Nationwide Building Society slashes mortgage interest rates in win for homebuyers - full list of changes

GB NEWS

| Ben Leo grills Mel Stride on the Tories's 'missed golden opportunity' with the economy

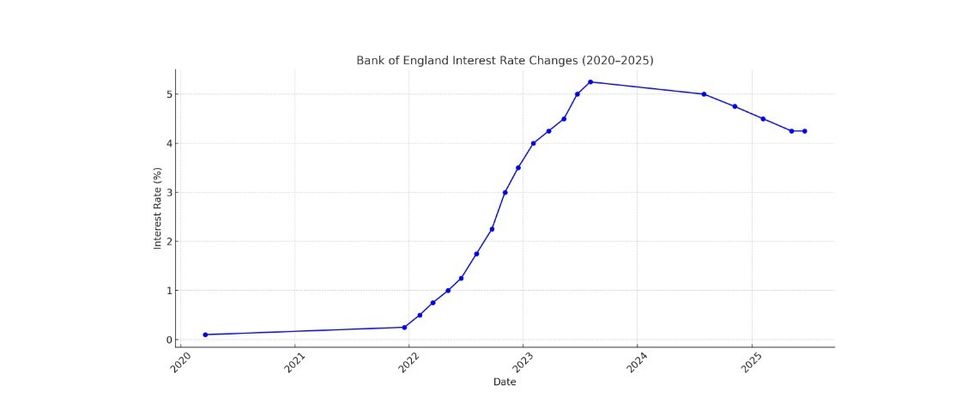

Mortgage repayments have surged in recent years due to interest rates being raised by the Bank of England

Don't Miss

Most Read

Nationwide Building Society has announced another major interest rate cut across its line of mortgage products in a major win for homebuyers.

This latest decision from the lender comes after recent base cut rates from the Bank of England, which has seen the cost of borrowing drop to 4.25 per cent.

The central bank's Monetary Policy Committee (MPC) has hinted that further interest rate cuts are expected to implemented throughout 2025.

While a blow for savers, those looking to get on the property ladder or remortgage are likely to benefit from these cuts, which are being passed onto consumers by Nationwide.

NATIONWIDE BUILDING SOCIETY |

NATIONWIDE BUILDING SOCIETY | Nationwide Building Society is cutting mortgage rates

Specifically, Nationwide has confirmed it is reducing rates by up to 0.20 percentage points across selected two, three and five-year fixed rate products. These new rates are effective from tomorrow, July 2.

The building society's lowest new lending rate now stands at 3.81 per cent with reductions also made for those remortgaging to the financial institution. Here is a full list of Nationwide interest rate cuts coming this week:

First-time buyers: reductions of up to 0.20 per cent across two, three and five-year fixed rate products up to 90 per cent LTV, including:

- Two-year fixed rate at 60 per cent LTV with a £1,499 fee is 3.94 per cent (reduced by 0.05 per cent)

- Three-year fixed rate at 75 per cent LTV with a £999 fee is 4.20 per cent (reduced by 0.14 per cent)

- Five-year fixed rate at 90 per cent LTV with a £999 fee is 4.39 per cent (reduced by 0.10 per cent).

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

GETTY | There are many mortgage deals on the market

GETTY | There are many mortgage deals on the market

New and existing customers moving home: reductions of up to 0.20 per cent across two, three and five-year fixed rate products up to 90 per cent LTV, including:

- Two-year fixed rate at 60 per cent LTV with a £1,499 fee is 3.81 per cent (reduced by 0.09 per cent)

- Three-year fixed rate at 85 per cent LTV with a £999 fee is 4.35 per cent (reduced by 0.09 per cent)

- Five-year fixed rate at 90 per cent LTV with a £1,499 fee is 4.34 per cent (reduced by 0.06 per cent).

Remortgage: reductions of up to 0.10 per cent across two, three and five-year fixed rate products up to 85 per cent LTV with rates starting from 3.89 per cent. These include:

- Two-year fixed rate at 60 per cent LTV with a £1,499 fee is 3.89 per cent (reduced by 0.03 per cent)

- Three-year fixed rate at 75 per cent LTV with a £999 fee is 4.19 per cent (reduced by 0.05 per cent)

- Five-year fixed rate at 75 per cent LTV with no fee is 4.22 per cent (reduced by 0.06 per cent).

Carlo Pileggi, Nationwide’s Senior Manager for Mortgages, broke down why the lender is opting to slash mortgage rates once again.

He explained: "These latest reductions will be welcome news for borrowers looking to buy their first home or move onto their next.

LATEST DEVELOPMENTS:

GETTY | The Bank of England has made changes to interest rates in recent years

GETTY | The Bank of England has made changes to interest rates in recent years

"We’re proud to support all areas of the market, whether it’s first-time buyers - through our Helping Hand boost, which enables eligible first-time buyers to borrow up to six times their income - home movers or those looking for a new deal.

"With our reduced rates starting from 3.81 per cent, we aim to be front of mind."

The Bank of England's MPC is next scheduled to meet to discuss the future of the base rate on August 7, 2025.