End stealth tax and hike basic rate tax threshold to £20,000, Hunt told: 'Simplest and fairest thing to do'

Dr Roger Gewolb shared his thoughts on the ongoing tax threshold freeze

|GB NEWS

Jeremy Hunt will deliver the Spring Budget on Wednesday

Don't Miss

Most Read

Chancellor Jeremy Hunt is being urged to end the six-year income tax threshold freeze, which is seeing millions being taxed more by "stealth".

Scrapping the Conservative Party's plan to hold the personal allowance and higher rate tax bands at 2021/22 levels until 2028 and increase the allowances would be the "fairest" thing the Government could do, a financial commentator has claimed.

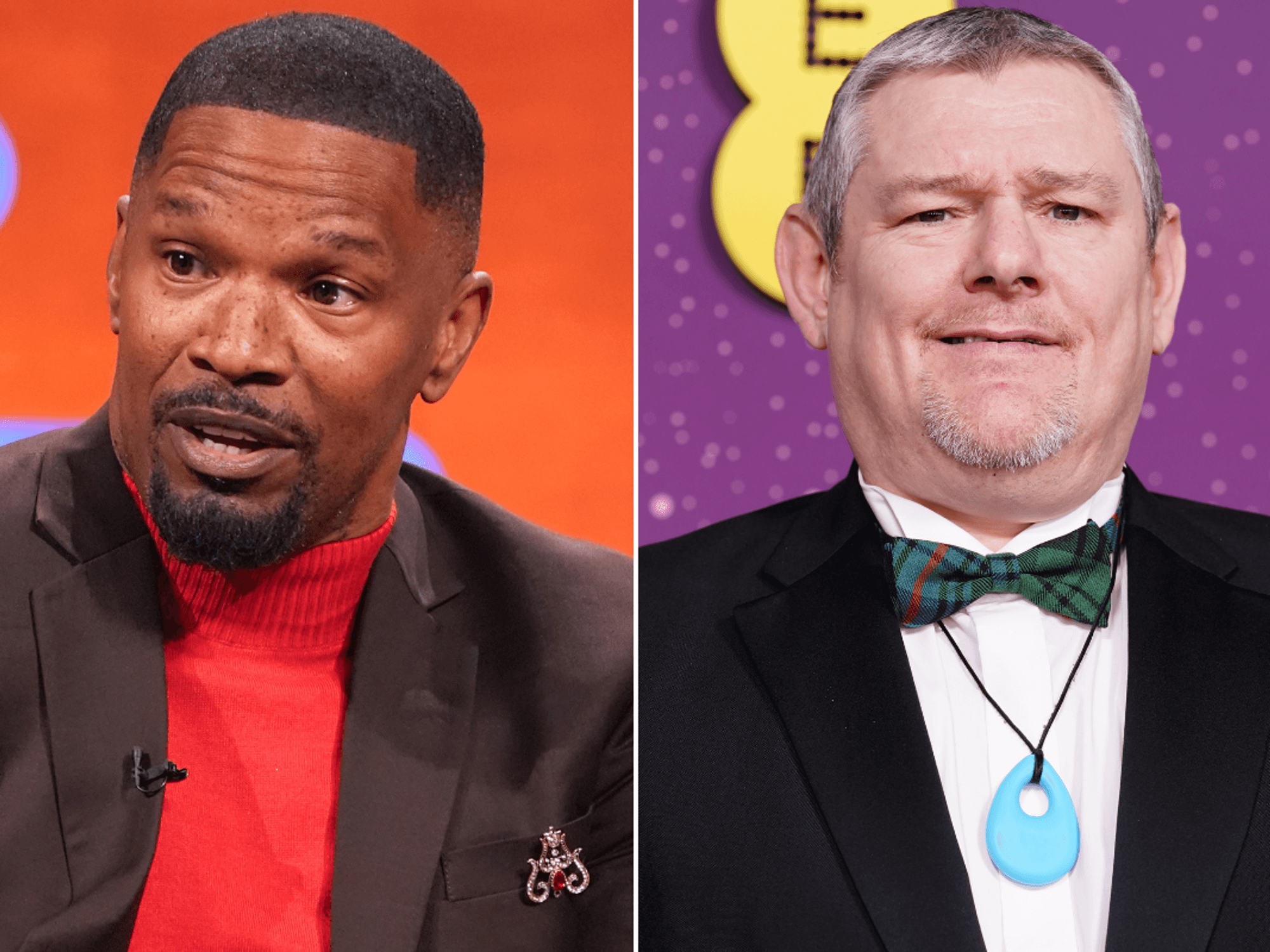

In an exclusive video for GB News, former Bank of England adviser Dr Roger Gewolb called for the personal allowance to be hiked from £12,570 to £20,000 to help millions of working-age adults and pensioners.

Dr Gewolb, who is the founder of the Campaign for Fair Finance, said: "I think it would be the fairest and simplest thing that the government could do.

Dr Roger Gewolb said ending the ongoing 'stealth' tax would be the 'simplest and fairest' thing to do

|GB NEWS | PA

"And people have been calling for this, all kinds of people - experts, economists, everyone - calling for this for a very long time. But they just won’t budge.

"If they moved the threshold - let’s say from £12,570 to £20,000, which has been the main proposal – that would allow people to earn more money to survive the cost of living crisis, to take a second job, without suffering tax on it.

"That would allow people who are earning, say £40,000, if that £50,000 threshold went to £60,000 or £70,000, they could do likewise.

"They could find some ways to earn more money in order to survive this dreadful cost of living crisis, which, I’m sorry, is government created at this point. They could have solved this long, long ago."

Dr Gewolb said he thought the tax thresholds should be increased by at least four per cent, which would be in line with the most recent inflation figure.

He said the bands should continue rising in line with inflation, and added: "They should not reduce it when inflation falls to two per cent, they should keep increasing it by two per cent.

"They have to realise how they’re strangling ordinary Brits and businesses."

This form of fiscal drag is due to raise £42.9billion by 2027/28, according to Office for Budget Responsibility forecasts. It's expected nearly four million more individuals will pay income tax between 2022/23 and 2028/29, three million more moved into the 40 per cent higher rate and 400,000 more onto the 45 per cent additional rate of tax.

Asked whether the Government could afford such a tax cut, Dr Gewolb said: “I challenge a lot of the Tory figures, and especially that they don't have the money accounted for.

“I've been saying for well over a year since the first interest rate rise, that I think that they are building up a war chest to have a heck of a lot of money to give away some pretty significant tax cuts that Labour won't be able to match before the next general election.

“I think they've got loads of money.

LATEST DEVELOPMENTS:

“If you remember the November before last, Mr Hunt used Project Fear kind of tactics to scare the wits out of us about a £55billion black hole."

Dr Gewolb said Mr Hunt said there would be £25billion of taxation and £30billion of cuts in services, police, education, NHS, military etcetera.

"Well, he adopted the £25billion of taxation – of stealth taxes. That's the stealth taxes that he introduced," he said.

“And then a couple of days later, he said 'We'll get to the £30billion of cuts in services later'. And you know what? It's never been heard from again, never been mentioned, didn't happen. It was all a myth in Mr Hunt's mind and Rishi's mind, I think."

An HM Treasury spokesperson said: “After providing hundreds of billions of pounds to protect lives and livelihoods throughout the pandemic and Putin’s energy shock, we had to take some difficult decisions to help pay it back.

“However, with inflation more than halved and because of the progress we have made, we have cut taxes for hard working people, with the average earner paying £1,000 less in tax a year than they otherwise would have done and provided the biggest ever cash increase to pension payments, a 10.1 per cent rise.”