Bank of England holds interest rate at 4% as inflation stays above target

How to save in this economy |

GB News

The decision by the Bank’s nine-member Monetary Policy Committee had been widely expected, with most economists forecasting no movement this month

Don't Miss

Most Read

The Bank of England has confirmed the UK’s base rate will remain at four per cent, pausing its run of cuts as inflationary pressures persist.

It comes despite growing political pressure for lower borrowing costs to ease the burden on households facing higher mortgage repayments.

The central bank said the UK was “not out of the woods” on inflation, with taxes contributing to rising food costs.

The Monetary Policy Committee (MPC) has previously signalled that while inflation risks remain, interest rates are still on a gradual downward path.

Yesterday, the consumer price index (CPI) rate stood at 3.8 per cent in the 12 months to August 2025, well above the Bank’s two per cent target.

The Bank of England has held the base rate at four per cent

|PA / CHAT GPT

At its meeting ending on September 17 2025, the MPC voted by a majority of seven-two to maintain Bank Rate at 4 per cent.

Two members voted to reduce Bank Rate by 0.25 percentage points, to 3.75 per cent.

During the meeting, the MPC voted by a majority to reduce the stock of UK government bond purchases held for monetary policy purposes, and financed by the issuance of central bank reserves, by £70billion over the next 12 months, to a total of £488billion.

There has been substantial disinflation over the past two and a half years, following previous external shocks, supported by the restrictive stance of monetary policy.

In minutes of the latest decision, the Bank said inflation was expected to rise slightly in September, before falling towards the two per cent target.

It said: “The Committee remained alert to the risk that this temporary increase in inflation could put additional upward pressure on the wage and price-setting process.”

It added: “The Committee judged that a gradual and careful approach to the further withdrawal of monetary policy restraint remained appropriate.

“The restrictiveness of monetary policy had fallen as Bank Rate had been reduced.

“The timing and pace of future reductions in the restrictiveness of policy would depend on the extent to which underlying disinflationary pressures would continue to ease.”

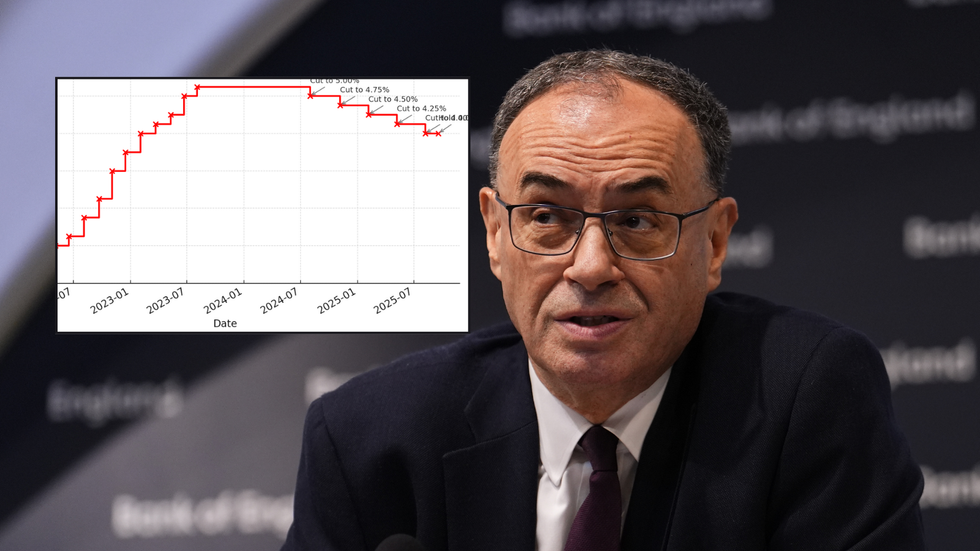

Members voted to hold the base rate seven to two

| PAMaxime Darmet, senior economist at Allianz Trade said: "As inflation remains stubbornly high, the Bank of England holding its base rate steady is a welcome change of strategy from the previous series of cuts.

"It signals a shift in the BoE’s approach to tackle the challenges brought by the persistently high inflation we’ve seen over the last two to three years.

