Mortgage boost: Homeowners can make 'significant savings' this month ahead of Bank of England rate decision

Expert says quieter December market could mean faster processing and competitive pricing for borrowers

Don't Miss

Most Read

Homeowners preparing to renew a fixed rate mortgage could save hundreds of pounds by acting before the end of December.

Richard Moring, director of RM Mortgage Solutions, said December is a strong month for arranging a new deal because activity in the mortgage market typically slows.

He said: "It's not a time of year that you tend to think about renewing your fixed rate mortgage deal, and that's exactly why it's a fantastic time to do it".

The pre-Christmas period is usually among the quietest for mortgage applications, which can benefit borrowers who take action earlier than most.

TRENDING

Stories

Videos

Your Say

Mr Moring said lenders often have more capacity during December and can therefore offer competitive pricing and quicker processing times.

He said mortgage providers are keen to meet annual targets before the year ends, prompting some to release attractive deals or streamline their internal procedures.

"Lenders have annual targets to meet and many release competitive deals or streamline their processes to tempt customers in, leaving them with potentially significant savings."

He said this creates an opportunity for homeowners willing to review their finances during a quieter period.

The reduced workloads at this time of year mean documentation can be handled faster than during the busiest months, shortening typical turnaround times.

Mr Moring said there is another reason to consider renewing a deal now rather than waiting until January.

Homeowners renewing fixed-rate mortgages could save hundreds by acting before December ends

|GETTY

He said lenders frequently reassess pricing models in the new year, and it is common for rates to rise in the first quarter.

Mr Moring said: "They will often reassess their pricing models in January and it's not unusual to see price rises in the first quarter of the year".

He said securing a deal in December could help households avoid higher costs early next year.

"By putting a little time aside in December to secure your next deal, you can save yourself a lot of time, money and stress compared to peak periods."

The Bank of England held interest rates at four per cent last month, and the impact of this decision varies depending on mortgage type.

A fixed rate mortgage sets an interest rate for the length of the deal, regardless of future movements in the base rate.

LATEST DEVELOPMENTS

Mortgages are becoming cheaper for consumers | GETTY

Mortgages are becoming cheaper for consumers | GETTYThis means monthly payments remain the same throughout the term.

A variable rate mortgage can rise or fall depending on decisions made by the Bank of England.

Variable products can offer lower early-stage costs and allow for reduced payments if interest rates fall.

They can also increase payments without warning if the base rate is raised.

Fixed rate deals remain the most popular choice among borrowers who prefer certainty over monthly repayments.

Mr Moring said fixed rate mortgage holders approaching the end of their current deal may find improved pricing available over the coming months.

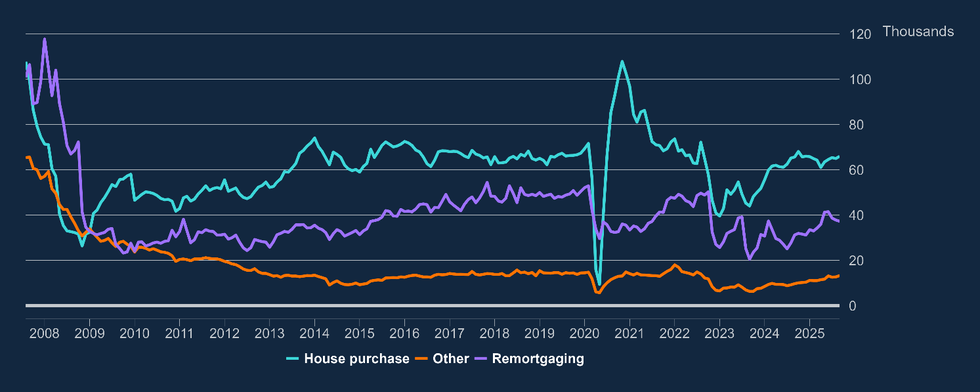

Net mortgage approvals increased by 1,000, to 65,900 in September | Bank of England report

Net mortgage approvals increased by 1,000, to 65,900 in September | Bank of England report"For fixed rate mortgage holders coming towards the end of their deal, there is reason to be optimistic that rates will continue to fall and there will be good deals to be found".

He said many lenders offer borrowers the ability to secure a rate months before their existing deal ends.

Most lenders allow customers to lock in a rate now that will not start for up to six months.

He said: "In practice, you can secure a competitive rate before Christmas and if rates fall next year, you can just switch again before completion so you get the best of both worlds".

The lighter workload during December can also lead to quicker document processing.

"The paperwork tends to get completed more quickly too with a lighter workload, so it's a win-win situation".

More From GB News