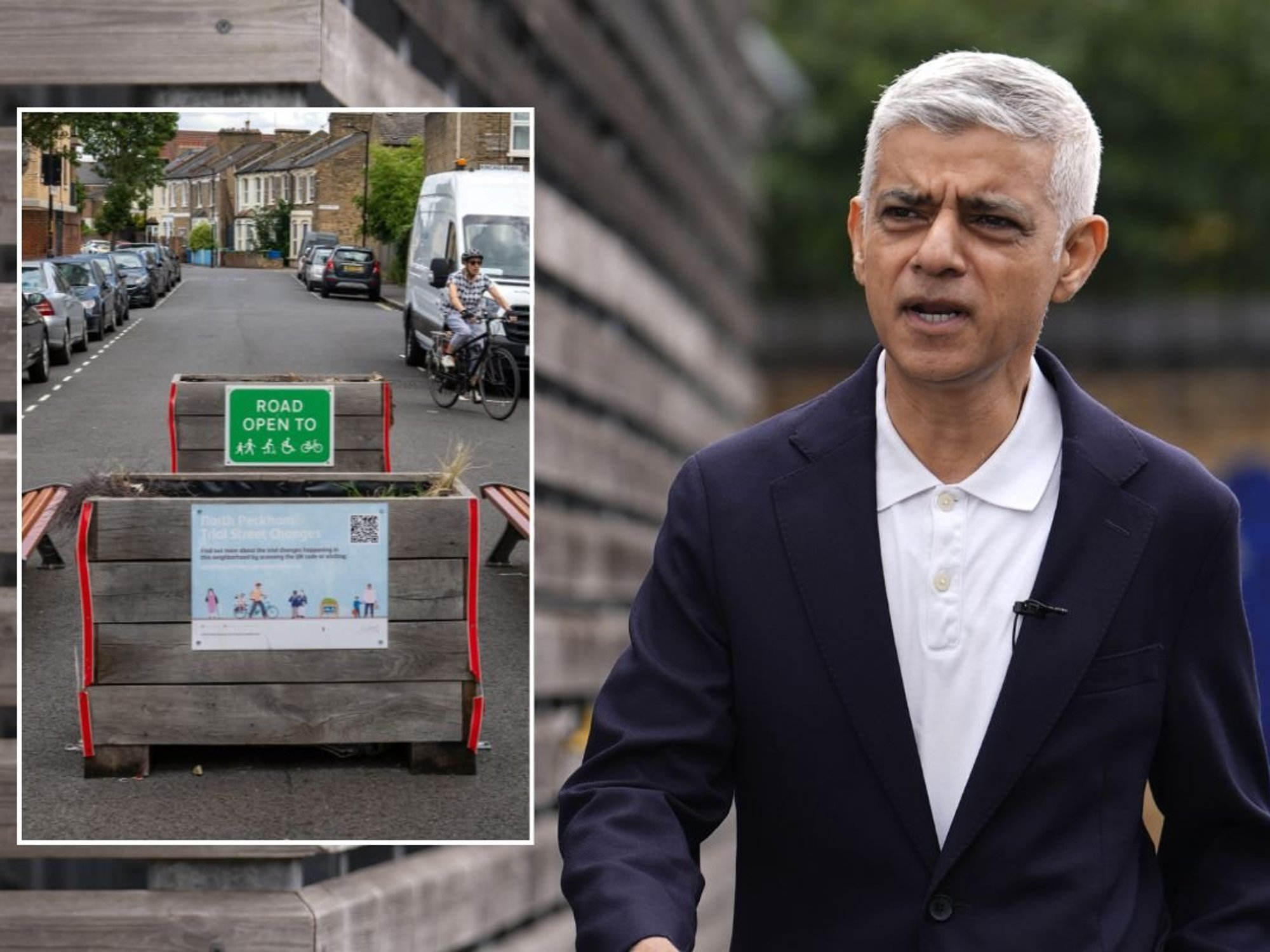

'Welcome boost!' Bank of England interest rate cut 'positive' for property market

Homebuyers have been awarded a "welcome boost" following the Bank of England's latest rate cut

|GETTY

Mortgage rates and house prices are likely to be impacted by the Bank of England's recent actions

Don't Miss

Most Read

The UK's property market has been handed a "welcome boost" in homebuyer activity following recent actions from the Bank of England.

Earlier this month, the central bank's Monetary Policy Committee (MPC) narrowly voted to cut interest rates from a 16-year high.

The base rate was reduced from 5.25 per cent to five per cent in a sign of much-needed relief for mortgage holders and those trying to get on the property ladder.

Notably, real estate agents have witnessed a 19 per cent rise in the number of people contacting them about homes for sale since August 1, compared with the same period in 2023.

