Martin Lewis warns 'huge payment shock' for MILLIONS is just weeks away

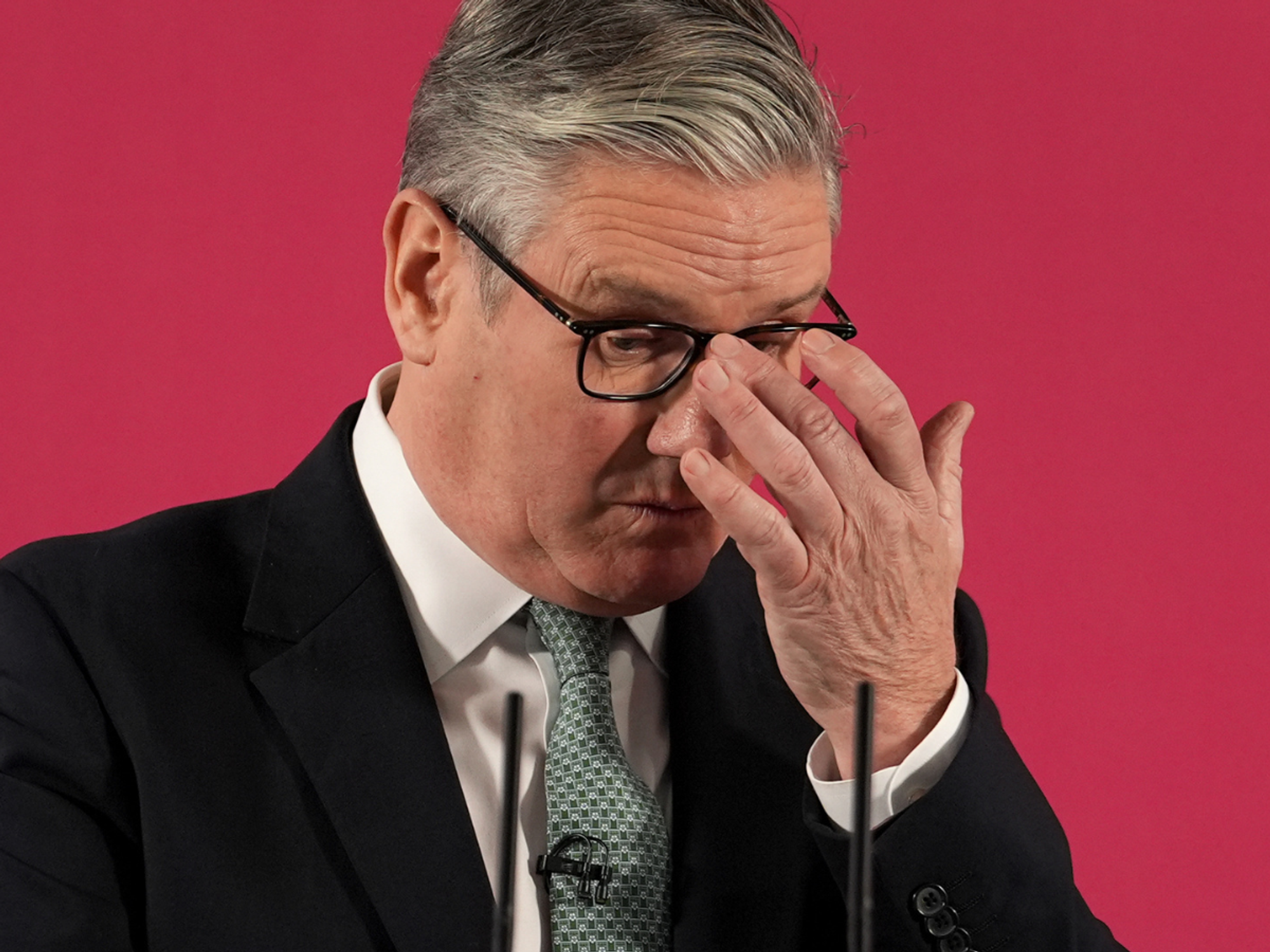

None | Kirsty O'Connor

The Bank of England is expected to push interest rates even higher next week at its latest meeting, putting further pressure on mortgages.

Don't Miss

Most Read

Latest

Finance expert Martin Lewis has warned of a huge payment shock ahead for millions of homeowners.

Speaking on his Martin Lewis Podcast, he said there will be “a huge payment shock” in the spring for those with mortgages which end shortly.

Mr Lewis said: “Those who already have mortgages are going to face huge payment shock when their current mortgages end and they’re moved onto far higher rates.

“That’s likely to peak in the spring, when it’s thought, and nobody truly knows, interest rates will be at their high.

"We all know interest rates go up and mortgage costs go up. There are a huge number of people whose fixes will be ending next year, and whose fixes are ending right now and they will all be seeing huge rises."

Steve Parsons

The Bank of England is expected to push interest rates even higher next week at its latest meeting, putting further pressure on mortgages.

In a crunch meeting, the nine members of the Monetary Policy Committee will make a decision that could push up the amount that millions of mortgage holders have to pay their banks every month.

The Financial Conduct Authority (FCA) has published guidance setting out options that firms can use to support their customers to manage their monthly mortgage payments amid the cost-of-living squeeze.

It is seeking comments on the draft guidance by December 21 2022.

The FCA’s draft guidance sets out the flexibility that firms have to support customers who have missed monthly mortgage payments or are worried they may not be able to make payments in future.

It covers options including extending the term of the mortgage, switching to interest-only for a temporary period, moving to a different interest rate or making reduced monthly payments for a temporary period. Making changes, even temporary ones, may result in higher monthly payments in future or paying back more overall. Mortgage borrowers should consider carefully any steps they take and customers who can keep up with their payments should continue to do so, the regulator said.

The FCA attended a roundtable, hosted by the UK Government, alongside mortgage lenders to discuss what support some mortgage borrowers may need.

It said it is closely monitoring the mortgage market and will continue to act so consumers get the support they need.

The Treasury said Chancellor Jeremy Hunt had met banking CEOs, along with consumer champion Martin Lewis and the FCA on Wednesday.

The banking CEOs, who cover more than 70% of the market, recommitted to protect mortgage holders by enabling them to switch to a new fixed rate mortgage, without a new affordability test, when their current deal ends if consumers are up to date with their payments. This covers 97% of the market.

Mortgage lenders should also provide customers with well-timed information ahead of any change to rates and offer specific help to those who start to struggle with payments.

Lenders should also ensure that highly trained and experienced staff are on hand to help.

Mr Hunt said: “We expect every lender to live up to their responsibilities and support any mortgage borrowers who are finding it tough right now.”

Kirsty O'Connor

MoneySavingExpert.com founder Mr Lewis said: “The major concern for people’s mortgages – and the knock-on impact of mortgage increases on rents – is the situation in the spring, when we expect interest rates to be higher, energy prices to be rising, and other cost-of-living impacts.

“So the most important thing is that now the conversations have started about what flexibility and forbearance measures can be put in place to help those struggling.

“The commitments today set a good direction, and after helpful conversations I’m hopeful that further progress will be made. For those worried about making mortgage repayments, the sooner you communicate with your lender the better.”

Anyone who is struggling financially can visit the Government-backed MoneyHelper service for money tips.