Inflation falls for first time in months handing Rachel Reeves a small boost ahead of Budget

Inflation falls in October 2025 |

GBNEWS

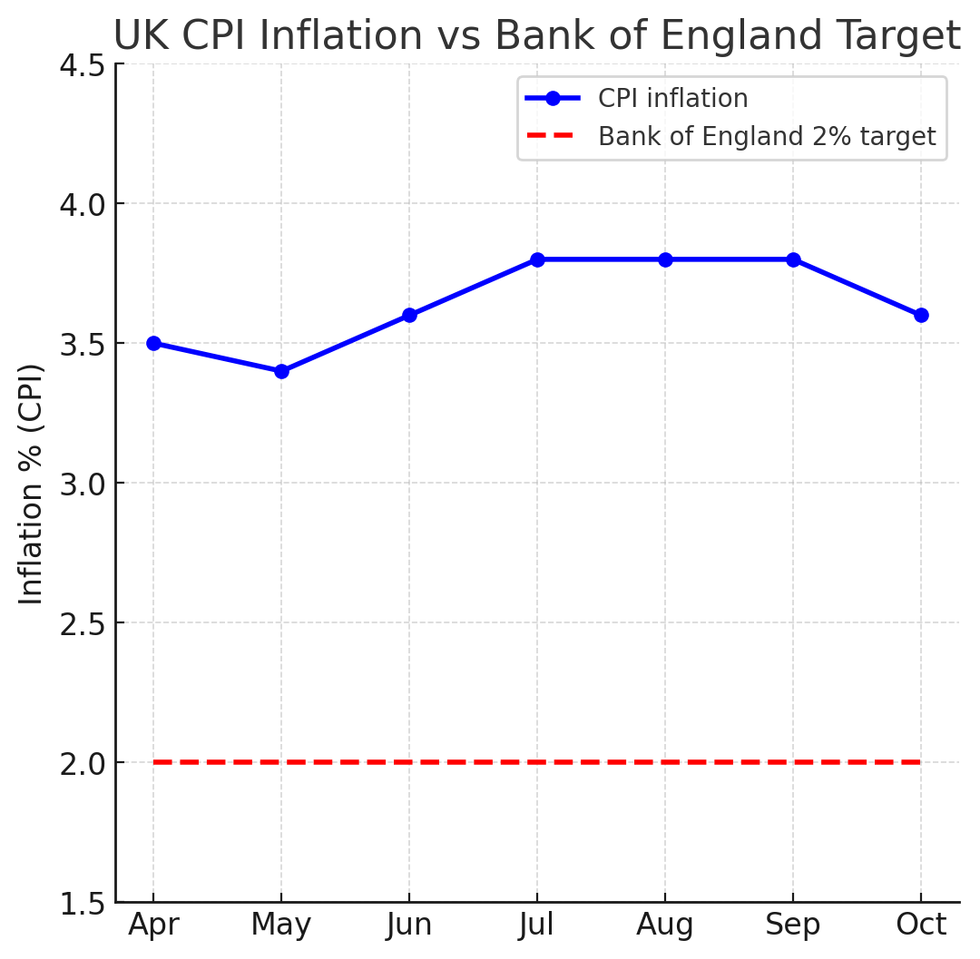

Despite today’s drop, inflation still sits well above the Bank of England’s two per cent target

Don't Miss

Most Read

Latest

Inflation has dropped to 3.6 per cent, but almost double the Bank of England's two per cent target.

The latest consumer prices index (CPI) figures were released this morning, down from 3.8 per cent in September.

The slight fall will come as rare good news for Chancellor Rachel Reeves just one week before she delivers her Budget on November 26.

A slower increase in gas and electricity prices was the biggest factor putting downward pressure on the overall inflation rate in October, the ONS said.

Ofgem raised the energy price cap by two per cent in October, but this is significantly less than the 9.6 per cent hike last year. However, food prices rose sharply again in October after easing back the previous month.

