DWP confirms state pension and Universal Credit payment date overhaul for January 2026 - full list of changes

Britons could be paid state pensions and DWP benefits earlier than expected due to bank holidays in the New Year

Don't Miss

Most Read

The Department for Work and Pensions (DWP) is reminding claimants of the state pension and other benefit support, such as Universal Credit, payment dates could change in January 2026.

Benefit recipients are usually paid on the same day every month, however if their payment date falls on a bank holiday, they receive their financial support earlier from the DWP.

Earlier this week, GB News broke down why thousands of Britons will get their benefits earlier in December 2025 due to Christmas Day and Boxing Day both being bank holidays.

As well as these changes, benefit claimants who receive payments on the first of every month will instead get their cash on December 31, 2025 instead of New Year's Day due to it being a bank holiday also.

DWP payment dates will be different for thousands of Britons in January 2026

|GETTY

While the vast majority of benefits will be paid on their regular payment date, the following payments will be paid on December 31 instead of January 1 if someone usually gets paid on the first of the month:

- Universal Credit

- State pension

- Pension Credit

- Child Benefit

- Disability living allowance (DLA)

- Personal Independence Payment (PIP)

- Attendance Allowance

- Carer’s Allowance

- Employment support allowance (ESA)

- Income support

- Jobseeker’s allowance.

Notably, Scottish benefit claimants who receive certain payments on the second of the month will also get paid on December 31 as January 2 is a bank holiday up north.

While many residents in Scotland receive support directly from the DWP, other payments are administered through the country's own welfare body, Social Security Scotland.

On the Government's website, the DWP states: "Benefits are usually paid straight into your bank, building society or credit union account. If your payment date is on a weekend or a bank holiday you’ll usually be paid on the working day before. This may be different for Child Benefit."

Outside of regular payments, recipients of certain benefits such as PIP and the state pension are in line for a £10 Christmas bonus which is annual tax-free sum awarded to help with heating costs.

As well as January's payment date changes, Universal Credit and other benefits are in line for rate hike in April, with the former receiving a 6.1 per cent hike while most other payments get a 3.8 per cent increase.

This 3.8 per cent figure is based on the consumer price index (CPI) inflation rate for September 2025, with the following payments set to receive this boost:

- ESA

- Income support

- Industrial injuries disablement benefit

- Jobseeker's allowance

- Maternity allowance

- PIP

- Statutory maternity/paternity/adoption/shared parental pay

- Statutory sick pay

- Tax credits.

With Universal Credit's higher 6.1 per cent rate rise, claimants will see their payments change in the following ways from April 2026:

- Rise £316.98 to £338.58 per month for single people aged under 25

- Rise £400.14 to £424.90 per month for single people aged 25 and over

- Rise £497.55 to £528.34 per month for joint claimants both aged under 25

- Rise £628.10 to £666.97 per month for joint claimants both aged 25 and over.

