HMRC set to issue £100 fines for solar panel users this January

Thousands risk penalties ahead of tax deadline

Don't Miss

Most Read

More than 54,000 homeowners with rooftop solar panels could face automatic £100 fines from HMRC if they fail to submit their self-assessment tax returns by the January 31 deadline.

The warning comes as growing numbers of households earn income by selling surplus electricity back to the national grid without realising it may be taxable.

George Penny, founder of The Solar Co, said hundreds of thousands of solar panel owners may be unaware they are required to declare these earnings.

Those who are required to pay additional tax must complete their online self-assessment returns by midnight on the final day of January to avoid penalties.

TRENDING

Stories

Videos

Your Say

HMRC issues an automatic £100 fine for late filing, even if no tax is ultimately owed.

The potential penalties apply to households generating income through renewable energy systems, including payments received for exporting unused electricity.

Many solar panel owners receive payments through the Smart Export Guarantee scheme, which allows households to sell surplus power to energy suppliers.

Following a record-breaking year for installations in 2025, around 1.6 million households across the UK now have photovoltaic panels fitted to their homes.

A significant proportion of those households are earning money through SEG payments.

Industry estimates suggest many solar households are receiving £300 or more per year through the scheme alone.

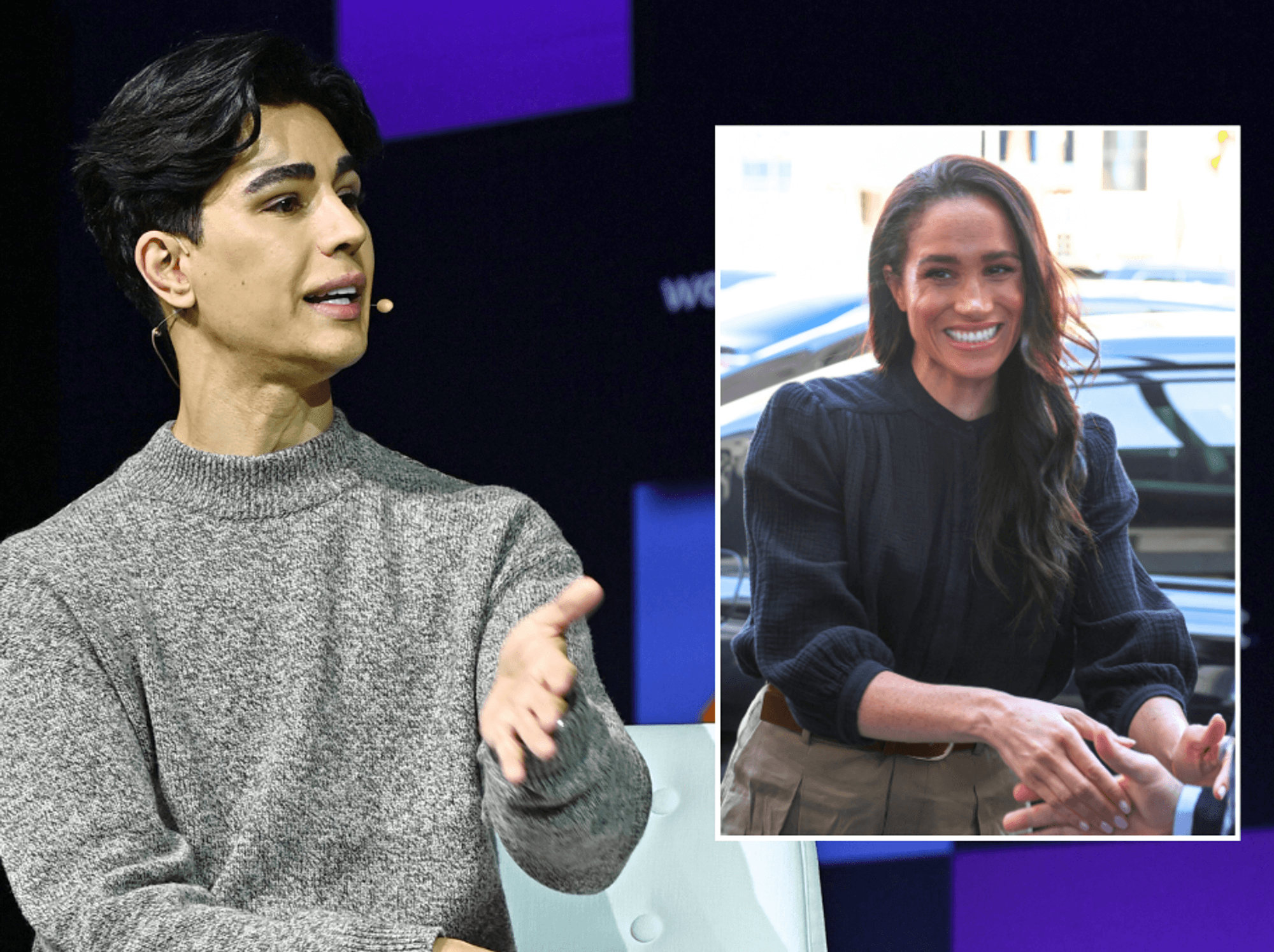

More than 54,500 solar‑panel homeowners risk automatic £100 HMRC fines if they miss the January 31 tax return deadline

|GETTY

This additional income means an estimated 605,966 solar panel owners could be exceeding HMRC’s £1,000 tax-free trading allowance without realising it.

The allowance applies to total supplementary income rather than individual sources.

When SEG payments are combined with other income streams, such as freelance work or side businesses, households can quickly exceed the threshold.

Exceeding the allowance creates a legal requirement to register for self-assessment and declare the income.

Mr Penny said: "After a record-breaking year for solar installations in 2025, around 1.6 million UK households now have solar panels, with more homeowners than ever earning money by selling unused electricity back to the grid".

He said SEG payments alone can push households closer to the tax-free limit.

LATEST DEVELOPMENTS

An estimated 605,966 solar panel owners could be exceeding HMRC’s £1,000 tax-free trading allowance without knowing it

| GETTYMr Penny added: "While households may receive £300 or more annually through the Smart Export Guarantee, those earning additional income can quickly exceed HMRC’s £1,000 tax-free trading allowance".

He said many people are unaware SEG income must be considered alongside other earnings.

Data suggests the risk is widespread, as around 39 per cent of people in the UK now operate some form of side hustle.

That significantly increases the likelihood that solar panel owners will need to submit a tax return.

HMRC figures show around nine per cent of taxpayers miss the annual self-assessment deadline each year.

Mr Penny warned that late filing penalties could have a meaningful financial impact.

He said: "More than 54,500 solar households could face an automatic £100 late-filing fine, which could wipe out around a third of their annual SEG earnings".

The warning comes as households face ongoing pressure on energy costs and household budgets.

Mr Penny urged solar panel owners to act before the deadline passes.

Solar panel owners have been urged to check their earnings

| GETTYHe said: "Ahead of the deadline, it’s vital that solar panel owners check exactly how much they’ve earned, including Smart Export Guarantee payments".

Mr Penny added: "If total supplementary income exceeded £1,000 between April 2024 and April 2025, it must be declared to avoid penalties".

He advised households to review their most recent energy supplier statements, which show how much has been earned from exporting electricity to the grid.

HMRC has repeatedly warned that individuals are responsible for understanding their tax obligations, regardless of how income is generated.

Our Standards: The GB News Editorial Charter

More From GB News