'I think leaving all my money as an inheritance for my children is the worst thing I could do’

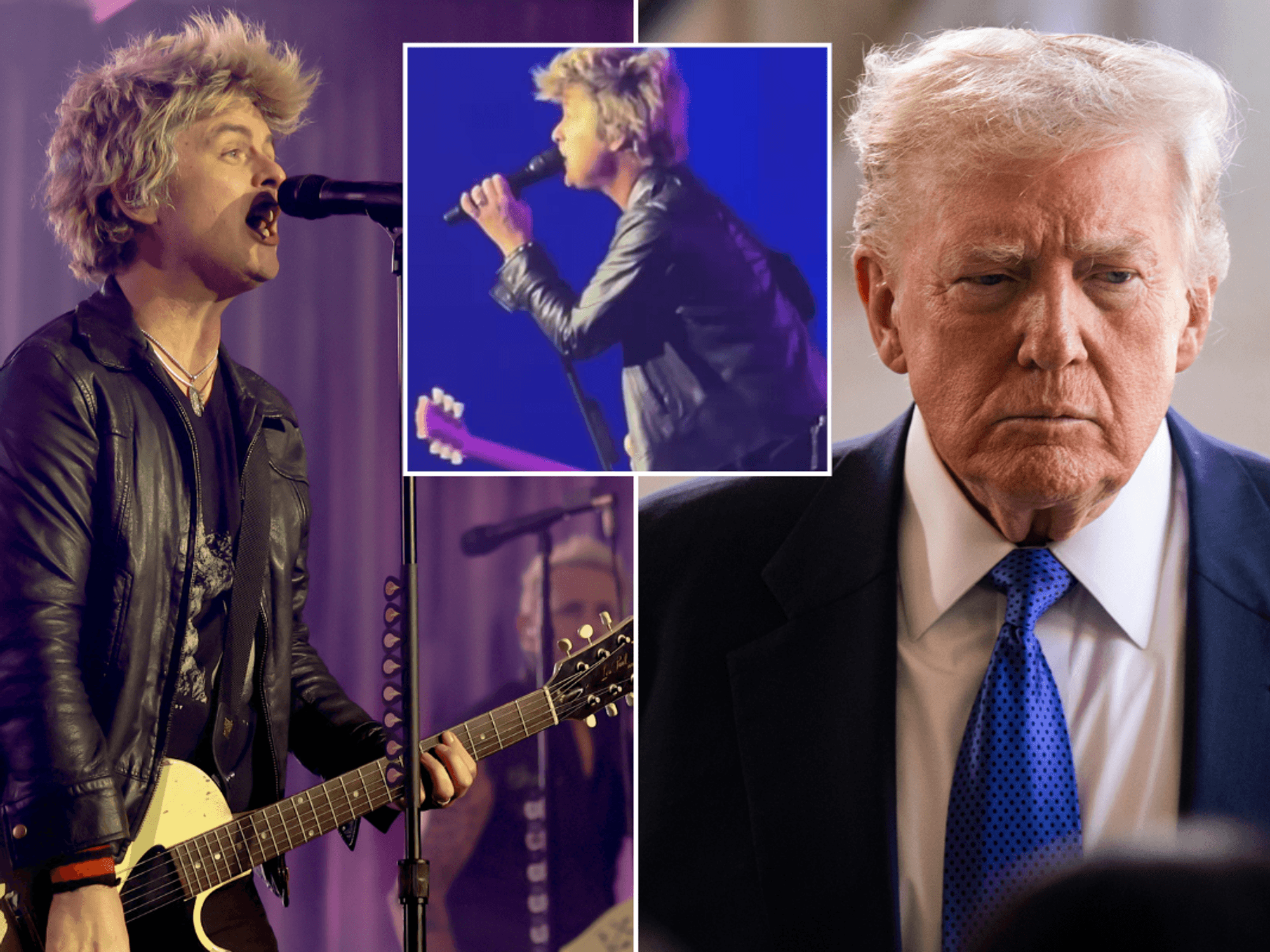

Siam Kidd has requested his money is left to charity in his Will

|SIAM KIDD

The former RAF pilot won't be giving his children an inheritance, but will be leaving behind a wealth action plan

Don't Miss

Most Read

A father-of-two who became a full-time crypto investor after teaching himself trading has said leaving his children all of his money when he dies is the "worst thing he could do".

Instead of leaving them money as an inheritance, Siam Kidd, 37, will help his children to learn knowledge and skills in building wealth.

The former RAF pilot turned businessman has instructed in his Will that his youngsters, who are currently five and seven years old, learn about money from videos he has created via his business The Wealth Action Plan.

Siam said: “I think the worst thing I could ever do for my kids is give them all my money when I die.

|

| PEXELS

“I’ve grown up around lots of spoiled people who have no work ethic, skills, or ambition because everything has been handed to them via an inheritance. I don’t want to breed entitlement.”

New research from the charity will-writing scheme Will Aid found less than three quarters (73 per cent) of respondents said they would share their inheritance equally among their children when they die.

The poll revealed 11 per cent said they would give each of their children a different amount, 12 per cent undecided, and four per cent stated they intend to leave their children nothing.

Siam made the decision to write a Will five years ago while grieving for the loss of loved ones.

He said: “In 2018 I lost several of my friends and I realised I needed a Will. I also still fly helicopters every week as a hobby so I have an element of added danger in my life.

“I knew I wanted my legacy to be about knowledge and skills rather than money.

“So I wrote down over 400,000 words about Wealth Generation and turned them into videos that my children can watch and learn from.

“It’s comforting to know that I’m leaving behind my expertise, which feels more valuable than a trust fund.”

Siam has said in his Will that when he dies, he expects his wealth to be used to support charity.

He said: “My money will go to a charitable foundation which will be used for good. There will be someone at the helm of the foundation who understands money and business.

LATEST DEVELOPMENTS:

Will Aid said having a valid and up-to-date Will in place is key

|PEXELS

“I don’t mind my children being stewards of that fund if they have the skills needed to manage it well.”

Siam, from Norwich, is already teaching his two young children about money, getting the youngsters involved in family conversations and legacy.

He said: “I think the mistake parents make is that they wait for their children to reach a certain age before having conversations about money.

“This leaves kids in the dark about the value of money and before they know it, they are adults with loans and debts. In our household money is a regular topic of conversation.”

Peter de Vena Franks, Will Aid campaign director, said whatever people choose to do with their assets after they die, having a valid and up-to-date Will in place is key.

He said: "Regardless of the amount of money someone leaves behind after their death, a Will is the best way to ensure your assets are distributed in accordance with your personal wishes. This means that family and loved ones are looked after, and other beneficiaries including charities can benefit from the individual’s legacy.

“Will Aid is a brilliant way to tick writing your Will off your to-do-list, whilst also knowing you are helping your loved ones and supporting charity. We would also suggest that having a conversation with your family so they understand your future intentions and know where your Will is stored, is usually a good thing to do.”