"This pause is likely to continue for at least the next six months, as the BoE navigates the delicate balance between persistent inflation and a looser labour market.

“With inflation likely to hover between 3 per cent and 3.5 per cent – way above the 2 per cent target – through next spring, patience will be key.

"We foresee the next rate cut in April 2026, followed by further reductions later in the year, ultimately bringing the Bank Rate down to 3.25 per cent by the end of 2026. This cautious stance suggests the BoE is now committing to fighting inflation as its top priority."

Unemployment is currently stuck at a four-year high of 4.7 per cent, and wage growth has slowed, raising concerns about weakening momentum in the UK economy.

Financial analysts had previously forecast at least one further rate cut before the end of the year, which could bring the base rate down to 3.75 per cent.

The base rate has a direct impact on mortgages, savings accounts, loans and credit cards across the country. Mortgage holders on variable or tracker deals see their repayments rise or fall when the Bank changes rates.

Those coming to the end of fixed-rate deals are also affected, as the cost of new mortgage offers reflects the Bank’s benchmark rate.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

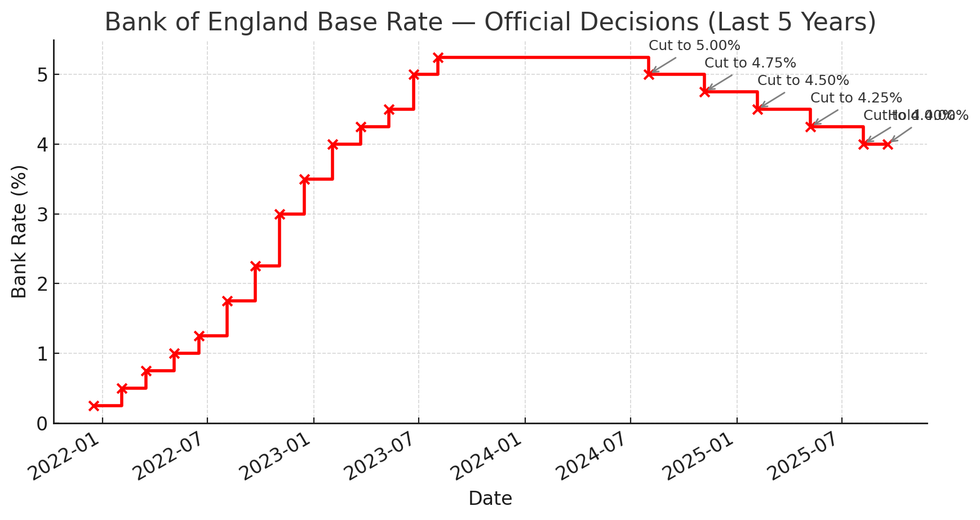

How has the base rate changed in recent years?

|CHAT GPT

Businesses face higher borrowing costs too, which economists warn is likely to make investment decisions more difficult. On the other hand, analysts have noted savers benefit when interest rates stay higher, as banks tend to pass on some of the returns through stronger savings rates.

The institution uses the base rate as its main tool to control inflation, ensuring price rises do not spiral too far above target. Over the past two years, the Bank raised rates as high as 5.25 per cent in an effort to bring inflation down after the cost of living crisis.

Since then, several cuts have taken place, but policymakers are treading carefully to avoid reigniting inflationary pressures. Economists point out that while inflation is lower than last year, food and energy prices remain elevated and household budgets remain tight.

The decision to hold interest rates also reflects uncertainty in the global economy, with new trade tariffs, higher oil prices and weaker growth forecasts weighing on policymaking.

The Bank of England's QE monetary policy is coming under fire | GETTY

The Bank of England's QE monetary policy is coming under fire | GETTY The base rate is set by nine members of the MPC, a group who vote on whether to raise, cut or maintain the current level. In recent meetings, the votes have been split, with some members pressing for faster reductions while others favour a more cautious approach.

MPC policymakers will next meet to discuss the trajectory of the Bank of England base rate on November 6, 2025.

LATEST DEVELOPMENTS:

More From GB News