Thousands of pensioners face Winter Fuel Payment clawback after missing deadline

Sue Ashcombe-Hurt rages at Labour after having winter fuel payment reinstated |

GB News

Automatic payments to higher earners will be recovered through tax codes over several years

Don't Miss

Most Read

Latest

Thousands of pensioners across Britain have missed their chance to avoid an administrative headache after the deadline to opt out of Winter Fuel Payments passed on September 15.

Those with annual incomes exceeding £35,000 who failed to decline the benefit will now automatically receive payments ranging from £100 to £300 this winter.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

The consequence of this oversight will become apparent next spring when HMRC begins recovering these payments through adjusted tax codes from April 2026 - creating an unwelcome surprise for many retirees.

The payments, scheduled for distribution in November and December, will reach eligible pensioners born before September 22, 1959.

TRENDING

Stories

Videos

Your Say

Despite the income threshold making these individuals ineligible to keep the funds, the automatic payment system means they will receive the money regardless.

For those caught in this situation, the recovery process will prove particularly irksome.

Monthly deductions of approximately £17 will appear in payslips throughout the 2026-27 tax year for recipients of the standard £200 payment.

Those who received the maximum £300 will face proportionally higher monthly deductions.

The situation becomes more complex in subsequent years.

The September deadline has passed, with thousands set to face tax complications

|GETTY

During 2027-28, pensioners will experience doubled deductions of roughly £33 monthly, as HMRC simultaneously recovers payments from both the 2026 and 2027 winter periods.

Only in the 2028-29 tax year will the monthly recovery amount return to the standard £17 level.

This staggered recovery schedule means affected pensioners will endure years of reduced take-home pay for benefits they never intended to receive.

The £35,000 threshold applies to total income before any deductions for charitable donations or Gift Aid contributions.

This calculation follows the initial step of the Income Tax Act 2007 computation, meaning pensioners cannot reduce their income figure through such payments to avoid the clawback.

HMRC's determination focuses solely on gross income during the 2025-26 tax year.

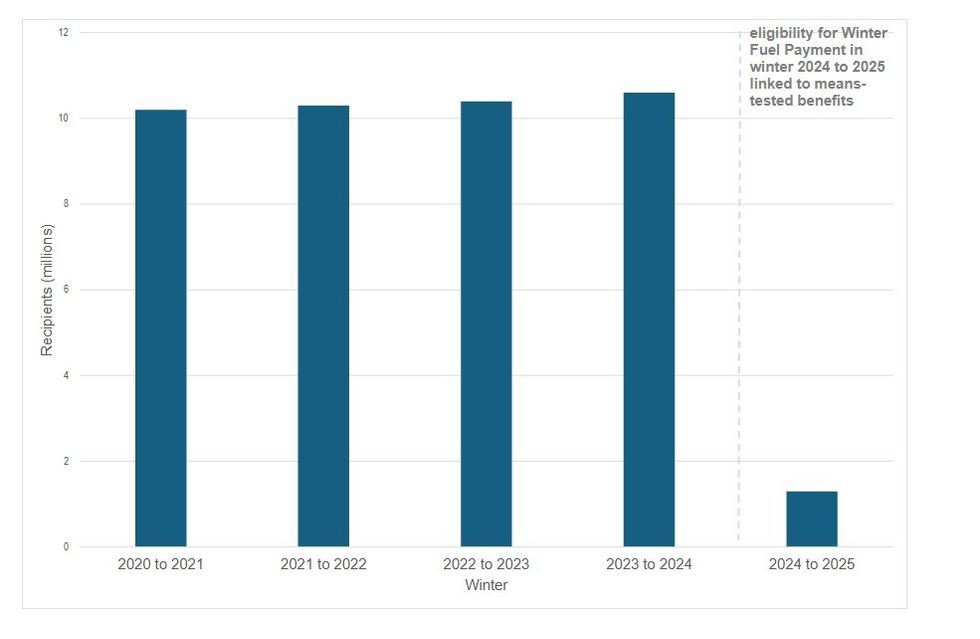

Eligibility of Winter Fuel Payment in winter 2024 to 2025 linked to means-tested benefits | DWP

Eligibility of Winter Fuel Payment in winter 2024 to 2025 linked to means-tested benefits | DWPWhether through pensions, investments, or employment earnings, any combination pushing annual income above the threshold triggers full recovery of the payment.

The all-or-nothing approach means a pensioner earning £35,001 faces the same clawback as someone earning £100,000.

No sliding scale or partial recovery exists, making the threshold particularly harsh for those marginally exceeding it.

The recovery mechanism differs significantly for self-assessment taxpayers.

Rather than monthly PAYE deductions, these individuals will see the Winter Fuel Payment automatically added to their 2025-26 tax returns.

The full amount will then form part of their balancing payment due on January 31, 2027.

Paper return filers face an additional administrative step, needing to manually include the payment on their forms.

This creates further opportunity for error and potential penalties if overlooked.

HMRC has introduced an online tool allowing pensioners to verify whether they will face recovery and through which method.

However, this resource arrived too late for those who might have chosen to opt out had they better understood the implications of automatic receipt and subsequent clawback.

The administrative burden created by this system extends beyond individual inconvenience.

Accountants and financial advisers now face additional workload helping clients navigate the recovery process, particularly those who overlooked the opt-out deadline.

LATEST DEVELOPMENTS:

Scotland presents its own complications

| SCOTTISH PARLIAMENTThe Scottish Government indicated that opting out after payment decisions would not prevent this year's payment, though the timing of these decisions remained unclear.

Scottish pensioners eligible for the Pension Age Winter Heating Payment face similar recovery challenges.

The episode highlights the complexity of means-testing universal benefits.

What began as an attempt to target support more effectively has created a bureaucratic maze, with higher-income pensioners receiving money they must later repay through years of tax code adjustments.

The system's inefficiency becomes apparent when considering the administrative costs of distributing, tracking, and recovering these payments.

More From GB News