Bank of England keeps interest rate at 4% AGAIN as it forecasts when 'problematic inflation' will end

How likely is the Bank of England to cut interest rates again? |

GB NEWS

Interest rates have soared to historic highs as a result of the Bank of England's decision-making

Don't Miss

Most Read

The Bank of England has announced the base rate will remain at its current level of four per cent despite pressure from politicians and business to slash the cost of borrowing faster.

Economists were split on whether the central bank would cut interest rates leading up today in light of recent inflation which signaled the consumer price index (CPI) rate was beginning to cool.

However, the Bank of England has determined inflation has peaked and is expected to fall to nearly three per cent next year before returning to the Bank of England’s target of two per cent in 2027.

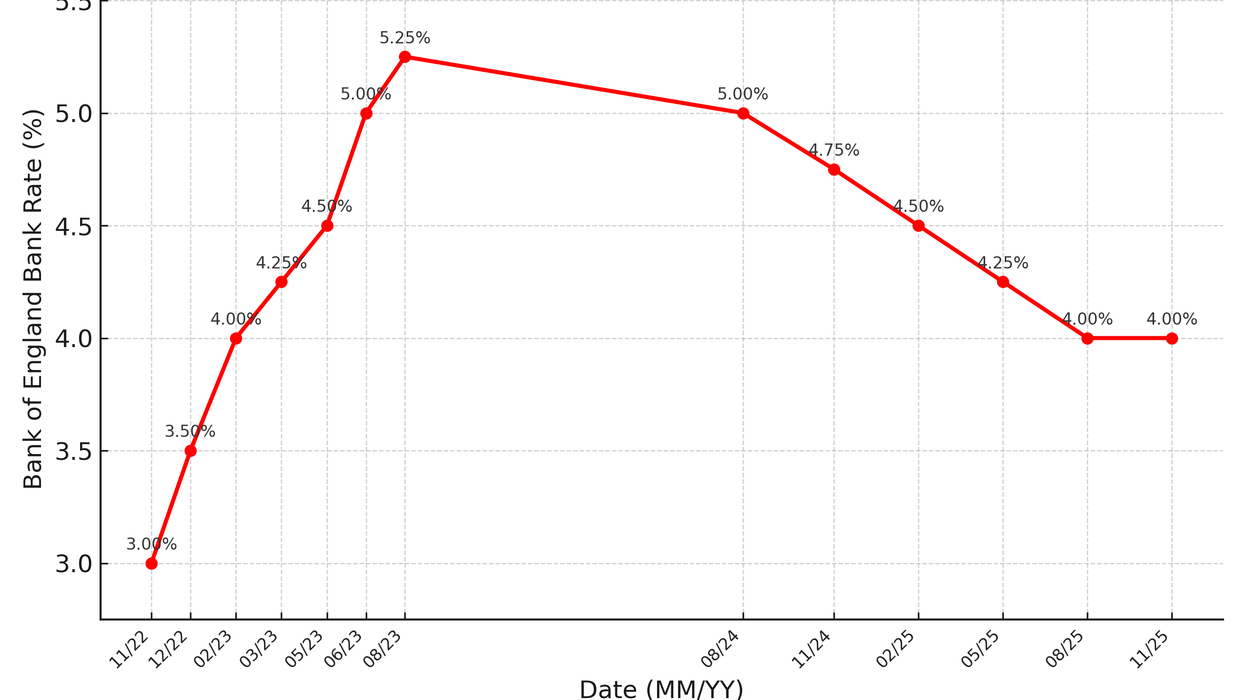

Following the Covid-19 pandemic, the Bank's Monetary Policy Committee (MPC) has opted to hike the base rate to as high as 5.25 per cent in an effort to ease inflationary pressures.

Inflation remains at 4%

|GETTY / CHAT GPT

This has since fallen to four per cent, but with the CPI inflation for the 12 months to September 2025 coming in nearly double the Bank of England's target at 3.8 per cent, policymakers appear to be exercising caution.

Members of the nine-strong committee voted five to four in favour of maintaining the rate, which is used to dictate mortgage rates and other borrowing costs, but pointed to a “gradual” easing of rates in the longer term.

Defending his decision to keep the UK's interest rate at four per cent, Bank of England governor Andrew Bailey shared: "Upside risks to inflation have become less pressing since August, and I see further policy easing to come if disinflation becomes more clearly established in the period ahead.

"Recent evidence points to building slack in the economy, and the latest CPI data were promising. But this is just one month of data. Labour costs remain elevated and wage growth, while on a downward path of late, may plateau. In assessing the outlook, I find the mechanisms underlying upside risks less convincing than those underlying the downside."

How has the Bank of England base rate changed in recent years

|CHAT GPT

James Smith, a UK developed market economist for ING, previously claimed that inflation in the UK "has almost certainly peaked" despite growing concerns over the cost of living.

He explained: "Food inflation – a critical concern at the Bank of England this summer – fell back in September and is now running half a percentage point below official forecasts. This all comes at a time when the Bank is visibly divided on how problematic inflation really is."

In reaction to the MPC' latest move, Scottish Friendly's savings expert Kevin Brown, said: "The Bank of England’s (BoE) decision to hold rates today shows it is still treading carefully despite inflation coming in flat in August.

"That said, a Christmas rate cut now looks likely, with markets pricing in a strong chance of a 25 basis point cut next month. However, we don’t believe that will result in an opening of the floodgates – memories of double-digit inflation are still fresh, and the BoE will want to avoid reigniting price pressures."

LATEST DEVELOPMENTS

William Ellis, senior economist at IPPR, added: "Monetary policy remains tight, and the Bank of England should have gone further today by cutting rates to support the economy. With inflation flat since the last decision, sluggish growth, and a cooling labour market, the case for easing is clear.

“As with the US Federal Reserve, the Bank should also have completely stopped active gilt sales. These sales are not needed to control inflation and currently place unwarranted pressure on UK borrowing costs and the taxpayer."

Chancellor Rachel Reeves would have likely been hoping for an earlier base rate reduction from the Bank to reduce pressure ahead of her Autumn Budget on November 2026.

Following the Bank of England's announcement, Ms Reeves said: "Under this Government, we have seen five interest rate cuts that have helped bring down costs for families and businesses and today’s forecast shows that inflation is due to fall faster than previously predicted.

Rachel Reeves is preparing her latest Budget statement | PA

Rachel Reeves is preparing her latest Budget statement | PA"At the Budget later this month I will take the fair choices that are necessary to build the strong foundations for our economy so we can continue to cut waiting lists, cut the national debt and cut the cost of living."

Conservative Shadow Chancellor Sir Mel Stride said: "Interest rates are staying higher for longer because Rachel Reeves does not have a plan or a backbone. With inflation running at almost double the target rate, families are facing rising prices in the shops.

"The UK has the highest inflation in the G7 thanks to Rachel Reeves’ Jobs Tax and reckless borrowing spree. And yet she is once again preparing to hike taxes, leaving us trapped in a doom-loop.

"Ordinary people are paying the price because Labour cannot reduce spending. Only the Conservatives have the team and the plan to deliver a stronger economy."

More From GB News