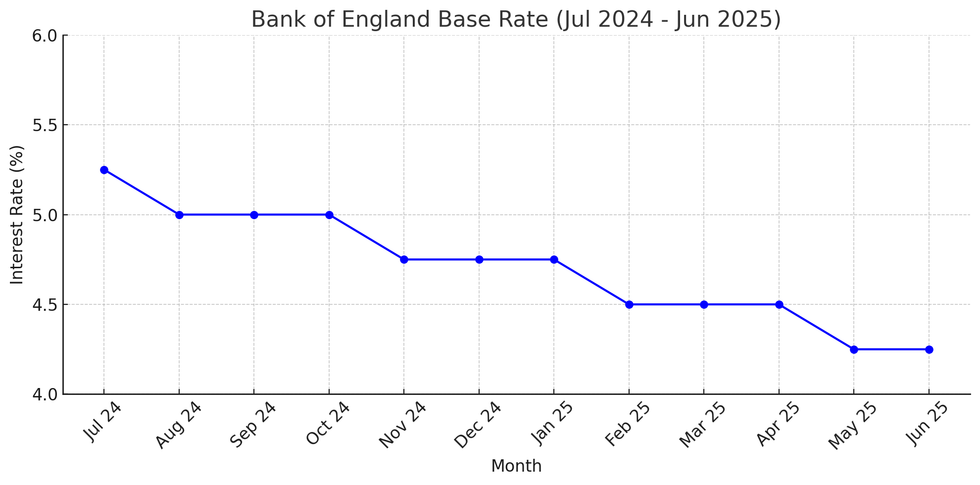

Bank of England holds interest rates at 4.25% as inflation remains well above target

At its meeting today, the MPC voted by a majority of 6 - 3 to maintain Bank Rate

Don't Miss

Most Read

The Bank of England has decided to hold the base rate at 4.25 per cent as inflation pressure continues to grow.

The decision follows yesterday's announcement that inflation stood at 3.4 per cent in May, well above the Bank’s two per cent goal.

Three members preferred to reduce Bank Rate by 0.25 percentage points, to four per cent

Bank governor Andrew Bailey said: "Interest rates remain on a gradual downward path, although we’ve left them on hold today. The world is highly unpredictable."

He added that there were "signs of softening in the labour market" – referring to indicators including slower hiring and wage growth easing – which were being closely watched to see how far they feed into UK inflation.

Most economists expected the Bank of England to keep interest rates the same, breaking the recent pattern of cutting rates every other meeting.

Rising food costs and geopolitical tensions in the Middle East are creating fresh concerns about price stability, making policymakers reluctant to ease monetary policy further at this stage.

The Bank of England’s Monetary Policy Committee (MPC) has signalled that further rate cuts are likely this year.

However, many analysts believe those cuts will be delayed until later in the year, as inflation remains above the Bank’s two per cent target.

The Bank rate serves as a key benchmark, influencing the cost of borrowing and the interest paid to savers by banks and building societies.

The last cut, in May, lowered the rate from 4.5 to 4.25 per cent, marking the fourth reduction in the past year.

Bank of England holds interest rates at 4.25 per cent

|GBNEWS

Professor Joe Nellis is economic adviser at MHA, the accountancy and advisory firm said: "The Bank’s decision to hold interest rates at 4.25 per cent does not come as a surprise but it will not be welcome news to the UK Government as they look to bounce back from the disappointing performance of the economy in April.

"It is likely although not certain that we will see a cut in UK rates in August and perhaps one more before the end of the year, but we are unlikely to see this pattern extended into 2026.

"As the Chancellor pointed out in her Spending Review speech to Parliament, four interest rate cuts in the last year is good progress.

"While the Government has not generated the growth it so desires and the economy desperately needs, it has provided enough economic stability to enable these cuts, and the Bank’s monetary policy of today is certainly more conducive to economic growth than it was a year ago.

"This is a positive omen for future policy. Once we see some sort of calm return to the global economy, we can hope to see the Bank return to rate-cutting and resume the progress that it has made in the past year."

Niesr expects "just one further cut this year", reflecting concerns about persistent inflationary pressures

| PAMonica George Michail, associate economist for the National Institute of Economic and Social Research, warned that inflation is forecast to remain above three per cent throughout 2025, citing "persistent wage growth and the inflationary effects from higher Government spending".

Niesr expects "just one further cut this year".

Sandra Horsfield, an economist for Investec, highlighted additional risks including potential US tariffs and their indirect impact on UK firms.

"The risk to energy prices has clearly intensified and moved up the agenda given developments in the Middle East," she said.

Whilst Horsfield noted some positive signs, including services inflation dropping to 4.7 per cent in May from 5.4 per centin April, she concluded: "It seems unlikely the MPC will want to change policy rates this week."

The decision to hold rates has significant implications for households across the UK, affecting both borrowers and savers.

Kevin Mountford, co-founder of Raisin UK, noted that whilst housing sales remained healthy in May according to Zoopla's House Price Index, fixed mortgage rates could become unsettled.

He said: "Consumers looking to borrow should take advantage when they see a good option for them. It's also worth researching savings accounts, comparing current rates, and moving money if it's sitting in a low-interest account as this can have rewarding returns in the long run."

Derek Sprawling, Managing Director of Spring Savings said: "Despite seeing no change in the Bank of England Base Rate, it’s important for savers to remember they could still see a fall in their savings account rates, particularly from high street banks.

The decision to hold rates has significant implications for households across the UK, affecting both borrowers and savers.

| GETTY"It usually takes a few weeks for a Base Rate cut to filter through to high street bank rates and we already know two major banks are reducing their easy access rates in July.

"I therefore urge savers to continue to look at their savings accounts and make sure they’re getting a fair return on their hard-earned money, despite there being no change in the Base Rate today."

Dean Butler, Managing Director for Retail Direct at Standard Life, part of Phoenix Group, said: "While some forecasters still anticipate rate cuts later in the year, today’s decision underlines the fact that the path to a lower-rate environment will not be straightforward.

"For borrowers on variable rate mortgages or nearing the end of fixed terms, any delay in rate cuts will continue to put pressure on monthly budgets - especially with the ongoing cost of living challenges and recent household bill increases in April.

More From GB News