Nationwide Building Society increases interest rates on two tax-free savings accounts

Nationwide Building Society has increased the interest rate offered on two ISAs

|GETTY | NATIONWIDE BUILDING SOCIETY

Nationwide Building Society has pulled previous issues from sale

Don't Miss

Most Read

Nationwide Building Society has increased the interest rate offered to customers seeking a tax-free savings option for one and two years.

The building society has upped the rate it offers on the one and two year fixed rate ISAs, and withdrawn all previous fixed rate ISAs from sale.

As of March 19, 2024, the One Year Fixed Rate ISA pays 4.50 per cent AER/tax-free.

Meanwhile, the new rate for the Two Year Fixed Rate ISA is now 4.20 per cent AER/tax-free.

These rates are available for balances of £1 or more.

In January, Nationwide announced a rate of 4.25 per cent AER/tax-free for its One Year Fixed Rate ISA.

The interest rates on these accounts are fixed, meaning they won't change during the term

|GETTY

At the same time, the Two Year Fixed Rate ISA paid four per cent AER/tax-free.

These accounts accept transfers in and can be opened via the website, internet banking, mobile banking app or in a branch.

The interest rates on these accounts are fixed, meaning they won't change during the period.

The current top one-year cash ISA is Virgin Money's One Year Fixed Rate Cash ISA Exclusive Issue 11 which pays 5.25 per cent AER/tax-free, according to Moneyfactscompare.

There are three providers currently offering the best interest rate available on two-year fixed rate Cash ISAs, at 4.70 per cent AER/tax-free.

They are UBL UK's 2 Year Fixed Rate Cash ISA, OakNorth Bank's Fixed Rate Cash ISA and Close Brothers Savings's 2 Year Fixed Rate Cash ISA.

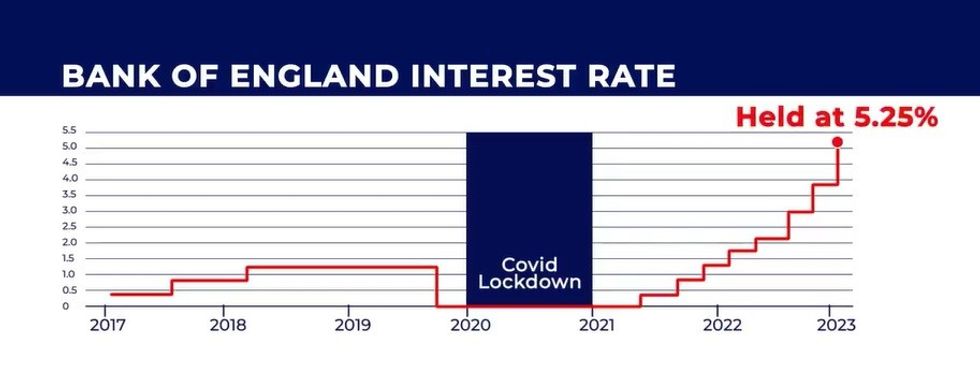

The Bank of England has held the base rate at a 16-year high of 5.25 per cent since August 2023, and speculation is mounting that they will cut the interest rate this year.

The move would be good news for borrowers, but less positive for savers, who are benefitting from higher interest rates.

It's possible to put up to £20,000 into ISAs each tax year, and this allowance will reset next month, when the new tax year begins on April 6, 2024.

It means those who want to take full advantage of their 2023/24 and 2024/25 annual ISA allowance will need to act fast before the new financial year arrives.

LATEST DEVELOPMENTS:

The Bank of England base rate has been held at 5.25 per cent, a 16-year high

|GB NEWS

There are four types of ISA, and it's currently possible to pay into one of each type each tax year, provided the annual allowance isn't breached.

These are:

- cash ISAs

- stocks and shares ISAs

- innovative finance ISAs

- Lifetime ISAs (which have a £4,000 per tax year deposit limit, included within the £20,000 ISA allowance)