Pension savers withdraw 'unprecedented' £18bn from retirement pots ahead of Rachel Reeves's tax raid

Last year, the Chancellor confirmed pension pots will become liable for inheritance tax by April 2027

Don't Miss

Most Read

Latest

Pensioners are withdrawing "unprecedented" amounts of money from retirement savings ahead of Chancellor Rachel Reeves's Autumn Budget on November 26, 2025.

British pension savers extracted £18.08billion in tax-free lump sums during the 2024/25 financial year, marking a dramatic 60.7 per cent surge from the £11.25billion withdrawn in the previous year.

Fresh data from the Financial Conduct Authority (FCA), secured by wealth management company Evelyn Partners, exposes an rush to access pension funds as savers scramble to secure their 25 per cent tax-free entitlements.

The surge came earlier in the year, with withdrawals reaching £10.43billion in the six months to March 2025 alone, a 72 per cent jump compared to the same period twelve months earlier.

Pension savers are withdrawing 'unprecedented' amounts of money from pots ahead of Rachel Reeves's Budget

|GETTTY

Nearly 112,000 savers accessed their pension commencement lump sums in just the final six months, representing a 33 per cent increase year-on-year, based on the FCA'S data.

The acceleration began well before the Chancellor delivered her first Budget in October 2024, with withdrawals already climbing rapidly during summer 2024.

Emma Sterland, the chief financial planning officer at Evelyn Partners, described the figures as "quite startling," noting that the nation's pension savers have been withdrawing their tax-free entitlements at an "unprecedented" pace.

Withdrawals in the second half of the financial year alone exceeded £10billion, dwarfing typical patterns and indicating a fundamental shift in saver behaviour as uncertainty gripped the pensions landscape.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

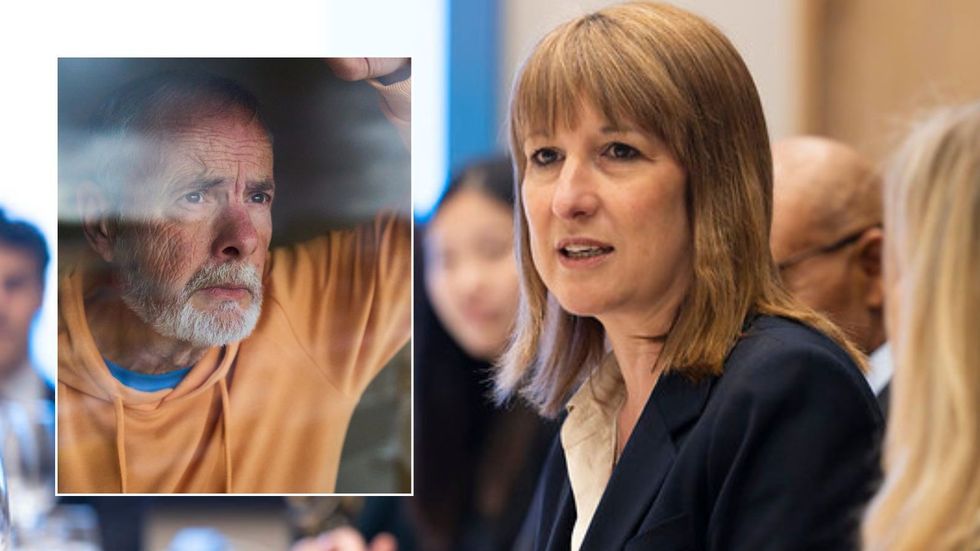

Rachel Reeve has unveiled drastic changes to the pension | GBNEWS

Rachel Reeve has unveiled drastic changes to the pension | GBNEWSGovernment policy uncertainty appears to be the primary catalyst behind this withdrawal trend, with savers particularly anxious about potential restrictions to their tax-free entitlements.

The Autumn Budget announcement in October 2024 that unspent pension assets would face inheritance tax (IHT) from April 2027 triggered immediate concern, though the panic had already begun months earlier amid speculation about possible Budget changes.

Reports circulated throughout 2024 and into this summer suggesting the Treasury might slash the tax-free cash cap from £268,275 to as little as £100,000, though these fears never materialised.

"Much of this increase is a slightly panicked dive into pensions sparked by uncertainty over policy change, particularly among those who aren't benefitting from expert financial advice," Ms Sterland observed.

