Pension annuities set for comeback amid rule changes

Reforms and higher yields reshape retirement income choices

Don't Miss

Most Read

Annuities are expected to regain prominence in 2026 as pension reforms begin to alter how people draw income in retirement, according to industry figures.

The anticipated shift follows changes announced in November’s Budget and further reforms due to take effect from 2027.

Adrian Murphy, chief executive officer at Murphy Wealth, said the inclusion of pensions within estates for inheritance tax purposes is likely to change long-standing retirement strategies.

He said: "The forthcoming changes that will bring pensions into estates are going to fundamentally change the way people take income in retirement.

TRENDING

Stories

Videos

Your Say

"Pensions have gone from the last place to take money from to among the first."

The renewed interest in annuities comes after a prolonged period during which they were less commonly used by retirees.

Annuities provide a guaranteed income for life in exchange for a pension lump sum.

They are typically used by retirees who want certainty over their future income and have clearly defined financial needs.

Higher Government bond yields have contributed to improved annuity rates over the past three years.

Because annuity pricing is closely linked to long-dated Government bond yields, rising yields have increased the income available from these products.

The reforms represent a significant change in how pensions are viewed within financial planning

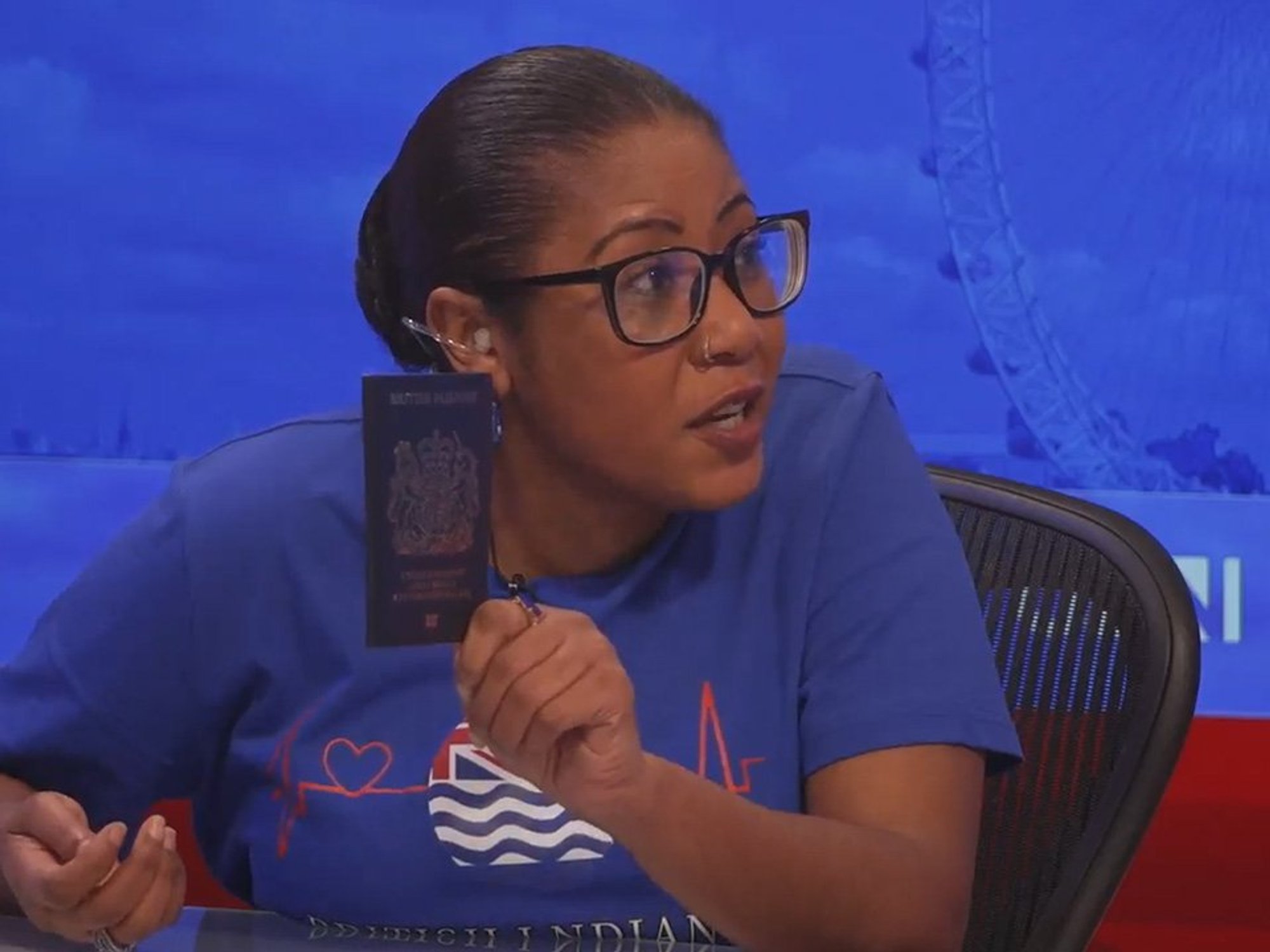

| GETTYIndustry data shows that rates available at the end of 2025 were significantly higher than those seen in the previous decade.

Figures from Fidelity Wealth Management in December 2025 showed that a 66-year-old in good health, with a £300,000 pension pot could secure an annual income of £22,447 by purchasing an annuity.

That equates to a rate of around 7.5 per cent for a single-life annuity paying a fixed income with no inflation protection.

The same pension pot would have generated a much lower income in earlier years.

Around five years ago, annuity rates typically ranged between four per cent and five per cent.

At those levels, a £300,000 pension pot would have delivered an annual income of about £13,500.

LATEST DEVELOPMENTS

Annuity returns were depressed for much of the past two decades

| GETTYRates began to recover after 2022 as interest rates increased and gilt yields rose despite the improved income on offer.

Mr Murphy said the inability to pass on an annuity to beneficiaries can be a key consideration.

"The main catch is you cannot pass them on to your family, which may make it self-defeating for those with inheritance in mind."

In most cases, income payments stop when the policyholder dies, which means any remaining value is not transferred to family members unless specific options are added at the outset.

As a result, annuities are often used only in particular circumstances.

They may be less suitable for individuals whose priority is preserving wealth for beneficiaries.

Mr Murphy said decisions around annuities should consider how an annuity fits with their wider retirement and estate planning arrangements.

Looking ahead, annuity rates may be affected by changes in interest rate expectations during 2026.

Market forecasts published in early December suggested the Bank of England could reduce the base rate over the course of the year.

Consensus expectations indicated rates could fall from fou per cent to around 3.25 per cent by the end of 2026.

Gilt prices as of Jan 5, 2026 at 3:12pm

|MarketWatch

Because annuity rates are influenced by long-dated government bond yields, any sustained fall in yields could reduce the income available from new annuity purchases.

Lower gilt yields would typically lead to lower annuity rates.

Industry analysts said this could alter the relative attractiveness of annuities compared with other retirement income options.

The outlook for annuities will therefore depend on how interest rates and bond markets develop over the coming year.

The combination of pension tax changes and shifting market conditions is expected to play a central role in shaping retirement income decisions.

More From GB News