HSBC launches £220 account switching deal with competitive savings rate: ‘Most lucrative on the market!’

Banks are looking to entice customers with HSBC now offering a new account switch deal with a high savings interest rate

Don't Miss

Most Read

HSBC UK has announced the launch of a new account switching deal which is offering up to £200 and a competitive savings interest rate.

Those looking to take advantage of this deal need to take out a current account, as well place money regularly into savings.

The bank’s new customers can receive £100 after opening an Advanced or Premier Account and meeting the eligibility criteria, while also opening an Online Bonus Saver.

If HSBC customers continue to keep to the monthly criteria, including depositing a minimum of £50 a month into their savings account, they could get an extra £120.

This means savers could receive up to £220 in total over the space of a year with this new switching offering.

Furthermore, the Online Bonus Saver pays an interest rate of four per cent AER (annual equivalent rate) on balances up to £50,000.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

HSBC is offering a new account switching deal for customers

|GETTY

The savings account will offer a rate of 2.30 per cent AER on any part of the balance which is over £50,000.

It should be noted that a standard interest rate of two per cent applies to balances in any month where a withdrawal has been made of if the account is closed.

The attached interest rate included a bonus which is paid in any month when someone does close the account or withdraw cash.

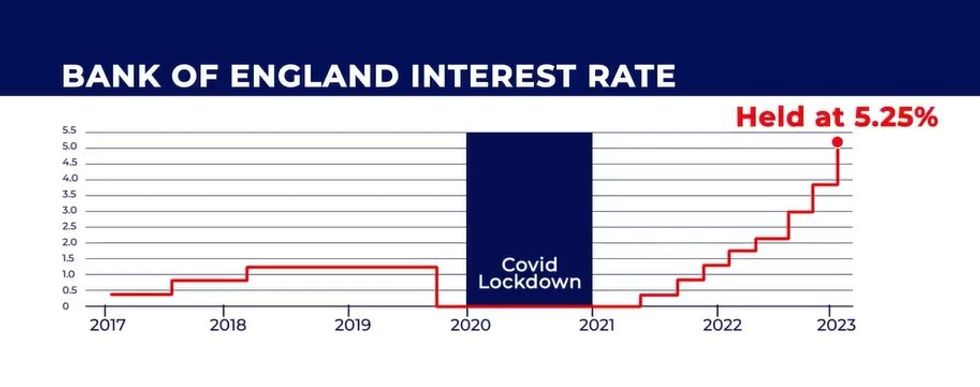

Savers have benefited from the Bank of England’s decision to raise the base rate in its fights against inflation.

While HSBC’s savings interest rate remains lower than the Bank’s 5.25 per cent rate, it remains competitive among the wider marker.

James Hyde, a spokesman at Moneyfactscompare, described the deal as “potentially the most lucractive on the market”.

He explained: “HSBC has joined the small group of providers currently offering cash incentives to attract consumers.

“This switching offer of up to £220 makes it potentially the most lucrative on the market at present. However, it’s worth pointing out that £120 of this figure is dependent on regular deposits being made over 12 months.

“Switching offers such as these are a great way of securing an instant cash injection, and incentives to encourage continuous saving are always a welcome option too.

“The process of transferring a current account is often very straightforward, so consumers would be wise to consider their options if they like what they see elsewhere.”

It should be noted that a standard interest rate of two per cent applies to balances in any month where a withdrawal has been made of if the account is closed.

The attached interest rate included a bonus which is paid in any month when someone does close the account or withdraw cash.

However, the £220 switching offer comes with certain terms and conditions. To claim the initial £100 incentive, customers must use the Current Account Switch Service (CASS) when making the switch.

LATEST DEVELOPMENTS:

The Bank of England base rate is at a 15-year high of 5.25 per cent | GB NEWS

The Bank of England base rate is at a 15-year high of 5.25 per cent | GB NEWSThis includes making at least two direct debits or standard into the account. Within 60 days of opening the account, customers must deposit at least £1,500.

Money could come from their salary but at least 20 transactions need to made using the HSBC debit card.

Furthermore, customers must also register and log on to mobile banking and open an Online Bonus Saver and deposit at least £50.

If this qualifying criteria is met, HSBC customers will receive £100 paid into their current account within 30 days.

In order to get the extra £120, customers must complete all the qualification criteria, and also make a monthly deposit of a minimum of £50 into their Online Bonus Saver.

Customers of HSBC will receive £10 per month, up to a maximum of £120 or 12 monthly payments, paid by the 20th of the following month if they have met qualifying criteria in the previous month.