Mortgage rates warning: Cheap deals rapidly being pulled from market as prices rise

After falling gradually since January, swap rates are now climbing again and will impact fixed rate mortgages.

Don't Miss

Most Read

Lenders who launched cheap mortgage deals below 4 per cent interest this month are now once again hiking up their fixed-rate offers, or pulling them from the market altogether.

Less than 48 hours after Platform launched its 3.75 per cent five-year fixed rate mortgage rate on Monday, the lender removed it from the market.

It has also withdrawn products on two-year, three-year, and ten-year fixes, saying that high volumes of business were impacting its service.

Lenders are bumping up their rates over fears of rising costs on the market.

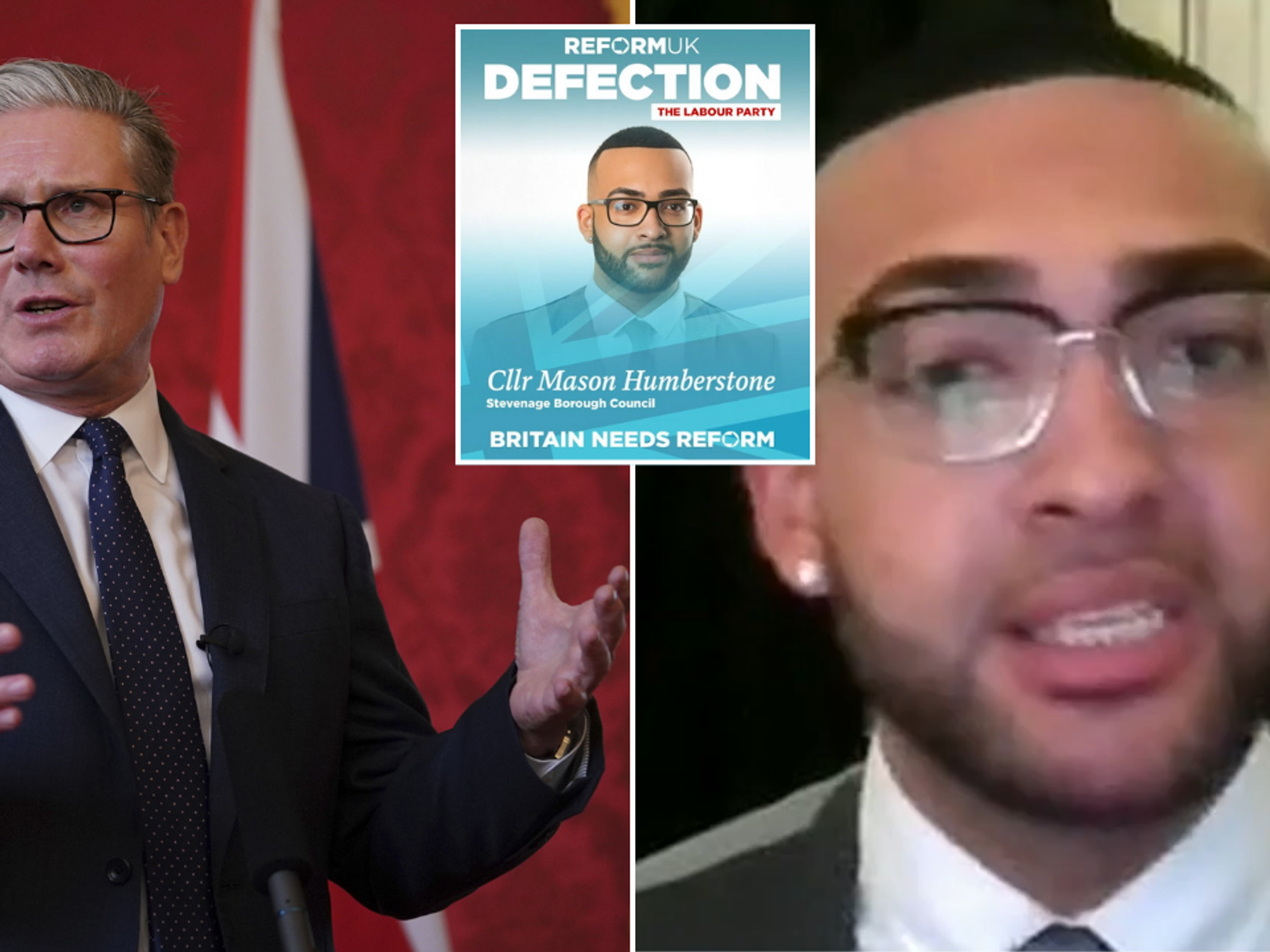

Yui Mok

In the first week of February the lender launched a five-year fixed remortgage deal at 3.95 per cent, which at the time was the cheapest on the market.

It undercut HSBC which brought out a 3.99 per cent deal.

Virgin Money has also pushed up its fixed mortgage range for both purchase loans and remortgaging.

For property purchases, rates have risen by up to 0.2 per cent, and for remortgaging by up to 0.26 per cent.

Those with fixed-rate mortgages could be hugely impacted.

Tim Ireland

Nicholas Mendes, mortgage technical manager at John Charcol, said: "Despite lenders breaking the 4 per cent barrier in recent weeks, any sort of momentum of other lenders following the pack looks to have been short-lived.

"In the last two days swap rates have increased meaning deals that had been on the market have quickly been withdrawn."

At the end of December 2021, the five-year swap rate was 1.10 per cent, it is now at 3.84 per cent, and is expected to continue rising.