Pension drawdowns surge as retirees rush to withdraw funds at record rates

Annuities and drawdown are the two main methods of using a pension pot to fund retirement

Don't Miss

Most Read

A record number of Britons are turning to pension drawdown to manage their retirement savings, with new figures revealing a sharp rise in take-up.

Financial Conduct Authority (FCA) data shows almost 350,000 people entered drawdown arrangements in 2024-25, representing a 26 per cent increase on last year.

In 2019-20, just 197,000 plans were opened, meaning drawdown usage has risen by 78 per cent in five years.

Drawdown allows savers aged 55 and over, rising to 57 from 2028, to access and invest their pension pot more flexibly than through traditional products.

TRENDING

Stories

Videos

Your Say

Under the rules, individuals can withdraw up to a quarter of their pension entirely tax-free at the outset.

The remainder moves into a drawdown account and stays invested in assets such as stocks and bonds chosen by the saver.

People can then take income or lump sums whenever they wish.

Withdrawals beyond the 25 per cent tax-free portion are taxed at a person’s standard income tax rate.

Record numbers of Britons are opting for pension drawdown as take‑up surges

|GETTY

Products are offered by pension providers and investment platforms, giving consumers a wide range of options.

The flexibility attracts many savers but introduces significant risk because funds remain invested, meaning their value can fluctuate and may fall sharply during market downturns.

Taking too much too soon, or experiencing a period of weak investment performance, can exhaust a fund during retirement.

Events such as global trade tensions or tariff disputes can also impact investment returns.

LATEST DEVELOPMENTS:

Payments can be made monthly, quarterly, twice yearly or annually

| GETTY/GB NEWSDrawdown requires ongoing monitoring of investment performance and careful management of withdrawals.

If a saver misjudges their decisions and the pot runs out, there is no safety net.

Annuities operate very differently by providing a guaranteed income for life or a fixed term.

People aged 55 and over can use their pension savings to buy an annuity from an insurance provider.

Payments can be made monthly, quarterly, twice yearly or annually.

Income levels depend on the pension pot size, the features selected and the purchaser’s health.

For example, a £100,000 pot placed into an annuity with a 5 per cent rate would deliver £5,000 a year.

The key distinction between drawdown and annuities lies in risk and flexibility.

Drawdown offers control and the potential for investment growth but comes with no guarantees.

Annuities provide certainty and stability but remove flexibility entirely.

Many savers are now combining both options by splitting their pension pots to secure a guaranteed income while keeping some funds invested for future growth.

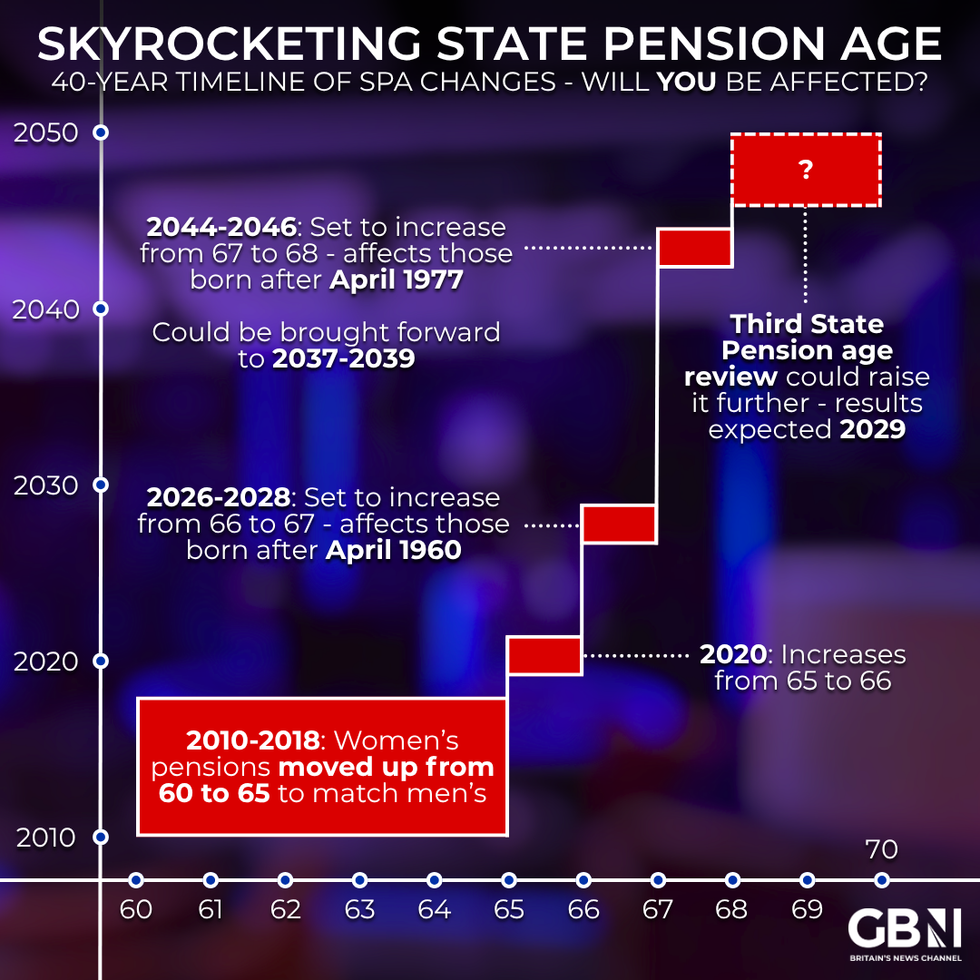

Skyrocketing state pension age - will you be affected? | GB News

Skyrocketing state pension age - will you be affected? | GB NewsAnnuities cannot be altered once purchased and do not allow lump-sum withdrawals.

Lifetime annuities pay out until death, while fixed-term options run for set periods of between three and 25 years and are often used to bridge the gap until the state pension begins at 66.

Several types exist, including level annuities, escalating annuities, inflation-linked products, enhanced versions for people with health issues and joint-life options that continue paying a partner after death.

Annuity income is taxable and counts towards a person’s annual tax-free allowance.

Our Standards: The GB News Editorial Charter

More From GB News