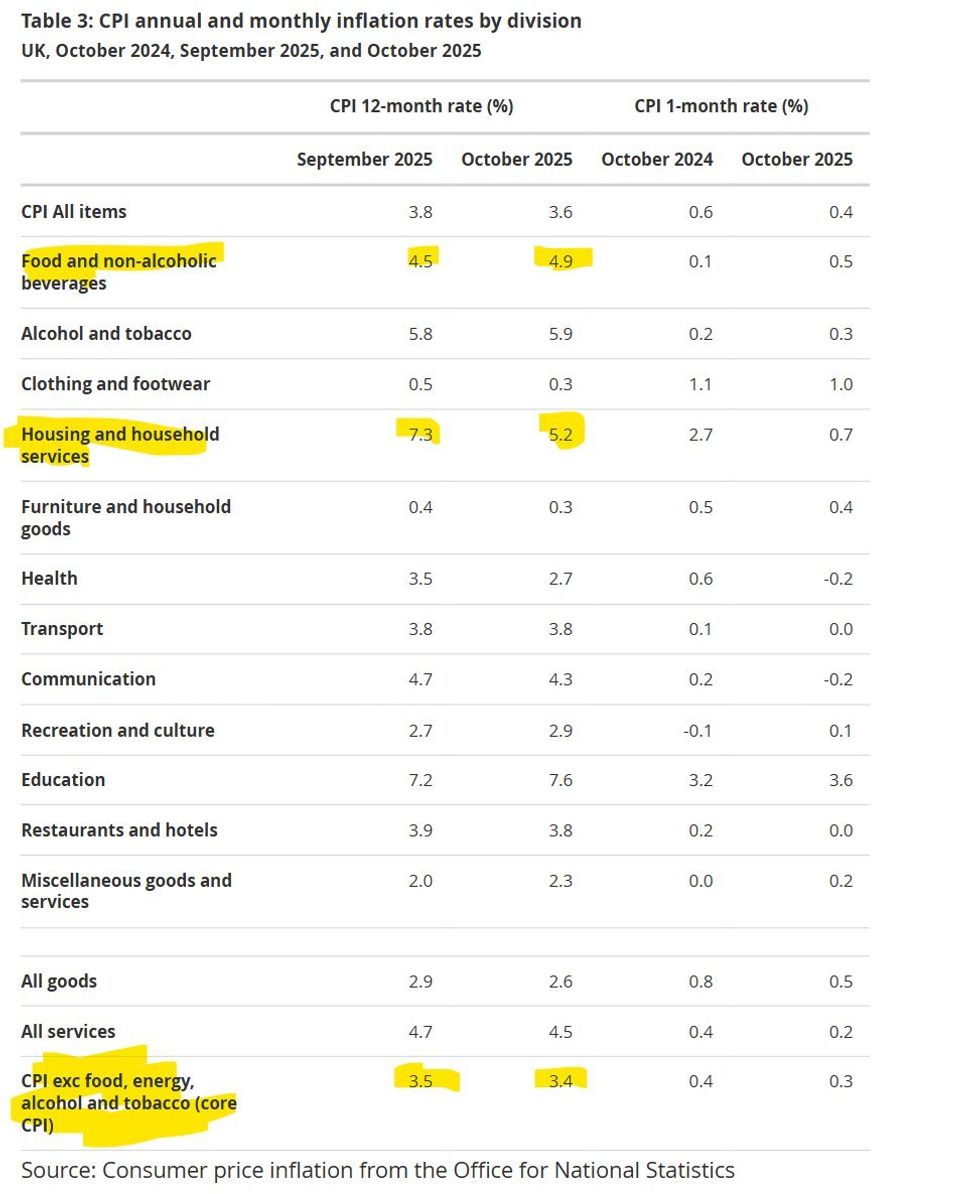

The annual rate of food and non-alcoholic drink inflation rose to 4.9 per cent, from 4.5 per cent in September, while prices increased by 0.5 per cent month on month.

Despite today’s drop, inflation still sits well above the Bank of England’s two per cent target, meaning interest rates are expected to stay high for now. The Bank of England itself expected inflation to hit 3.6 per cent.

The Bank held rates at four per cent earlier this month, saying it needed stronger evidence that inflation was "fully under control". The MPC does not expect inflation to fall to its two per cent target level until 2027.

TRENDING

Stories

Videos

Your Say

Rachel Reeves said she was planning to make “fair choices” at the upcoming Budget to help further cut the cost of living.

