Lloyds Bank urges homeowners to switch mortgage deal as Britons could save £450

Lloyds announces 1,600 job losses across bank branches

|GB News

Thousands could face higher monthly payments as low 2020 mortgage rates expire

Don't Miss

Most Read

Around 135,000 homeowners who secured exceptionally low mortgage rates during the final quarter of 2020 are approaching a potential financial cliff edge as their five-year fixed deals expire.

Borrowers who locked in rates averaging 2.4 per cent when the market hit historic lows, could collectively face additional costs totalling £1billion if they fail to secure new arrangements.

The impending expiry affects mortgages originally worth £210,000 on average, taken out when fixed-rate products were available below two per cent.

Without action, these homeowners will automatically transfer to their lenders' standard variable rates (SVR), currently averaging 6.9 per cent.

That's nearly triple their existing rates.

Lloyds has urged customers to secure a new fixed-rate deal before current arrangements expire.

This is in order to generate substantial savings compared to defaulting onto the standard variable rate.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

TRENDING

Stories

Videos

Your Say

This rate shock threatens to dramatically increase household costs across the country as the protected period ends.

For standard repayment loans with approximately £177,000 remaining, monthly costs would rise from £932 to £1,361 – an increase of £429.

Interest-only borrowers face even steeper increases, with payments soaring from £420 to potentially £1,208 monthly – a jump of £788.

These calculations assume borrowers default to their lender's standard variable rate after their fixed period concludes.

The dramatic payment increases reflect the stark difference between the pandemic-era rates and current market conditions, where standard variable rates have climbed to 6.9 per cent on average.

Lloyds has urged customers to secure a new fixed-rate deal before current arrangements expire

|GETTY/PA

Interest-only customers would pay £757 monthly under this arrangement, representing savings of £450.

The bank has introduced digital solutions to streamline the remortgaging process, with existing Lloyds customers able to complete their entire application through a mobile app in minutes.

Andrew Asaam, mortgage director at Lloyds, stressed the importance of prompt action for those approaching the end of their fixed-rate periods.

"While interest rates are higher than they were five years ago, for people coming to the end of their current fixed rate, taking early action can help minimise the jump in monthly payments they may be expecting," he said.

This rate shock threatens to dramatically increase household costs across the country as the protected period ends

| GETTY IMAGESMr Asaam highlighted the increased ease of switching lenders in today's market, noting the availability of competitive remortgage products designed to cushion the impact of higher rates.

"Acting now gives you the certainty of knowing you won't see a bigger rise in your monthly payments than necessary, while still giving you the flexibility to choose another deal if rates continue to drop in the meantime," he added.

The current mortgage market presents a mixed picture for those exiting their 2020 fixed-rate deals.

While today's rates cannot match the exceptional sub-two per cent offerings from five years ago, competitive alternatives exist that significantly undercut standard variable rates.

LATEST DEVELOPMENTS:

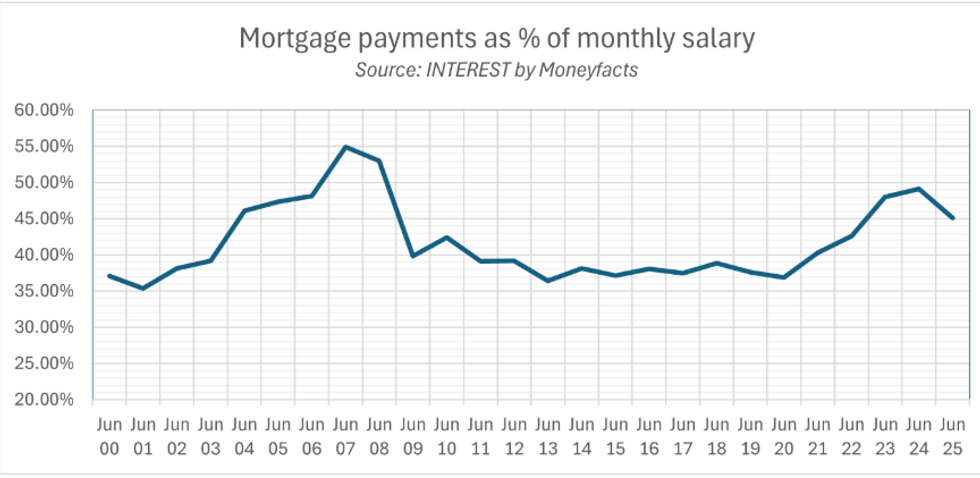

Analysis shows mortgage repayments now swallow nearly half of average earnings

| INTEREST BY MONEYFACTSFixed-rate products currently available offer substantial protection against the full impact of rate increases.

The difference between securing a new fixed deal versus defaulting to a standard variable rate could mean hundreds of pounds in monthly savings for affected households.

Market conditions suggest borrowers have options to mitigate payment shock, though they must accept that the era of ultra-low borrowing costs has passed.

Lloyd's message remains clear: taking action before fixed terms expire provides the best opportunity to manage the transition to higher rates while avoiding the worst-case scenario of expensive variable rates.

More From GB News