Nationwide Building Society cuts mortgage rates as rivals hike costs

Cuts of up to 0.18 points come as Halifax, Santander and Barclays push rates higher

Don't Miss

Most Read

Latest

Britain’s largest building society has cut its mortgage rates, moving against the trend of major competitors who have recently raised the cost of borrowing.

Nationwide confirmed reductions of up to 0.18 percentage points across a range of fixed-term products, effective from today.

The announcement follows increases from Halifax, Santander and Barclays, which have all raised rates in response to wider market pressures.

The new cuts apply to two, three and five-year fixed-rate mortgages, covering deals for both new and existing customers. Nationwide’s most competitive offer now stands at 3.80 per cent.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

TRENDING

Stories

Videos

Your Say

For first-time buyers, several products have been reduced.

A three-year fixed mortgage at 85 per cent loan-to-value with a £999 fee now costs 4.34 per cent, down by 0.15 percentage points.

Buyers with larger deposits can access a two-year fix at 75 per cent LTV for 4.09 per cent, following a 0.10 point reduction.

The most substantial cut applies to a three-year fix at 95 per cent LTV with no fee, which has fallen by 0.18 points to 5.21 per cent.

Those able to provide a 40 per cent deposit can now secure a two-year fixed rate at 3.99 per cent with a £1,499 fee.

Nationwide Building Society has unexpectedly dropped its mortgage rates

| GETTY / NATIONWIDEHome movers also benefit. Nationwide’s lowest available rate is now 3.80 per cent on a two-year fix at 60 per cent LTV with a £1,499 fee, reduced by 0.07 points.

A two-year fixed mortgage at 90 per cent LTV with no fee is priced at 4.52 per cent, following a 0.16 point cut.

For longer-term borrowers, a five-year fix at 95 per cent LTV with a £999 fee has dropped by 0.13 points to 4.81 per cent.

The building society’s three-year fixed rate at 80 per cent LTV with a £999 fee has also been reduced by 0.10 points to 4.24 per cent.

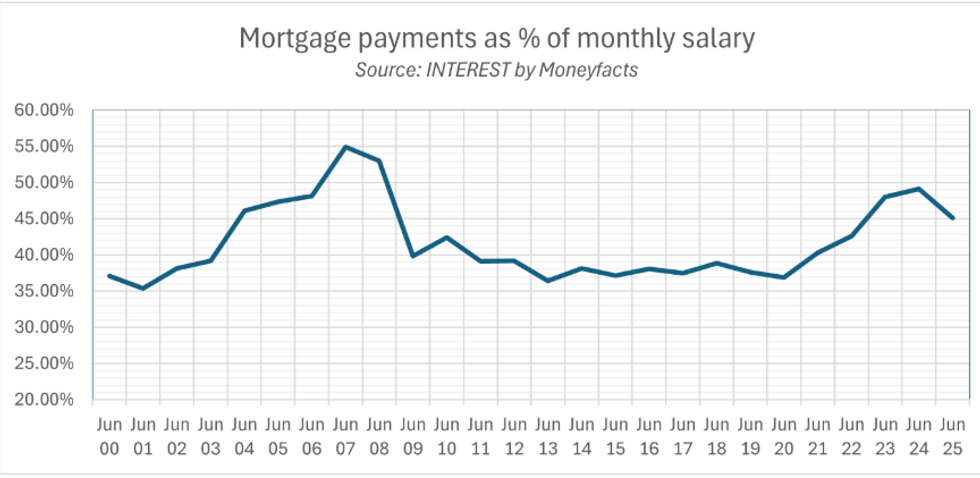

Analysis shows mortgage repayments now swallow nearly half of average earnings | INTEREST BY MONEYFACTS

Analysis shows mortgage repayments now swallow nearly half of average earnings | INTEREST BY MONEYFACTSThese changes span a broad range of deposit sizes and fee structures, allowing borrowers to select between lower upfront costs or reduced interest rates depending on their circumstances.

Carlo Pileggi, Nationwide’s senior mortgages manager, said: "We regularly review our rates because it’s important that, as Britain’s biggest building society, we maintain a competitive position in the market."

He added: "These latest changes will be particularly good news for those looking to move home, with rates now starting from 3.80 per cent, and for first-time buyers as we make a wide range of cuts across those product ranges."

The decision marks a significant move within the mortgage market, offering relief to borrowers while other lenders have been tightening terms.

LATEST DEVELOPMENTS:

Nationwide is slashing rates once again | GETTY/NATIONWIDE

Nationwide is slashing rates once again | GETTY/NATIONWIDE The contrast underlines Nationwide’s strategy to remain competitive at a time when rivals are raising costs.

This follows the Bank of England's announcement that the UK’s base rate will remain at four per cent on Thursday, pausing its run of cuts amid ongoing inflationary pressures.

The decision came despite mounting political pressure for lower borrowing costs to ease the burden on households facing higher mortgage repayments.

Lloyds Bank has urged homeowners to switch mortgage deals in order to generate substantial savings compared to defaulting onto the standard variable rate.

More From GB News