Nationwide Building Society recommits to ‘stay everywhere’ until 2028 as UK banks close 6,000 branches

The number of bank branch closures in the UK has hit a new milestone but Nationwide Building Society has reaffirmed its commitment to in-person banking for the foreseeable future

Don't Miss

Most Read

Latest

Nationwide Building Society has reconfirmed its pledge to having banking services “stay everywhere” amid the trend of closures from high street banks.

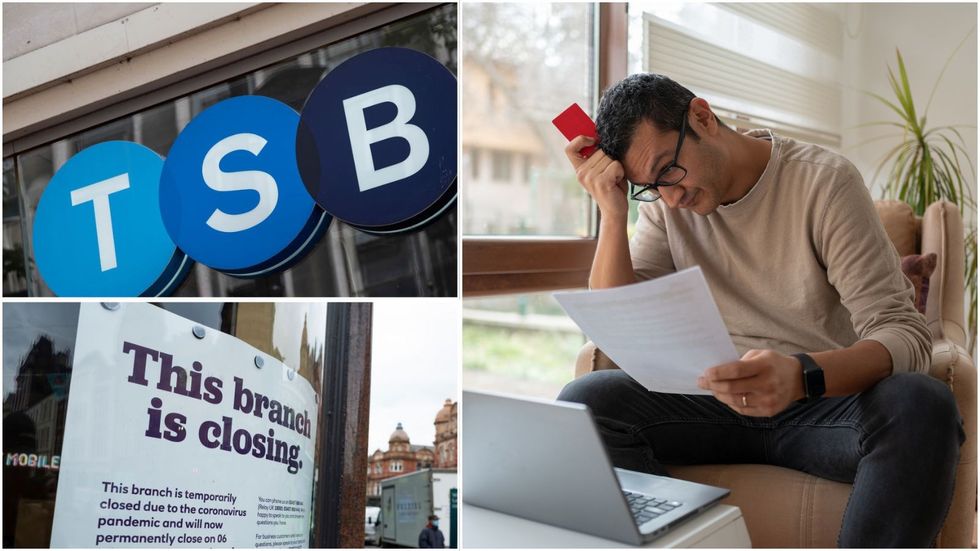

This comes following new research from Which? that found the number of bank branch closures in the UK since 2015 has hit 6,000.

According to the consumer watchdog, a further 645 sites are earmarked for closure later this year.

This is the equivalent to over 60 per cent of the bank branch network since Which? began tracking closures in 2015.

Under Nationwide Building Society’s Branch Promise, the financial institution is committed to offering banking services everywhere it currently has a branch until 2028.

If the building society were to close a branch in a community, Nationwide would still provide in-person banking services to offset any detrimental impact on the local area.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Nationwide is committed to "staying" in local communities in the face of the recent bank branch closure trend

|GETTY/PA

On its website, the financial institution explained: “There may be circumstances outside of our control that mean we have to close a branch.

“But we will only do this if we don’t have another workable option.

A recent survey from the building society revealed that half of people aged 16 to 24 have been left “frustrated” upon discovering their local branch has been shut down.

In a poll of 2,000 Britons, 73 per cent of people admitted that they were “concerned” about the rate of closures.

According to Nationwide’s research, 70 per cent of consumers still value bank branches despite changing consumer trends.

Some 43 per cent of those surveyed cited the importance of banking locations for vulnerable people with 21 per cent of young people recognising this as a key reason branches exist.

The building society’s poll found that branches are valued by Britons of all age groups for a variety of reasons outside of day-to-day transactions.

These include making cash withdrawals and checking balances, according to 44 per cent and 28 per cent of respondents, respectively.

Furthermore, 19 per cent use branches to transfer large sums of money and 38 per cent prefer physical interaction when dealing with issues relating to scams.

Stephen Noakes, the director of Retail at Nationwide, outlined what these findings suggest about people’s opinions about banking in-branch.

LATEST DEVELOPMENTS:

The number of bank branch closures in the UK has hit 6,000 since 2015 | GETTY

The number of bank branch closures in the UK has hit 6,000 since 2015 | GETTY He said: “What’s clear from our research is that people of all ages are frustrated and concerned about the rate of branch closures.

“Our own customers tell us how much they rely on them.

“This is why we are proud to have Britain’s biggest branded branch network, a manager in every branch and a commitment to stay everywhere we have a branch until at least 2028.”

GB News has previously covered the wave of bank branch closures sweeping the UK.