Lifetime ISA penalties soar to over £100m as withdrawals rise

Savers urged to be careful of tax on savings interest |

GB News

Savers face hefty charges outside first-home or retirement withdrawals

Don't Miss

Most Read

Savers using Lifetime ISAs faced withdrawal penalties totalling approximately £102million during the 2024/25 tax year, figures from HMRC have revealed.

This represents a significant rise from £75.3million in penalties during the previous year.

The government-backed savings scheme is designed to help people save for their first property or retirement.

It imposes a 25 per cent charge on withdrawals made outside permitted circumstances.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

TRENDING

Stories

Videos

Your Say

Savers can access funds penalty-free only when purchasing a first home valued at £450,000 or below, after reaching 60 years of age, or if diagnosed with a terminal illness giving them less than 12 months to live.

The sharp increase in penalties has intensified scrutiny of the product's design and effectiveness in supporting savers' financial goals.

Industry experts argue the penalty mechanism can unfairly penalise savers beyond removing government benefits.

Helen Morrissey, head of retirement analysis at Hargreaves Lansdown, stated: "The 25 per cent government bonus for Lisa contributions can really boost people's savings and help that dream of owning your first home or having a decent retirement feel that bit more real."

Financial specialists argue the early exit penalty can erode part of a saver’s own money in addition to the government bonus

|GETTY/PA

She added: "However, the way the early exit penalty works is that it not only takes away the benefit of the government bonus but also a chunk of your own savings.

"For someone who has saved hard to try and meet a financial goal it's a tough lesson to take when they need to tap into that income for unforeseen circumstances and then get hit hard with a penalty."

Despite penalty concerns, data shows substantial growth in first-time buyers using Lifetime ISAs for property purchases.

Approximately 87,250 account holders accessed their savings to buy their first home during 2024/25, marking an increase of roughly 30,500 compared to the previous tax year.