Critics have noted that the Treasury's failure to dismiss such speculation has only intensified saver anxiety about future restrictions. Financial advisers are sounding alarm bells about the potential consequences of these hasty withdrawals for retirement security.

MEMBERSHIP:

- EXPOSED: Bombshell report blows lid on the staggering number of Channel migrants who pretend to be children

- REVEALED: The five biggest scandals that have rocked Labour since sweeping to power as Angela Rayner on brink

- Reform's Doge unit has uncovered a £1.2bn money pit. Labour must be terrified about May 2026 - Ann Widdecombe

Neil Wilson, an investor strategist at Saxo UK, warned: "Taking large sums in one go can push you into a higher income tax bracket, eroding pension value and, in extreme cases, depleting funds too quickly."

Sterland highlighted that extracting tax-free cash prematurely shifts money from a tax-sheltered environment into one potentially subject to capital gains, dividend or savings taxes.

Some savers who withdrew funds purely due to Budget fears last year desperately attempted to reverse their decisions when no changes materialised, with mixed success.

The irony is particularly cruel for those who die before April 2027, having moved their money from an inheritance tax-free pension into their taxable estate.

LATEST DEVELOPMENTS:

How are you preparing for retirement?

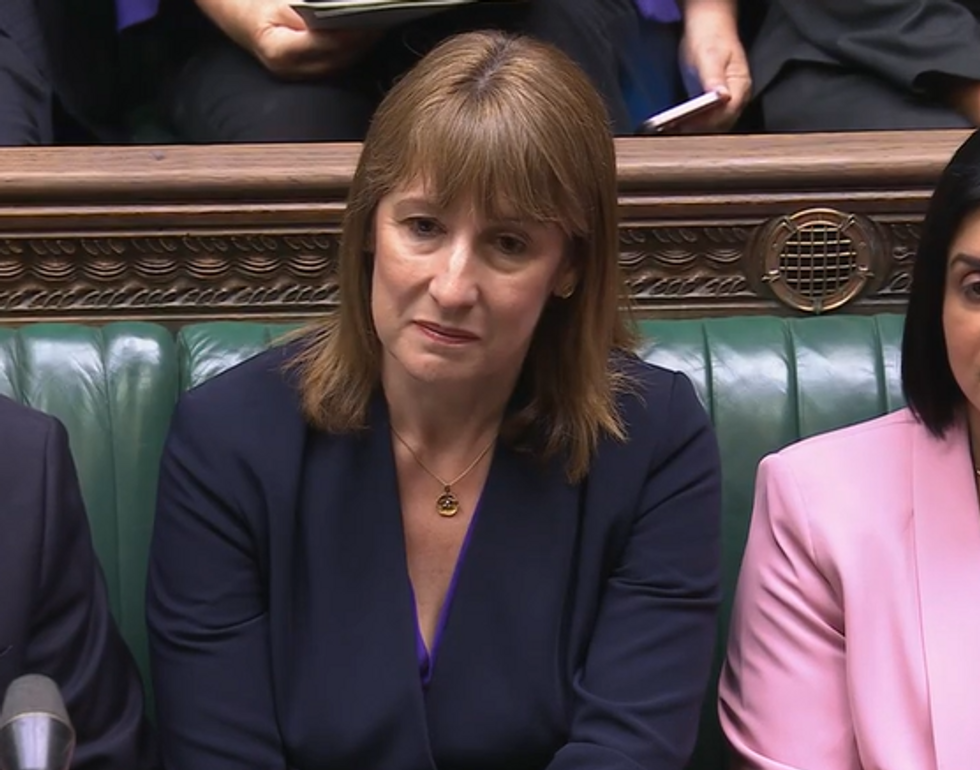

| GETTYThe withdrawal surge reflects a broader pattern of early pension access, with government data revealing that three-quarters of the three million savers who've taken flexible payments since 2015 were under 65.

Of the £103billion withdrawn through flexible payments since pension freedoms began, £36 billion went to those under 60 and £29 billion to those aged 60-64.

This creates a policy dilemma for the government, which recently launched a commission to boost pension saving whilst grappling with unsustainable state pension costs.

"A reduction in tax-free cash would feel to many who have yet to take their PCLS, whether they are retired yet or not, like the goalposts are being moved as they're halfway down the pitch," Sterland cautioned.

More From GB News