Pension crisis looms as Britons 'ill equipped to retire comfortably' due to 'chronically' low savings

GB NEWS

New DWP figures are shining light on the state of pension savings in Britian

Don't Miss

Most Read

Britain is experiencing a "chronic pensions crisis" which is impacting peoples' ability to save for retirement, according to the latest figures from the Department for Work and Pensions (DWP).

Data from the Government department found that 43 per cent of working-age Britons are under-saving for retirement, which is the equivalent of 14.6 million people living in the UK.

Less than one in four working-age individuals are currently on course to hit trade body Pensions UK’s "comfortable" retirement income level, which is £43,900 for one person and £60,600 for a couple.

Notably, more than one in 10 Britons are projected to not even reach the "minimum" retirement income level, which is set at £13,400 for individuals and £21,600 for two people.

Analysts are sounding the alarm over Britain's pension crisis

|GETTYB

Furthermore, the DWP figures highlighted that more than three million self-employed are not savings into pension pot at all.

Last week, DWP minister Liz Kendall unveiled the Government's plan to launch a Pension Commission, which will attempt to tackle the retirement saving crisis.

Kendall said: "People deserve to know that they will have a decent income in retirement – with all the security, dignity and freedom that brings.

"But the truth is, that is not the reality facing many people, especially if you’re low paid, or self-employed.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

DWP minister Liz Kendall has launched a new Pensions Commission | PA

DWP minister Liz Kendall has launched a new Pensions Commission | PA"The Pensions Commission laid the groundwork, and now, two decades later, we are reviving it to tackle the barriers that stop too many saving in the first place."

Chancellor Rachel Reeves added: "We’re making pensions work for Britain. The Pension Schemes Bill and the creation of pension megafunds mean an average earner could get a £29,000 boost to their pension pots. Now we are going further to ensure that people can look forward to a comfortable retirement."

Tom Selby, the director of public policy at AJ Bell, broke down the growing anxiety surrounding pension saving in Britain.

Selby explained: "There’s no escaping the fact that a chronic retirement under-saving crisis looms over the UK pensions system in its current form, and the latest government stats make for suitably grim reading.

"Those set to retire in 2050 are on course for eight per cent less private pension income than those retiring today, even when you factor in that they will have likely been automatically enrolled into a pension for a significant chunk of their working lives compared to their counterparts retiring today.

“Much of this will be down to the dwindling number of defined benefit pension schemes outside of the public sector over the past few decades. But there are also more worrying trends that emerge from these latest figures."

LATEST DEVELOPMENTS:

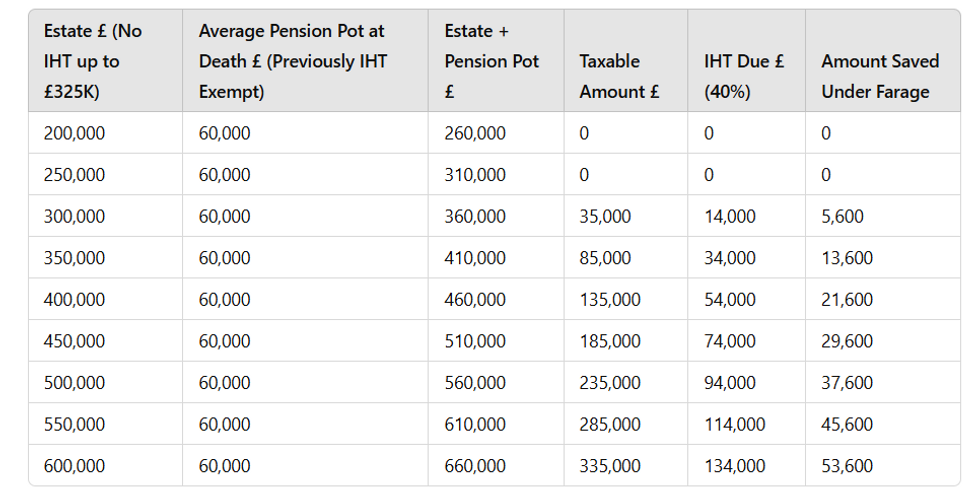

How much could you save? Pension pot | GBN

How much could you save? Pension pot | GBNRegarding self-employed Britons not saving enough, he added: “In essence, all signs are pointing to a nation that will be ill equipped to retire in any way comfortably by the middle of this century, if not sooner.

"More needs to be done to ensure savers, particularly lower earners and the self-employed, can retire with a decent standard of living, rather than scraping by on the state pension alone.

"The government has revived the Pension Commission to spearhead a wholesale review into the entire UK pensions system to future-proof the retirement prospects of the next generation of retirees.

"But there is no guarantee substantial reforms will happen this side of the general election and there are steps people can and should take now, rather than waiting for the government to intervene."