Nationwide Building Society mortgage overhaul ahead of Bank of England interest rate decision - full list

Mortgage rates are beginning to fall with Nationwide Building Society leading the way among the lenders

Don't Miss

Most Read

Nationwide Building Society has announced another overhaul to its line of mortgage products ahead of the Bank of England's upcoming decision over interest rates later this month.

The lender has confirmed it will be slashing rates across its fixed rate mortgage range in win for prospective homebuyers with the new deals being available from tomorrow, December 5.

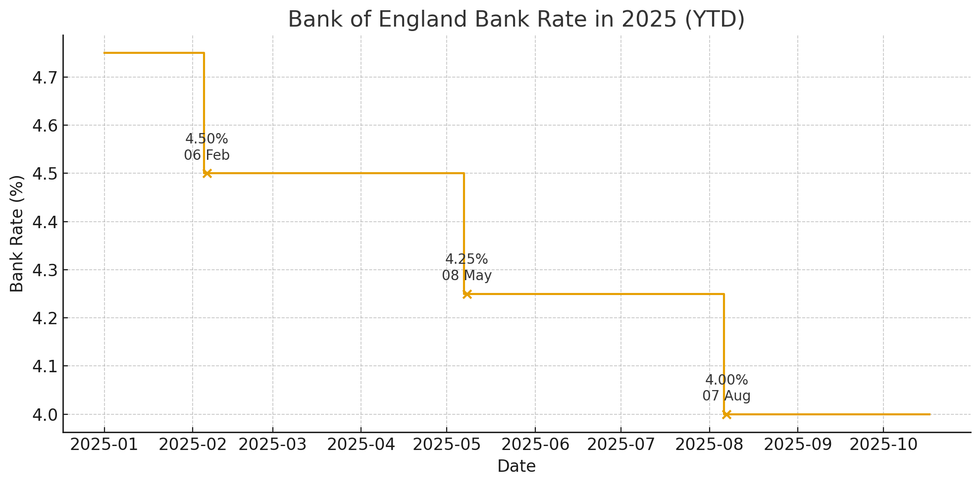

This comes ahead of the next Bank of England Monetary Policy Committee (MPC) meeting on December 18 with rate-setters widely expected to reduce the base rate from four per cent to 3.75 per cent.

With these upcoming changes, mortgage rates will drop by up to 0.21 percentage points across two, three and five-year products and are set to reward first-time buyers as well as those moving home or looking for a new mortgage deal.

The building society is slashing mortgage rates before the Bank of England's upcoming base rate meeting

|GETTY / NATIONWIDE

As such, Nationwide’s lowest rate now stands at 3.58 per cent and it is the first time that the building society has offered a fixed mortgage rate lower than 3.60 per cent since September 2022.

Carlo Pileggi, Nationwide’s head of Mortgage Products, said: "We’re making cuts across our fixed rate mortgage range with even more of our rates now below four per cent.

"These latest changes, which follow hot on the heels of the wide-ranging rate cuts we made at the end of last week, demonstrate that Nationwide remains focused on offering competitive rates to first-time buyers, home movers and those looking for a new deal."

According to the lender, these changes remain true to Nationwide’s existing mortgage customer pricing pledge, which affirms that all switcher product rates will be the same or lower than the remortgage equivalents.

Britons have been forced to deal with hiked mortgage and debt repayments due to the Bank's base rate decision-making | GETTY

Britons have been forced to deal with hiked mortgage and debt repayments due to the Bank's base rate decision-making | GETTY Here is a full list of the Nationwide Building Society mortgage rate changes:

First-time buyers

- Two-year fixed rate at 85 per cent LTV with a £999 fee is 3.92 per cent (reduced by 0.16 per cent)

- Two-year fixed rate at 95 per cent LTV with no fee is 4.68 per cent (reduced by 0.21 per cent)

- Five-year fixed rate at 95 per cent LTV with a £999 fee is 4.78 per cent (reduced by 0.11 per cent).

First-time buyers also receive £500 cashback when they complete their mortgage with Nationwide.

Existing and new customers moving home

- Two-year fixed rate at 60 per cent LTV with a £1,499 fee is 3.58 per cent (reduced by 0.02 per cent)

- Two-year fixed rate at 75 per cent LTV with a £999 fee is 3.67 per cent (reduced by 0.12 per cent)

- Two-year fixed rate at 85 per cent LTV with a £999 fee is 3.81 per cent (reduced by 0.13 per cent)

- Five-year fixed rate at 60 per cent LTV with a £999 fee is 3.80 per cent (reduced by 0.04 per cent)/

LATEST DEVELOPMENTS

The Bank of England base rate has fallen in recent months | CHAT GPT

The Bank of England base rate has fallen in recent months | CHAT GPT Switcher (for existing Nationwide customers coming to the end of their current mortgage deal):

- Two-year fixed rate at 60 per cent LTV with a £999 fee is 3.65 per cent (reduced by 0.07 per cent)

- Five-year fixed rate at 60 per cent LTV with a £999 fee is 3.74 per cent (reduced by 0.10 per cent)

- Three-year fixed rate at 75 per cent LTV with a £999 fee is 3.93 per cent (reduced by 0.06 per cent).

Remortgage:

- Two-year fixed rate at 60 per cent LTV with a £1,499 fee is 3.65 per cent (reduced by 0.07 per cent)

- Five-year fixed rate at 60 per cent LTV with a £999 fee is 3.79 per cent (reduced by 0.10 per cent)

- Three-year fixed rate at 85 per cent LTV with no fee is 4.35 per cent (reduced by 0.14 per cent).