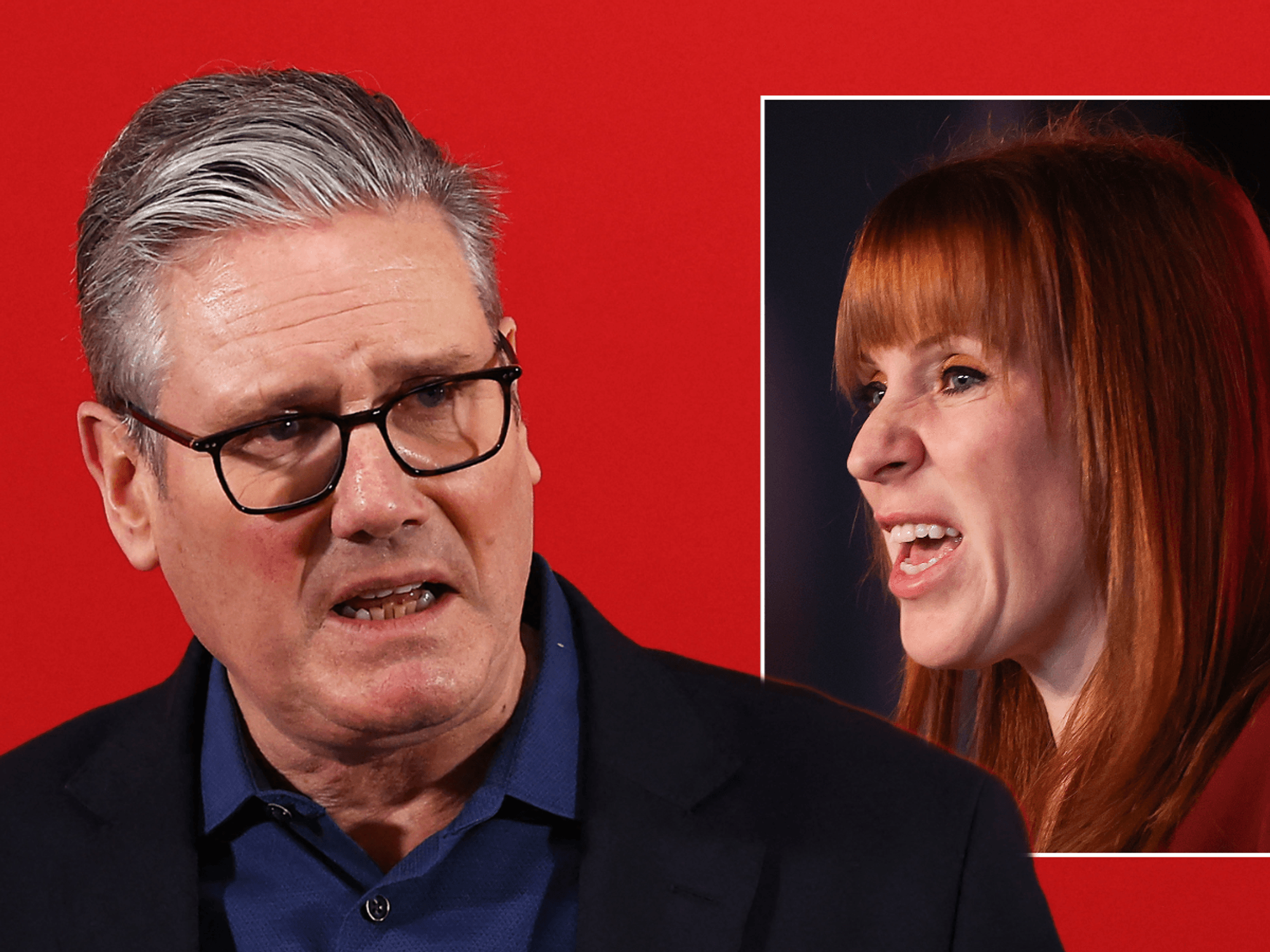

Rachel Reeves warned Lifetime ISA rules 'nonsensical' | GETTY

Rachel Reeves warned Lifetime ISA rules 'nonsensical' | GETTYThe typical amount withdrawn for property purchases reached £15,782 in 2024/25, climbing by approximately £857 from 2023/24 levels.

Claire Exley, head of financial advice and guidance at JP Morgan-owned wealth manager Nutmeg, commented: "Property purchases using the Lifetime Isa increased significantly during the 2024/25 tax year, likely driven by first-time buyers keen to beat changes to stamp duty rules at the start of April."

The Treasury Committee has expressed doubts about whether the Lifetime ISA properly serves those genuinely requiring financial assistance.

MPs cautioned that the scheme's combined savings objectives might steer individuals away from more appropriate financial products while exposing portions of their savings to risk.

The government has pledged to collaborate with Lifetime ISA providers to improve communication about the product's features and limitations.

Exley noted: "Whether it is rising house prices which have put properties beyond the Lisa house price cap or a change in life circumstances that means people need the money in their Lisa, more savers are handing over their savings to pay the exit penalty."

These developments have prompted renewed demands for comprehensive reform of the savings vehicle.

The broader ISA market experienced substantial growth during 2023/24, with adult ISA subscriptions reaching approximately £103billion, an increase of £31.4billion from the previous year.

LATEST DEVELOPMENTS:

The sharp increase in penalties has raised questions about its effectiveness

| GETTYCash ISA subscriptions drove much of this expansion, rising by £27.9billion.

Jason Hollands, managing director of Bestinvest, warned: "Isas should not be taken for granted given the increasingly painful tax burden in the UK."

He highlighted that the personal savings allowance has remained frozen since April 2016.

Elsa Littlewood from BDO observed that many individuals sought tax-efficient savings options through ISA wrappers during the period.

Industry experts remain concerned about potential future reforms, with speculation earlier this year that Chancellor Rachel Reeves might reduce the annual cash ISA limit from its current £20,000 threshold.

More From GB News