Last year, the property market slowed down due to soaring interest rates and the wider cost of living crisis.

This figure also represents a hike from the 11 per cent year uplift recorded for July.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Interest rate hikes have pushed up mortgage repayments for many | GETTY

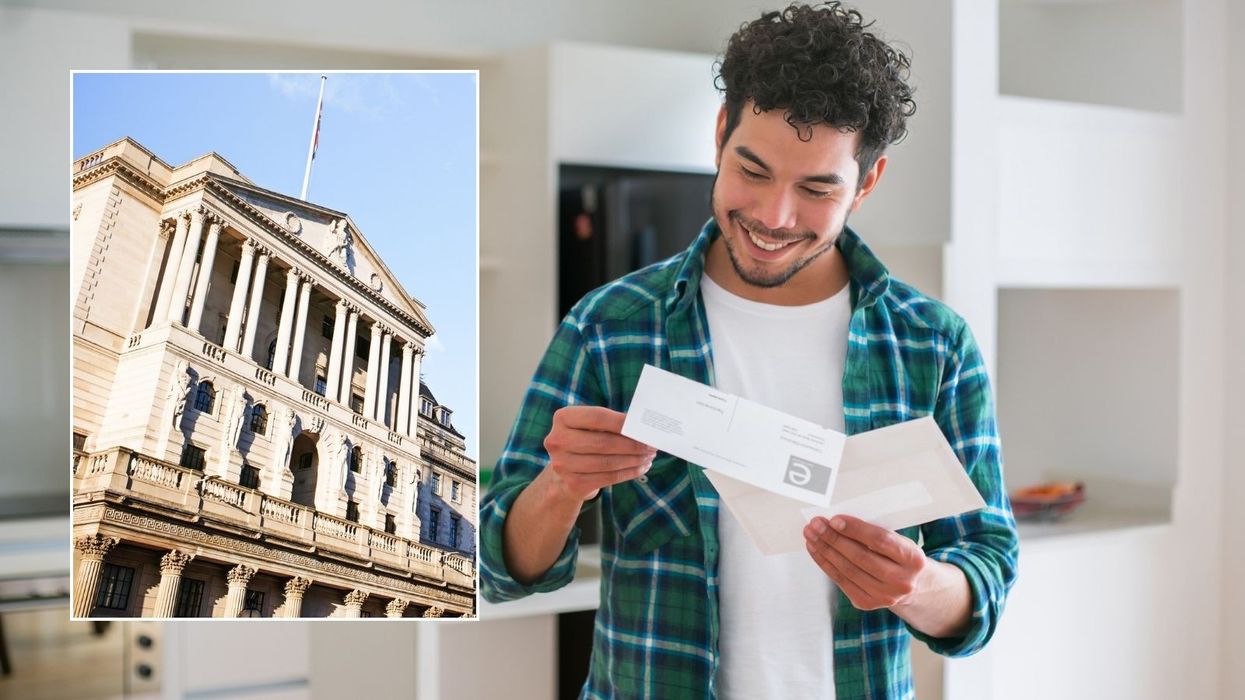

Interest rate hikes have pushed up mortgage repayments for many | GETTY According to Rightmove, the average new-seller asking price across the country had slipped by 1.5 per cent in August to £367,785.

This represents a £5,708 monthly drop.

Despite this, the property website believes this fall is seasonal and has happened for nearly two decades.

This is due to home sellers putting moving plans on pause until after the summer holiday season.

Furthermore, Rightmove has revised its yearly house price forecast up to a one per cent rise, which is up from a previous forecast of a one per cent drop over the whole of 2024.

Tim Bannister, the website's director of property science, noted the rate cut from the Bank of England "sparked a welcome late summer boost in buyer activity".

He explained: "While mortgage rates aren’t yet substantially lower since the rate cut, the fact that the long-hoped-for first cut has finally arrived, and mortgage rates are heading downwards, is positive for home-mover sentiment,” he said.

"As the summer holiday season comes to an end, the conditions are there for a more active autumn market."

LATEST DEVELOPMENTS:

Earlier this month, the Bank of England voted to cut interest rates | GETTY

Earlier this month, the Bank of England voted to cut interest rates | GETTY As it stands, the average five-year, fixed mortgage rate is sitting at 4.80 per cent, according to Rightmove.

This is higher than it was three years prior to the Bank of England's base rate but is lower than 5.83 per cent this time last year.

Based on Rightmove's weekly mortgage tracker, the best available five-year is sitting at 3.83 per cent for people with

With this figure, the average five-year fixed rate is the lowest it has been since former Prime Minister Liz Truss's mini-Budget in September 2022.