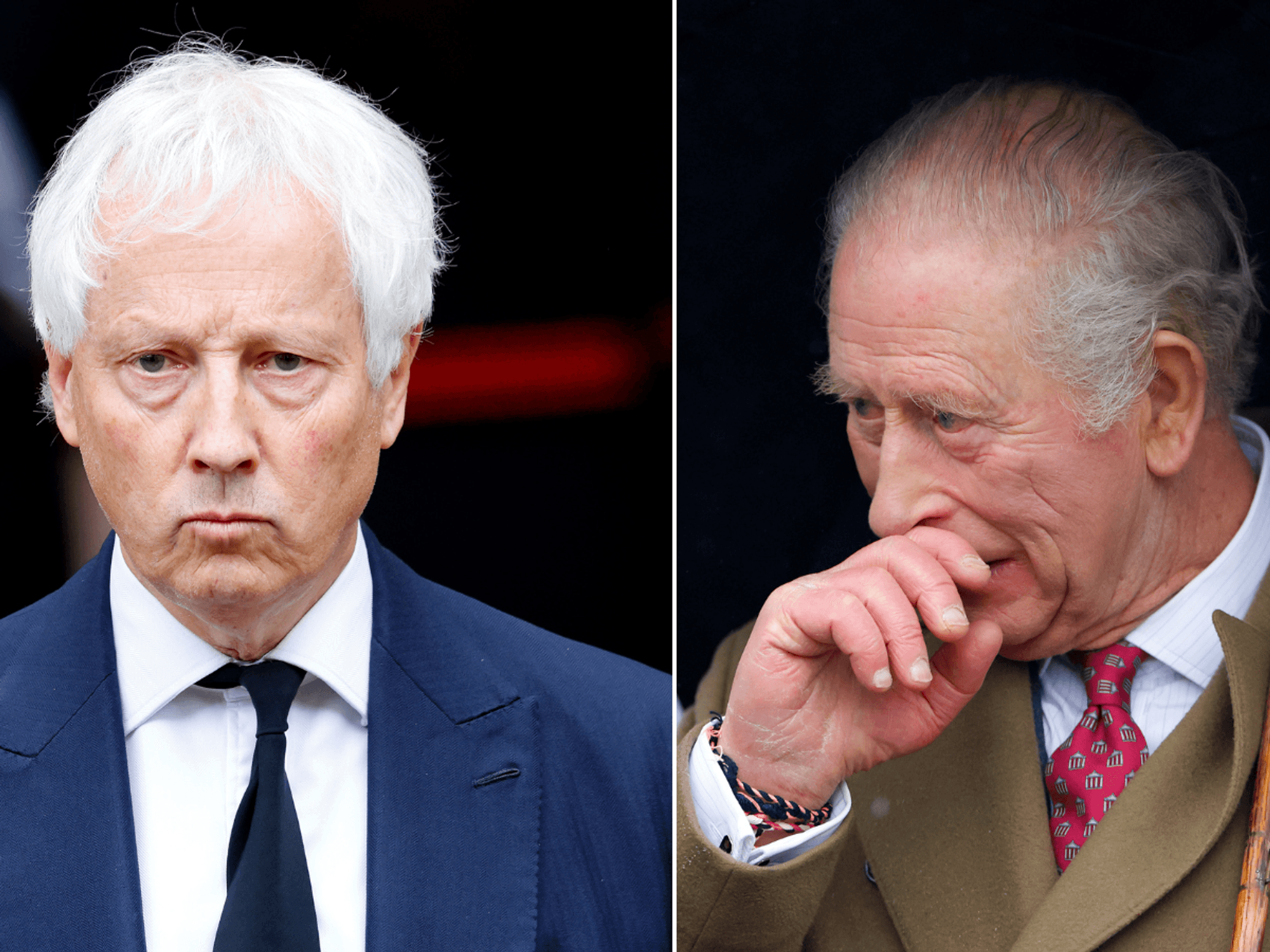

Shadow minister Mel Stride has slammed

| GB NewsAdrian Pabst, the deputy director for public policy at NIESR, said: "The Government's ambition of boosting growth and living standards in every part of the United Kingdom requires a comprehensive, credible plan of economic transformation which is yet to emerge.

"While planning reform and infrastructure investments in London and the South East will add to GDP growth, we need higher public investment in second-tier cities and poorer regions to unlock greater business investment."

Meanwhile, the Conservative Party accused Reeves of "playing fast and loose with the public finances".

Shadow Chancellor Mel Stride added: "She should have learned lessons after she was forced into an emergency budget in March. Now she is once again teetering on the edge of breaking her own fiscal rules.

"This inevitably means rising speculation about further painful tax rises come the autumn, all at a time when businesses are in desperate need of certainty, and households are worried about rising bills."