LATEST DEVELOPMENTS

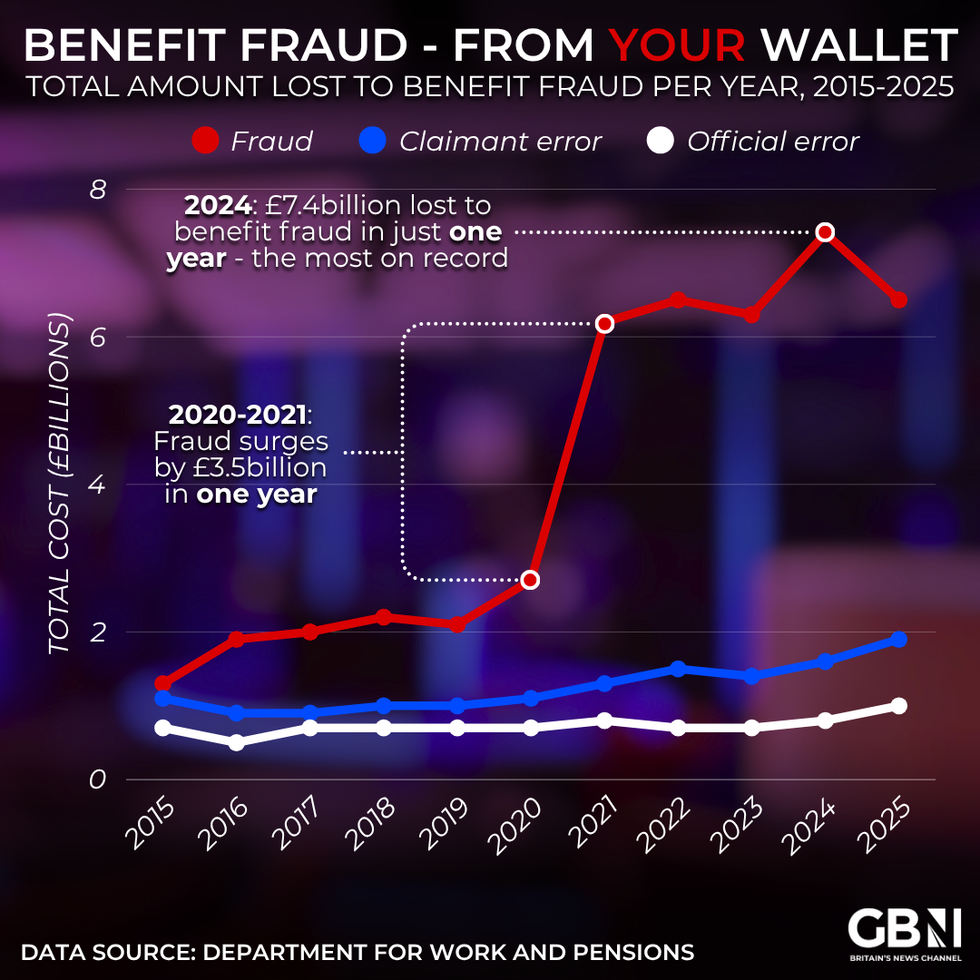

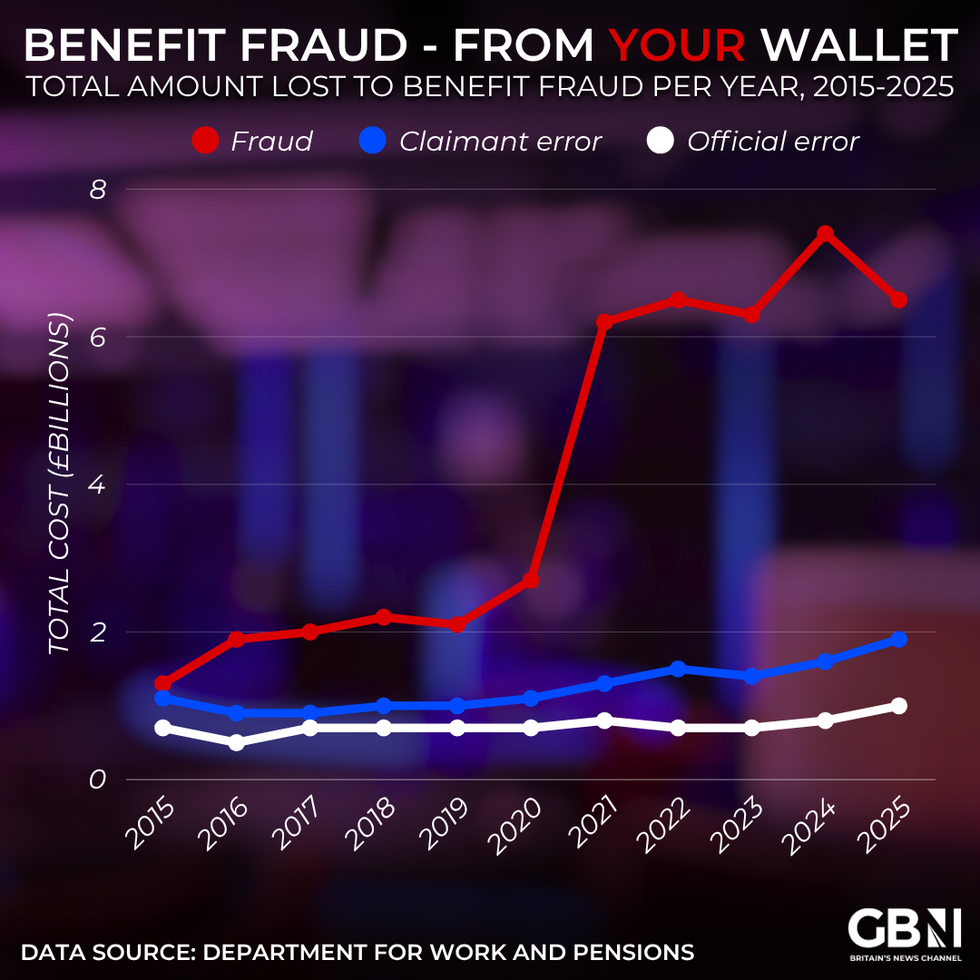

Benefit fraud - from your wallet: Total amount lost to benefit fraud per year | GB NEWS

Benefit fraud - from your wallet: Total amount lost to benefit fraud per year | GB NEWSDespite this boost to Universal Credit payments, claimants are being reminded they could be impacted by looming welfare cuts which are being pushed through by the Labour Government.

Increases to the primary benefit for working-age people only apply to the standard allowance, while the health element linked to the payment is expected to be reduced for thousands.

Under the most recent legislation passed through Parliament, Universal Credit recipients of the health element will have that rate frozen and halved until 2029-30 from April of next year.

State pension payments will enjoy a 4.8 per cent rate hike in April thanks to the triple lock, which ensures the benefit increases by either the rate of inflation, average wage growth or 2.5 per cent; whichever is highest.

The amount lost to benefit fraud has surged | GB NEWS

The amount lost to benefit fraud has surged | GB NEWSThrough the triple lock, the state pension is set to increase by 4.8 per cent from April 2026 based on average wage growth in the UK between May and July of this year.

As a result, the full, new state oension will go from about £230.25 to around £241.30 per week, roughly a £570 a year increase for someone on the maximum entitlement.

The older basic state pension, which is reserved for those who reached retirement age before April 6. 2016, will also be uprated, rising from about £176.45 to around £184.90 per week.

- Jobseeker’s Allowance - usually every two weeks

- Maternity Allowance - every two or four weeks

- Employment and Support Allowance - usually every two weeks

- State Pension - usually every four weeks

- Universal Credit - every month

- Pension Credit - usually every four weeks

- Disability Living Allowance - usually every four weeks

- Personal Independence Payment - usually every four weeks

- Attendance Allowance - usually every four weeks

- Income Support - usually every two weeks

- Carer’s Allowance - weekly in advance or every four weeks

- Child Benefit - usually every four weeks - or weekly if you’re a single parent or you or your partner get certain benefits

More From GB News