"This fall in inflation is good news for households and businesses across the country, but I’m determined to do more to bring prices down," she said.

"That’s why at the Budget next week I will take the fair choices to deliver on the public’s priorities to cut NHS waiting lists, cut national debt and cut the cost of living."

Rebecca Florisson, Principal Analyst at the Work Foundation, said the fall in inflation to 3.6 per cent "could indicate we’re past the worst of the recent inflationary surge and may boost hopes of faster interest rate cuts."

However, she warned it still "leaves millions of workers struggling with day-to-day costs as we approach the Autumn Budget."

Ms Florisson highlighted that food prices remain 4.8 per cent higher than a year ago and said the IMF expects UK workers to face "the highest level of inflation in the G7 over the coming years."

Inflation falls to four month low

|GETTY/ONS

She added that the pressure is particularly severe for low earners, noting that "only a third of low paid workers (34 per cent) [are] expecting an above inflation pay increase this year, compared to over two thirds of high paid workers (69 per cent)."

She said the Government now faces a "significant challenge" in supporting the three million workers on the National Living Wage and called for action in the Budget, stating: "The Chancellor must prioritise the living standards of lower earners by taking action to tackle the cost of essentials and ensuring that their wages can rise in real terms during the years ahead."

Economist Julian Jessop has warned that UK inflation remains "sticky" despite the headline rate dipping from 3.8 per cent to 3.6 per cent. He said the entire fall can be explained by "favourable base effects in domestic energy", noting that bills "still rose, but by less than in the same month last year".

Mr Jessop pointed out that housing and household services inflation "remains high at 5.2 per cent", and flagged "an unwelcome pick up in food inflation", which increased from 4.5 per cent to 4.9 per cent. He added that core inflation, which excludes food and energy, "did at least tick down to 3.4 per cent", but stressed there is "little here to change anybody's mind about the outlook for inflation".

LATEST DEVELOPMENTS

Inflation figures October 2025

|ONS

Professor Joe Nellis, economic adviser at MHA, said the latest inflation figures suggest the UK is "finally moving beyond the stalemate that has held headline inflation at 3.8 per cent for the past three months". He noted that after months where inflation "stubbornly refused to budge downwards despite easing global pressures", the improvement offers consumers "a rare moment of encouragement".

Mr Nellis said many families will welcome signs that the cost-of-living squeeze is beginning to lift, "even if their weekly shop still feels painfully expensive".

However, he warned that services inflation remains elevated due to wage growth, rent and higher costs across hospitality and travel, reinforcing why the Bank of England has held back on rate-cut signals.

He argued that "the time is right for action" and that "a timely interest rate cut in December is almost certain unless the inflationary landscape changes dramatically in the next month".

He added that the figures are "good news for the Chancellor ahead of the Budget", especially after recent market volatility.

Mr Nellis said the inflation fall marks "a turning point rather than a finish line", adding that Budget decisions now need to support "productivity, investment, and stability".

If progress continues, he said 2026 could be a year in which "real incomes grow again, business confidence gradually recovers, and the UK economy begins to rebuild momentum".

Personal finance experts say that while the pressure on prices is easing, it remains a crucial moment for households to take stock of their finances.

Borrowing costs are not expected to fall any time soon, making it important for people to ensure they are on competitive savings, mortgage and loan deals.

Inflation falls for first time in months handing Rachel Reeves a small boost ahead of Budget

|ONS

Kevin Mountford, personal finance expert and co-founder of Raisin UK, said the fall in inflation is "welcome news and provides some relief for households heading into the winter months."

He noted that although borrowing costs remain high, "stabilising price pressures may pave the way for lower interest rates in the future, which could make mortgages and loans more affordable over time."

However, Mountford warned that many people are still feeling the strain. He said the latest Raisin UK Great British Savings Report shows "six per cent of Britons using savings to cover debt and five per cent turning to savings for healthcare costs."

According to Mr Mountford, this means "the need to plan ahead and maximise returns on savings remains critical."

He added that it may be a good moment for savers to lock in stronger returns, saying "taking time now to review your finances can help ensure your savings continue to work hard as inflation cools."

More From GB News