Labour's pension system overhaul under fire as savers could be left worse off in retirement - 'very concerning!'

WATCH: State pension rise will be swallowed up, retiree fears - ‘Doesn’t go anywhere’

|GB News

Experts warn that attempts to boost the British economy could come with a cost to retirement pots

Don't Miss

Most Read

Millions of pension savers could face lower returns under Labour’s proposed shake-up of pension rules.

Chancellor Rachel Reeves wants funds to back British assets more heavily, but experts and industry insiders warn this could damage long-term outcomes for retirees.

Reeves is pushing for pension schemes to direct more investment into UK businesses, infrastructure and private markets, arguing this will boost national growth.

But critics say forcing funds to focus on domestic assets — rather than choosing the best global opportunities — risks weakening returns and could leave millions worse off in retirement.

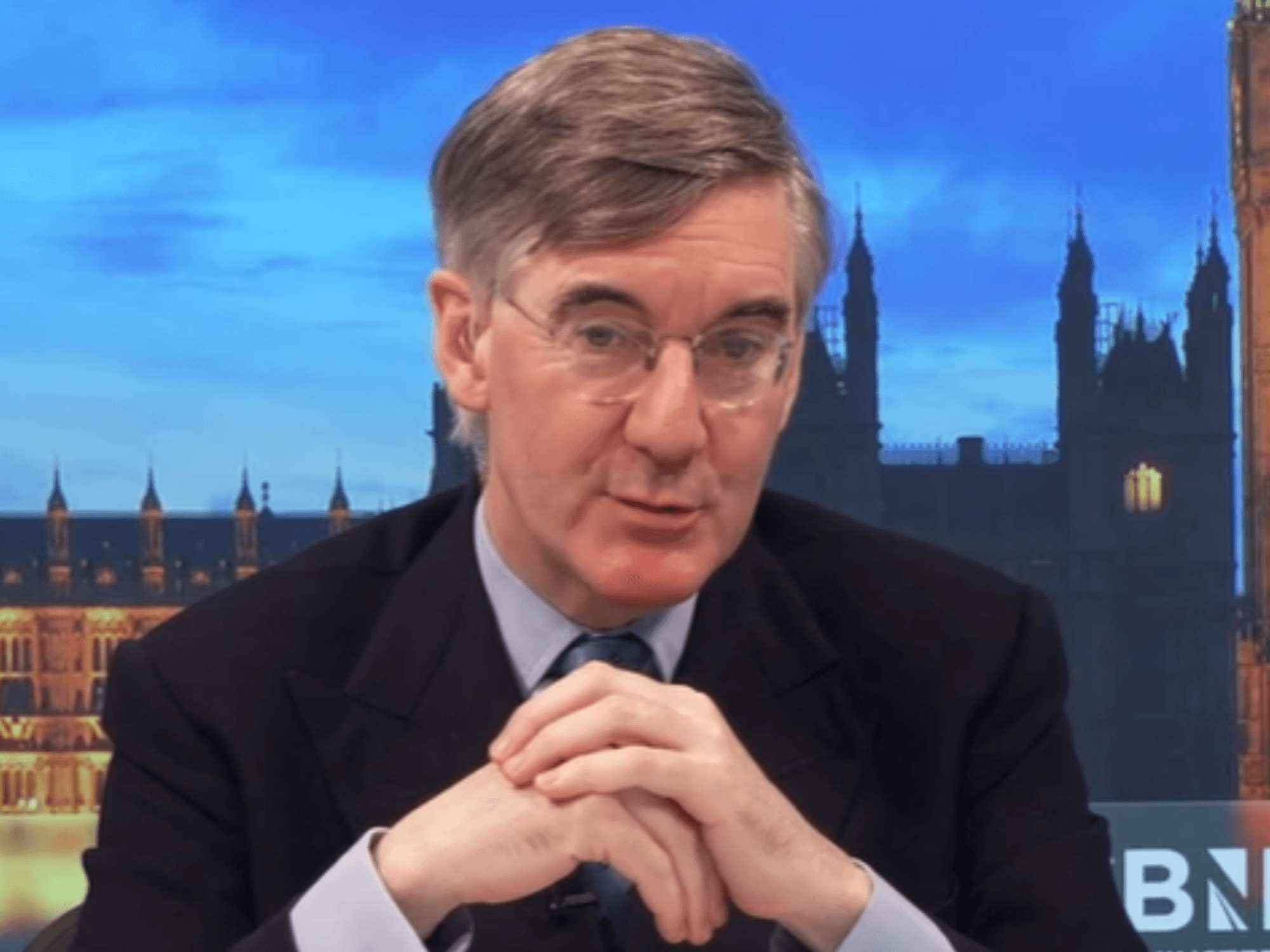

Shadow chancellor Mel Stride accused Reeves of risking savers’ money for political ends. Stride said: "Pension funds must be free to make investment decisions based on what’s best for savers.

"The suggestion they should be compelled to invest in what the Labour government wants them to, even if this means leaving their members worse off, is very concerning."

Millions of pension savers could face lower returns under Labour’s proposed shake-up of pension rules

|GETTY

Reeves is building on a voluntary agreement first introduced by former chancellor Jeremy Hunt. That deal, known as the Mansion House Compact, encouraged pension funds to invest more in UK private assets.

Reeves now wants to go further with a second agreement, asking funds to allocate 10 per cent of their portfolios to private markets by 2030, with at least half of that staying in the UK.

The Treasury has not ruled out making the voluntary targets mandatory but industry executives say that it would open "a can of worms", including cutting across their fiduciary duty to ensure the best possible returns for savers.

Stride warned against such a move, saying: "Voluntary initiatives like the Mansion House Compact showed how growth can be unlocked without coercion." He added: "Rachel Reeves wants to use your pension pot to bail her out of her own economic failings."

Even Treasury officials have raised concerns

| PA"Voluntary initiatives like the Mansion House Compact showed how growth can be unlocked without coercion. New transparency rules to require funds to divulge how and where their assets are allocated, introduced by the Conservative government, will also help.

"But now the chancellor is threatening to use legislative pressure to force funds into domestic equities, regardless of risk or return. That’s not leadership — it’s desperation."

The pensions industry is pushing back. Phoenix Group, one of the UK’s largest retirement firms, said it supported efforts to increase domestic investment but not through legal force. A spokesperson said: "We believe it is right to focus on efforts to unlock more domestic investment, but we believe the most sustainable solution lies in creating the right incentives, not mandates."

The group added: "The UK has the talent required but what is needed is a competitive, stable policy and regulatory environment that rewards long-term investment in growth."

Another major provider told the Financial Times that granting ministers powers to compel investment could set a dangerous precedent: "The problem with powers of mandation isn’t necessarily just what this government might do; it’s also future governments who may inherit these powers."

Torsten Bell is conducting a separate review, which could feed into new legal powers in the Pensions Schemes Bill expected this summer

| GETTYSome pension executives believe Reeves may never formally mandate investment, but is using the threat to pressure funds. One described the approach as a "sword of Damocles" hanging over the sector.

Even Treasury officials have raised concerns. One said: "There was also concern that if we elbowed funds into equities they would buy fewer gilts, which created its own problem."

Meanwhile, pensions minister Torsten Bell is conducting a separate review, which could feed into new legal powers in the Pensions Schemes Bill expected this summer.

A Treasury spokesperson said it would not provide a "running commentary" but confirmed it was considering "whether further interventions may be needed by the government" to ensure pension investment supports UK growth.

For savers, the message is clear - attempts to boost the British economy could come with a cost to retirement pots.