Lloyds Bank to launch new £40,000 offer for customers from next Friday - are you eligible?

GB News

Bank lowers income threshold and extends eligibility to self-employed applicants under major lending overhaul

Don't Miss

Most Read

Latest

Lloyds Banking Group has announced major changes to its First-Time Buyer Boost programme, committing an additional £1billion in mortgage lending to support more people trying to enter the housing market.

The move marks the group's largest expansion of the scheme since its launch 16 months ago.

The bank will lower the minimum household income requirement from £50,000 to £40,000, extending access to enhanced borrowing terms at both Lloyds and Halifax branches.

The shift broadens eligibility for thousands of prospective homeowners.

Self-employed buyers will also be included in the scheme for the first time. They will receive the same loan-to-income ratios as employed applicants, addressing a previous gap in accessibility.

Eligible buyers will be able to borrow up to 5.5 times their annual income.

This compares with the standard loan-to-income multiplier of 4.49 times used across much of the mortgage market. The changes will take effect on December 5, 2025.

Lloyds says the new terms represent a significant update to its lending approach for first-time buyers across the UK.

Lloyds Banking Group has expanded its First-Time Buyer Boost

|GETTY

The additional £1billion allocation brings total funding for the programme to £9billion since its introduction in August 2024.

More than 15,000 buyers have already secured homes through the enhanced borrowing arrangements. Lowering the income threshold amounts to a 20 per cent reduction in minimum earnings.

This opens the scheme to households earning between £40,000 and £50,000, a group previously unable to access the higher borrowing multiples.

Under the revised terms, the 5.5 times loan-to-income ratio delivers a 22 per cent increase in maximum borrowing capacity when compared with the earlier 4.49 times multiplier. Lloyds says the change will substantially improve affordability for many buyers.

LATEST DEVELOPMENTS

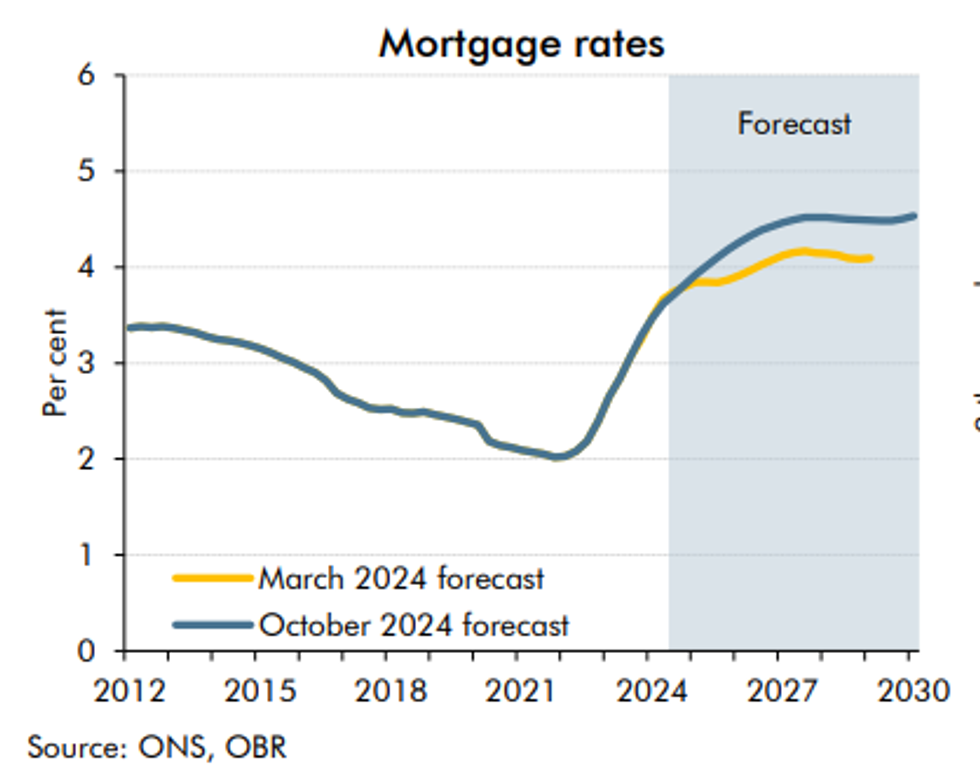

Mortgage rates are set to fall in a boost for holders | OBR

Mortgage rates are set to fall in a boost for holders | OBRA buyer earning £40,000 a year with a 10 per cent deposit can now access a mortgage of £220,000 under the new rules. Under the previous system, the maximum loan available on the same income and deposit level would have been £179,600.

This equates to an increase of £40,400 in borrowing power for those at the updated minimum income threshold.

Lloyds says the uplift could be decisive for customers who were previously priced out of suitable properties.

The changes build on earlier affordability adjustments introduced in April, which had already raised typical borrowing levels by about £38,000. The group says the new measures form part of its broader strategy to improve homeownership opportunities for first-time buyers.

The same enhanced terms will be available through both Lloyds and Halifax, with Halifax continuing to serve as Britain's largest lender to first-time buyers. Customers applying through either provider will be offered the same loan-to-income ratios.

Self-employed buyers will be able to apply for the First-Time Buyer Boost when the changes begin next Friday. They will receive the same 5.5 times income allowance as employed customers and will be subject to the same deposit and affordability requirements.

The decision to extend eligibility reflects changes in working patterns and the growing number of self-employed individuals seeking mortgages.

Lloyds says the update is designed to create parity between applicants regardless of employment type.

The move will come as a boost to people looking to get on the property ladder

| PEXELSAll amendments to the First-Time Buyer Boost programme will apply to new applications submitted from December 5 2025. The bank expects demand to rise as the enhanced terms become available.

Since its launch, the programme has delivered £8billion in lending to first-time buyers. The additional £1billion announced this week raises the total to £9billion in dedicated support for people seeking to buy their first home.

Andrew Asaam, homes director at Lloyds Banking Group, said: "Today's £1billion commitment takes us to a total of £9billion specifically to help people get on the ladder quicker".

He added: "We understand the difference this can make to First-Time Buyers, having lent more money to more aspiring homeowners than any other bank so far this year, and we're really pleased to be able to offer what they need in a responsible and sustainable way".

Mr Asaam said the group is focused on "making better lending decisions for those who can genuinely afford to borrow more".