Mortgage repayments to rise by £1,800 for 1.5 million households in New Year

Public react to interest rates being kept at 5.25 percent

|GB NEWS

Mortgage rates have soared thanks to action from the Bank of England and will be high for most of 2024

Don't Miss

Most Read

Latest

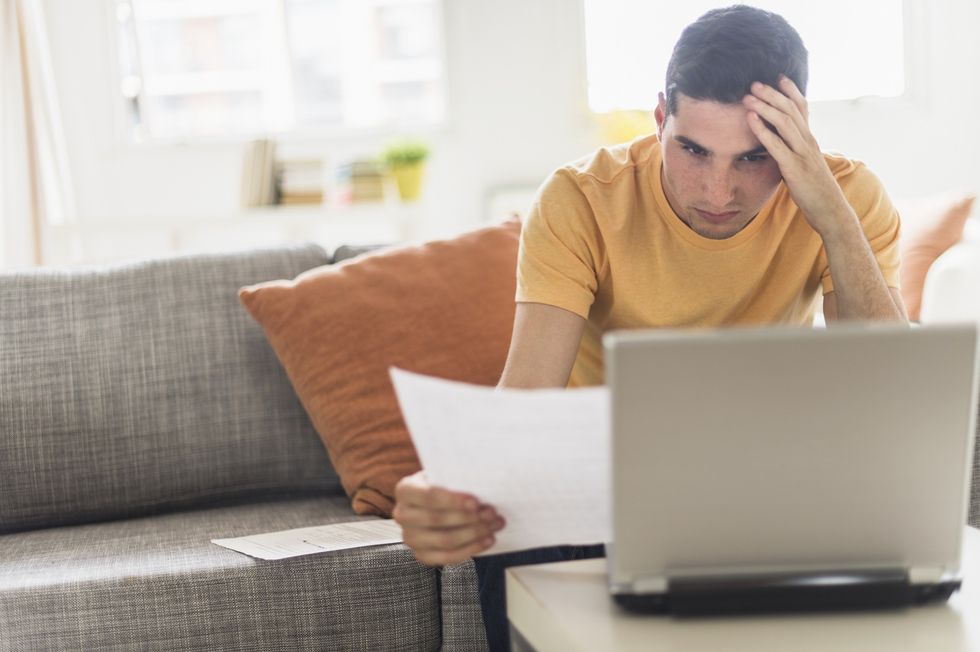

Around 1.5 million homeowners are set to be slapped with mortgage repayment hikes of £1,800 in the New Year.

The Resolution Foundation is sounding the alarm that upcoming tax changes and cuts to interest rates will benefit the richest people in the UK and not the poorest.

Mortgage repayments will continue to be high for over 1 million families in 2024 as interest rates are still expected to remain above pre-pandemic levels.

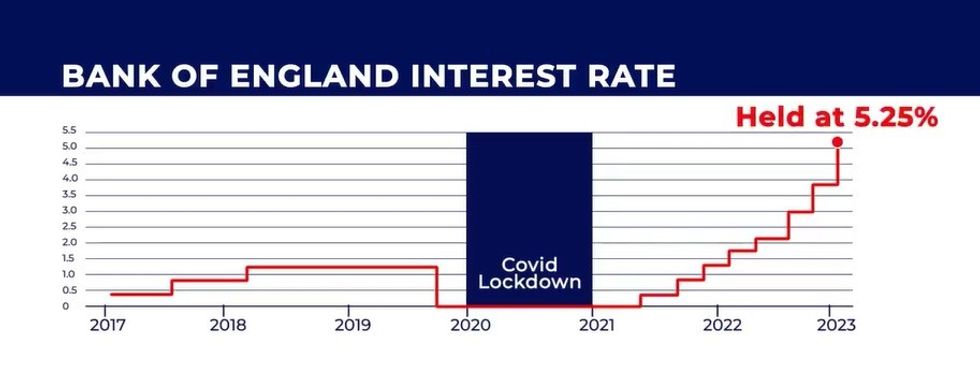

Interest rates have been on the rise as the Bank of England has attempted to rein in inflation to two percent.

Mortgage repayments will rise for many in 2024

|GETTY

As the Consumer Price Index (CPI) rate has eased, the central bank has paused its series of base rate hikes over the last three months.

Analysts are confident that rates will be cut in 2024 but not until the later part of the year which means sizable increases to mortgage repayments are coming.

As it stands, the Bank of England’s base rate is sitting at 5.25 percent and has been for the past three months.

Torsten Bell, the managing director of the Resolution Foundation, warned that the country’s cost of living woes will likely be continuing.

The economist explained: “2024 is going to be messy, for our living standards not just politics.

“The past two years have been dominated by rising energy and food bills, with everyone affected. It will be very different in 2024. Inflation falling back faster than expected means many will benefit from rising real wages.

“But politicians tempted to claim happy days have arrived should be cautious – it won’t feel like that for everyone.”

The think tank’s highlighted the plight of homeowners and renters as rates continue to push repayments up for the foreseeable.

LATEST DEVELOPMENTS:

The Bank of England base rate has been held at 5.25 per cent | GB NEWS

The Bank of England base rate has been held at 5.25 per cent | GB NEWSMr Bell added: “Higher interest rates actually made households better off in 2023 – higher returns on savings outweighed higher mortgage bills, raising household incomes by £19billion.

“But the reverse will be true in 2024, as 1.5 million mortgagors see their annual bills rise by an average of £1,800.

“Millions of renters will also face big hits when it comes to housing costs – only outright owners will see strong living standards growth.”