Brexit partly to blame for inflation as Britons 'locked out of Europe', Rachel Reeves claims

The Chancellor noted that British businesses face 'red tape' when it comes to accessing the EU market

Don't Miss

Most Read

Chancellor Rachel Reeves has blamed Brexit as a contributing factor to Britain's elevated inflation levels, citing increased expenses associated with European Union trade during her address at Saudi Arabia's Future Investment Initiative summit in Riyadh.

The Chancellor pointed to heightened trading costs with Brussels as one element driving price increases across the UK.

Her comments coincided with the announcement of bilateral trade and investment agreements between Britain and Saudi Arabia valued at £6.4billion, as she leads a Government delegation seeking stronger regional economic partnerships.

The timing proves significant with Ms Reeves facing a difficult Autumn Budget next month with the Office for Budget Responsibility (OBR) predicted to downgrade economic growth.

The Chancellor has partially blamed Brexit for inflation

|GETTY / PA

During her summit appearance, Ms Reeves characterised the UK's departure from the EU as "a rejection of open borders" while highlighting widespread approval for the Government's efforts to restore connections with the bloc.

She referenced the May accord designed to reduce bureaucratic obstacles for businesses and travellers, alongside proposals for an ambitious youth mobility programme.

"Businesses, especially small businesses, who face increasing red tape since we left the European Union, for workers, who are now locked out of the jobs market in Europe, there are obviously huge benefits from rebuilding some of those relations," the Chancellor stated.

Ms Reeves noted that initial concerns about revisiting EU relations had proved unfounded, with the public response being "very good".

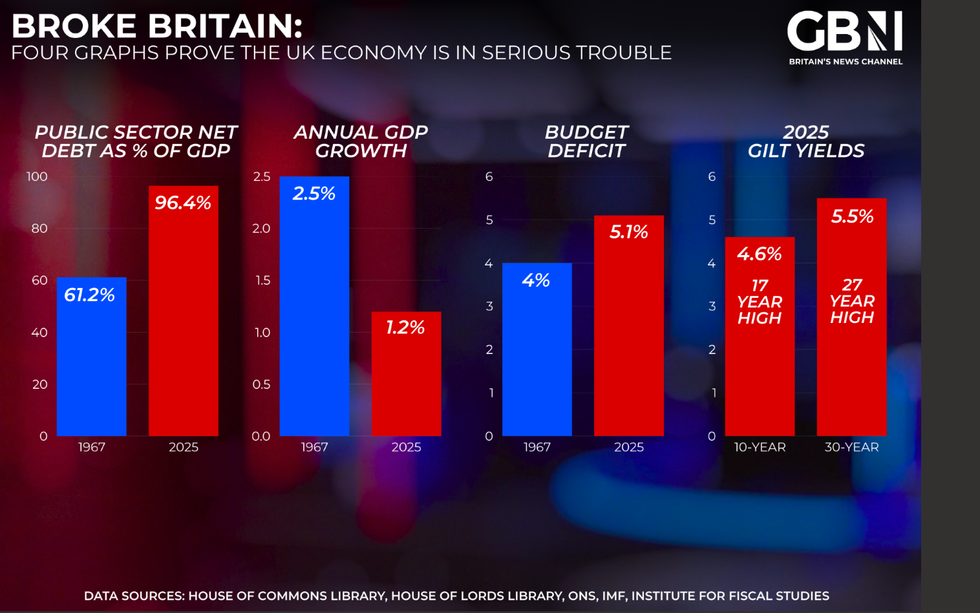

Four graphs prove the UK economy is in serious trouble | GB NEWS

Four graphs prove the UK economy is in serious trouble | GB NEWSThe Chancellor faces mounting fiscal challenges ahead of her Budget, with the Institute for Fiscal Studies (IFS) calculating she requires £22billion to achieve the £10billion buffer she established against her borrowing targets in March.

September's Consumer Prices Index held at 3.8% per cent, offering modest relief from expectations, though Reeves maintains this level remains excessive.

"Inflation is too high in countries around the world including in the UK, and one of the reasons for that is that there's too much cost associated with trade with our nearest neighbours and trading partners," she told the Riyadh audience.

The UK-Saudi agreements encompass up to £5billion in UK Export Finance backing for Saudi projects, potentially generating contracts for British suppliers, plus plans for a new Barclays headquarters in Riyadh.

"The £6.3billion package of new trade, procurement and investment commitments unveiled today will turbocharge business opportunity and create thousands of jobs at home key ingredients for kickstarting economic growth and building an economy that works for, and rewards, working people," Reeves declared.

The Prime Minister's spokesperson addressed concerns regarding Saudi Arabia's human rights situation on Monday, maintaining that "economic partnership can co-exist with frank dialogue on areas of disagreement".

Recent research has found that Britons are opting to save more money in the wake of the UK's inflationary woes.

Kate Steere, a personal finance expert at Finder, said: "Inflation is lower than many expected, but it's still an extremely worrying figure for Brits who are seeing their hard-earned savings eroded in real terms.

LATEST DEVELOPMENTS:

Inflation is stuck at 3.8%, nearly double the Bank of England's desired target | GETTY / CHAT GPT

Inflation is stuck at 3.8%, nearly double the Bank of England's desired target | GETTY / CHAT GPT"The impact of this could be softened if providers were committed to offering inflation-beating rates.

“But, instead, several well-known banks are continuing a campaign of cutting rates despite the base rate staying put. HSBC and Coventry Building Society lowered rates on several savings products on Monday, while Co-op Bank, Barclays and Virgin Money will also reduce select savings rates in the coming days and weeks.

“It’s clear that in the current climate, loyalty doesn’t pay; finding the best deal does. So, make sure you’re seeking out the best inflation-beating rates on the market, even if that means switching providers or exploring digital-only options.

"Digital banks like Zopa, offering 4.75 per cent, and Chase, with its 4.5 per ent boosted saver, are good examples of where to look.”

More From GB News