NS&I accused of ‘ripping off’ Britons with 1% interest on savings account

Over a million depositors face real-terms losses as inflation erodes value of Treasury-backed savings

Don't Miss

Most Read

Latest

National Savings and Investments (NS&I) faces fierce backlash for offering meagre returns that fail to protect depositors from rising prices, according to some critics.

The Investment Account from Britain's state-back bank pays just one per cent annually, while July's inflation reached 3.8 per cent, guaranteeing real-terms losses.

Around 1.4 million savers hold £1.5billion in these variable-rate accounts, with balances of up to £100,000. The postal-only product is popular with older customers who trust the Treasury-backed institution's security.

Finance experts warn the financial impact on NS&I's customers could be notable.

NS&I has been accused of "ripping off" consumers

|NS&I / GETTY

A £50,000 deposit earns £500 interest a year, yet inflation cuts its real value to £48,651 — with Bank of England forecasts pointing to four per cent inflation and deeper losses ahead.

The gap is stark compared to the wider market. Competitive providers are offering 4.5 per cent returns, more than quadruple NS&I’s rate.

Consumer champion Martyn James condemned the account as “ripping off” customers, particularly elderly investors.

“These tend to be longer-term investments that older people have taken out and who might not realise they’re being paid lower rates,” he said.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Mr James stressed that NS&I’s reputation is misleading. “It’s seen as a safe and trusted place to put your money but in some of the policies it’s certainly not beneficial and you’ll actually be losing money.”

He also accused the Treasury-backed bank of failing its duty to customers.

“It would be very easy for these people to switch their account to one of these infinitely superior rates and get four times as much,” Mr James argued.

Rachel Springall, finance expert at Moneyfacts, echoed those concerns and warned customers could begin to look elsewhere.

Ms Springall said: “NS&I is a trusted brand, but savers are losing out on better interest rates available elsewhere if they fail to shop around, particularly if they have a sizeable pot.”

At today’s market-leading rates, a £50,000 deposit would return £2,250 a year. That leaves savers £1,750 better off than with NS&I’s one per cent product.

Even with inflation factored in, higher rates deliver modest real-terms growth. A £50,000 deposit at 4.5 per cent provides £337.19 in real value, compared to a guaranteed erosion under NS&I.

The Investment Account allows deposits up to £1million, all fully protected by the Government.

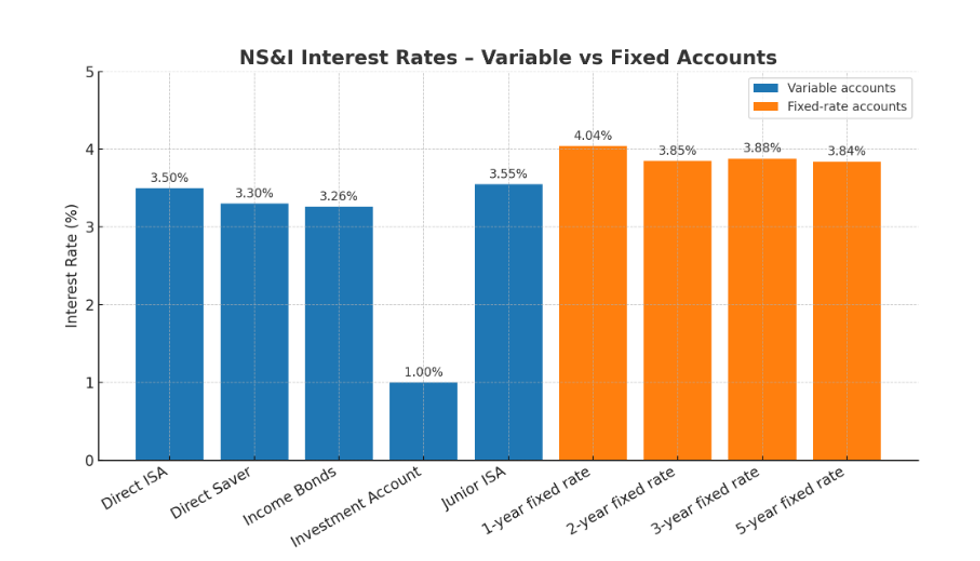

NS&I interest rates - Variable and Fixed Accounts

|CHAT GPT

In contrast, the Financial Services Compensation Scheme covers just £85,000 per individual or £170,000 for joint accounts.

Personal finance expert Anna Bowes urged savers to act. She said customers should “vote with their feet by moving their cash.”

NS&I insists it no longer promotes the Investment Account to new customers.

Instead, it highlights alternatives such as Direct Saver and Income Bonds, which pay higher rates and can still be managed by post.

LATEST DEVELOPMENTS

July's inflation reaching 3.8 per cent, is guaranteeing real-terms losses.

| GETTY IMAGES“For existing Investment Account customers, we include details of other NS&I products which they may find more suitable in their annual postal statements,” a spokesperson said.

“We also run regular email campaigns to Investment Account customers highlighting other NS&I products with higher interest rates.”

The Financial Conduct Authority (FCA), which reviewed the cash savings market in 2023, continues to monitor whether providers offer “fair value” to customers.

More From GB News