Inflation: Prices set to ease in reprieve for households after September peak

GB News

Economists expect UK inflation to drop from September's 3.8 per cent peak as food and energy costs ease

Don't Miss

Most Read

Latest

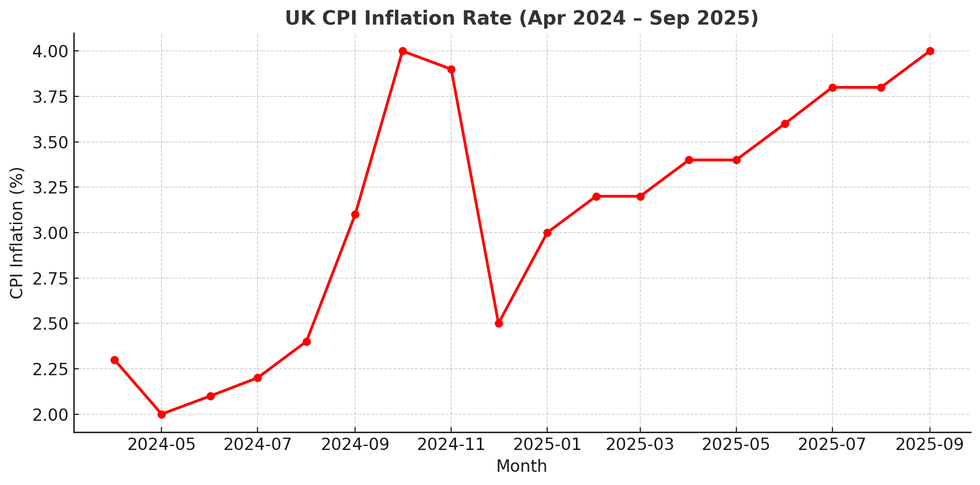

UK inflation appears to have reached its zenith at 3.8 per cent in September 1, with analysts expecting a decline when October's Consumer Prices Index data is released on Wednesday.

The September rate matched July and August, according to the Office for National Statistics (ONS).

Multiple economists anticipate the October reading will show a fall to around 3.5 per cent, marking the first decline after months of elevated price pressures.

The Bank of England said last week that inflation has "peaked" and is expected to start easing.

Jack Meaning, chief UK economist for Barclays, said September "represented the peak of the inflation hump" and forecast the CPI rate would fall to 3.5 per cent in October.

Economists Robert Wood and Elliott Jordan-Doak at Pantheon Macroeconomics share this prediction, while Deutsche Bank chief UK economist Sanjay Raja expects a slightly smaller decrease to 3.7 per cent.

British households are seeing tentative signs of relief as food prices have recorded their first monthly decrease since May last year.

Costs for food and non-alcoholic drinks fell between August and September, following sharp rises driven by items such as chocolate, coffee, cheese and eggs earlier in the year.

Prices are set to cool in a boost for consumers

|GETTY

Energy bills are also expected to play a major role in pushing down the overall inflation reading.

While Ofgem raised the energy price cap by two per cent in October, this compares with a 9.6 per cent rise in the same month last year.

This difference means energy price inflation will be significantly lower than in previous periods.

These twin trends of easing food prices and reduced upward pressure from energy bills are expected to help moderate household costs after a prolonged period of persistent rises.

Analysts expect food price inflation to continue declining through October, contributing further to the anticipated reduction in the headline CPI rate when Wednesday's figures are published.

LATEST DEVELOPMENTS:

Inflation had been projected to hit four per cent in September | CHAT GPT

Inflation had been projected to hit four per cent in September | CHAT GPT Some economists have warned that increases in university tuition fees, particularly affecting international students, could have added some upward pressure to last month's inflation data.

Deutsche Bank's Mr Raja is forecasting a slightly higher 3.7 per cent for October's reading.

He said the autumn Budget later this month will represent the "next most important inflation forecast update", noting that potential tax changes could influence overall price levels.

"Speculation around lower energy bills, indexation costs, duties and food prices remains rife."

He added: "We expect the Chancellor to push through some modest measures to pull down on prices come November 26."

Deutsche Bank warns that the Chancellor’s decisions may influence price trends through 2026

| GETTYAccording to Deutsche Bank's analysis, decisions taken by the Chancellor could shape price movements well into 2026.

Mr Raja said the Budget would provide "a good sense of where 2026 inflation will land".

Possible Government interventions could include changes to energy bill structures, adjustments to indexation mechanisms, alterations to duties and potential reforms targeting food price pressures.

These fiscal tools sit alongside the Bank of England's monetary measures, offering the Treasury additional ways to influence household costs.

Our Standards: The GB News Editorial Charter