Widow who was overtaxed on £8,000 pension drawdown asks how to claim refund from HMRC

HMRC applied an emergency tax code to a widow's pension withdrawal

|GETTY

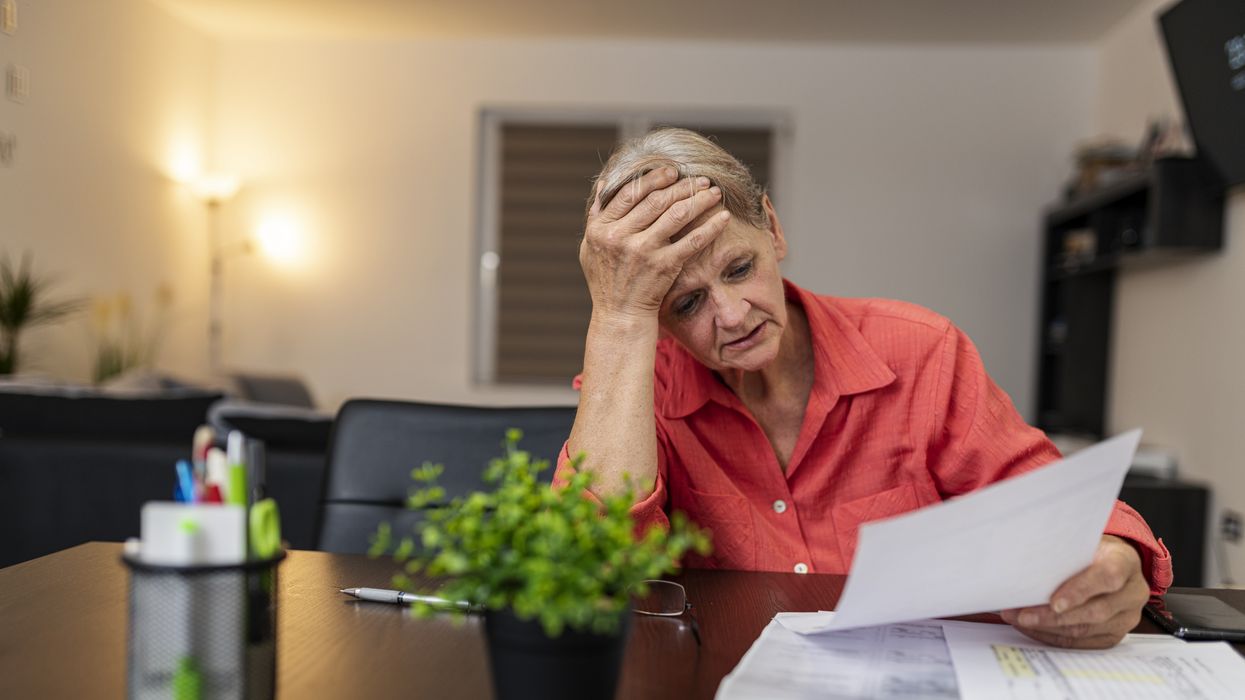

The woman needed some guidance on the form for claiming overpaid tax back from HMRC

Don't Miss

Most Read

Latest

A widow who paid thousands of pounds in tax after taking a drawdown from their pension pot has been left unsure how to get a tax refund.

The retiree contacted GB News, who put the query to pensions expert Becky O’Connor.

The woman asked: “I took a drawdown of £8,000.00 (October 2023) financial year 2023-2024 from my pension pot.

“I have contacted HMRC as I received £5,847.94 after tax but they were not sure what online form to fill in to claim overpaid tax back.

Do you have a money question you'd like financial experts to answer? Get in touch by emailing money@gbnews.uk.

HMRC may apply an emergency tax code the first time someone makes a withdrawal of income from their pension

|PA

“I am a widow, could you please confirm what online form I need to fill in. I also heard that if I did nothing this would be rectified the next financial year by HMRC is this correct?

“Many thanks in advance for your help.”

Becky O’Connor, who is the director of public affairs at PensionBee, replied: “Unfortunately, you were put on an emergency tax code.

“This typically happens the first time someone makes a withdrawal of income from their pension - and it can come as a bit of a shock, especially as you end up with far less from your withdrawal than you had anticipated.

“It’s slightly troubling that HMRC was unable to tell you which form to fill out.

“The form you need to fill out is most likely form P55.

"There are other forms to fill out if you’ve taken out your full pension (P507 and P537).

“Once this form is filled out and a new tax code applied, the refund should come through with your next withdrawal.

“However it’s also possible to wait until the end of the tax year and get a refund when you file your self-assessment tax return.

LATEST DEVELOPMENTS:

“What you were told about HMRC correcting it for at the end of the tax year is also true.

“They would send you a calculation at this point, confirming any overpayment or underpayment of tax.”

An HMRC spokesperson said: “Nobody overpays tax as a result of taking advantage of pension flexibility.

“We will automatically repay anyone who pays too much because they’re on an emergency tax code. Individuals can claim back any overpayment earlier if they wish.”

HMRC confirmed that if an individual doesn't apply directly for a refund, HMRC will work out their annual tax bill at the end of the tax year.

If too much tax has been paid on the lump sum, an individual can claim the tax back from HMRC, which is usually repaid within 30 days. More information is available online on the Government website.