Nationwide Building Society offering 'high' 6.5% savings interest rate but Britons urged to 'act quickly'

Savers are looking for the best interest rates, with Nationwide Building Society among the financial institutions offering competitive deals

Don't Miss

Most Read

Savers are being reminded to take advantage of competitive savings accounts while they still can, with Nationwide Building Society offering customers interest rates of 6.5 per cent.

This deal is available through the building society's Flex Regular Saver account, however analysts are sounding the alarm that it could be impacted by future base rate cuts from the Bank of England.

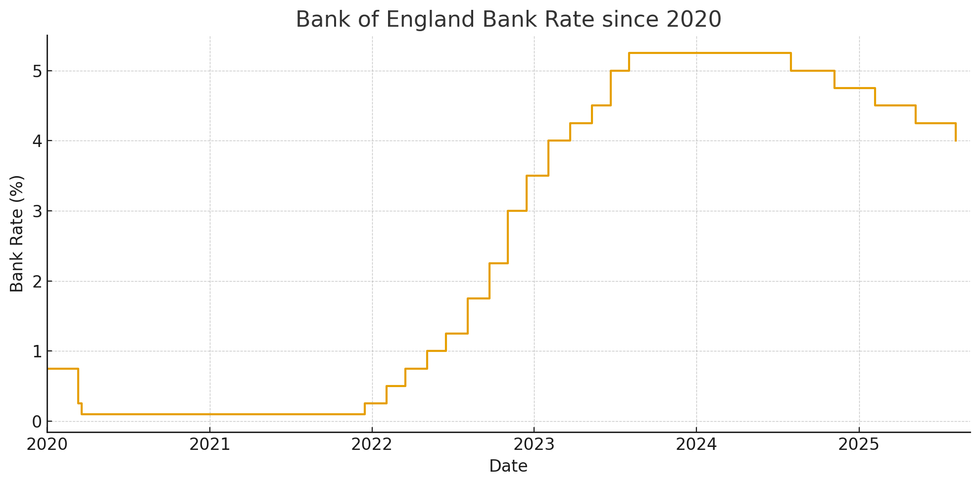

In recent years, the central bank has raised interest rates in an effort to bring down the consumer price index (CPI) rate of inflation from historic heights seen in the aftermath of the Covid-19 pandemic.

The UK base rate has since been slashed from 5.25 per cent to four per cent in a win for borrowers, but savers are expected to lose out on competitive returns as a result.

Nationwide is offering competitive savings deals

|GETTY / NATIONWIDE

What is Nationwide Building Society's Flex Regular Saver?

As it stands, the variable account offers customers a interest rate of 6.5 per cent AER/annual gross, which is significantly higher than the rate offered by Nationwide's competitors.

According to Moneyfactscompare, the average interest rate offering to customers in the UK at the end of August 2025 was 3.47 per cent across all types of savings accounts.

On Nationwide's website, the lender gave an example of someone savings the maximum amount of £200 on the first of month to illustrate the returns someone can earn.

If someone were to have this strategy, they will save £2,400 after one year. With the current interest in place, and if they make no withdrawals, the building society would pay the customer £84.50 in interest.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Are you eligible for Nationwide's Flex Regular Saver?

| NATIONWIDE BUILDING SOCIETYIt should be noted that the interest rate attached to the Flex Regular Saver is variable, which means it can fluctuate either up or down, with the interest only being charged after the one-year term.

Currently, Nationwide Building Society's competitive product is available to customers who are UK residents, at least 16 years old and have a current account with the lender.

Unlike other savings accounts, customers are able to withdraw their cash three times without incurring a penalty, but after the four withdrawal the interest rate will drop to 1.25 per cent.

Those interested in the Flex Regular Saver account can apply for it by visiting Nationwide Building Society's website, and must have both a mobile phone number and email address.

MEMBERSHIP:

- EXPOSED: Bombshell report blows lid on the staggering number of Channel migrants who pretend to be children

- REVEALED: The five biggest scandals that have rocked Labour since sweeping to power as Angela Rayner on brink

- Reform's Doge unit has uncovered a £1.2bn money pit. Labour must be terrified about May 2026 - Ann Widdecombe

Alastair Douglas, CEO of TotallyMoney, said: "The Bank of England is expected to continue cutting rates over the next 12 months in a bid to boost the economy – so it’s important that savers act quickly, and make sure their money is working for them.

"Some banks are paying below one per cent interest, and with inflation at 4.10 per cent, for some people, their cash will effectively be losing value. When shopping around, keep an open mind, and consider smaller or newer banks and building societies.

"They’ll often offer some of the best rates in a bid to try and win customers from the big high street providers. And under the Financial Services Compensation Scheme, up to £85,000 per person and per bank, building society or credit union is protected.

"Loyalty doesn’t pay, but being savvy with your savings can. Just watch out for accounts which call themselves ‘easy access’ but will slash your interest rate if you make withdrawals."

LATEST DEVELOPMENTS:

How has the base rate changed since 2020?

|CHAT GPT

Andrew Hagger, the personal finance expert of Moneycomms, added: "Your average saver simply wants a decent rate of return on their money without having to worry about the impact of confusing terms and conditions. Their priority is to be able to get their hands on their cash whenever they need it.”

"Opening a separate savings account (even a different brand) and using it as a bolt-on to your existing bank account can get you a ‘clean and simple’ savings account paying a far better return than they receive at present.”

"Open banking advances means there’s no need to switch bank account to take advantage of a high savings rate elsewhere, because the task of moving money from an existing current account to a new savings App and vice versa is simple and quicker than people realise."

The Bank of England's Monetary Policy Committee (MPC) is next scheduled to meet and discuss the future of the UK's base rate on September 18, 2025.