Inheritance tax deadline looms as THOUSANDS to be slapped with 'sudden and large' HMRC charge

Inheritance tax is a levy from HMRC charged on the estates of individuals who have passed away

Don't Miss

Most Read

Business owners across the United Kingdom face a critical deadline on April 6, 2026, when sweeping changes to inheritance tax (IHT) business relief from Chancellor Rachel Reeves come into force.

From that date, full 100 per cent relief will be restricted to the first £2.5million of qualifying business and agricultural assets, with anything above this threshold receiving only 50 per cent relief.

The reforms mean many entrepreneurs and their families will confront substantially larger IHT bills upon death, potentially threatening the survival of otherwise thriving companies.

Wealth management experts are warning that firms lacking sufficient liquid assets to cover an unexpected tax liability could face collapse, putting jobs at risk. With barely two months remaining before the new rules take effect, advisers say the window for protective planning is rapidly closing.

An important inheritance tax deadline looms for businesses

|GETTY

Lee Matthews, a senior partner in financial planning at wealth management firm Evelyn Partners, described April 6 as "a date that creates a clear deadline for planning" for business owners concerned about their firm's long-term prospects and their family's financial security.

"A sudden and unexpectedly large IHT bill, particularly where liquid assets are in short supply, could spell the end for even a successful enterprise and the jobs it provides," he said.

Mr Matthews noted that asset transfers currently possible without immediate tax charges will become restricted after the April deadline, with trusts playing a potentially crucial role.

Recent data shows trust registrations during the 2024/25 tax year represented 14.5 per cent of all existing trusts, reflecting heightened interest since the October 2024 Budget announced these reforms alongside plans to include unspent pension assets in IHT calculations from April 2027.

Rachel Reeves unveiled £26billion of tax hikes in her most recent Budget | UK PARLIAMENT/PA

Rachel Reeves unveiled £26billion of tax hikes in her most recent Budget | UK PARLIAMENT/PA The specific mechanics of the new regime mean that qualifying assets exceeding the £2.5million threshold will attract only half the current relief rate, resulting in an effective inheritance tax charge of 20 per cent on those excess amounts.

This cap was recently increased from the £1million figure originally announced in the Chancellor's October 2024 Budget. A further revision has introduced spousal transfer provisions mirroring the existing nil-rate band rules, allowing any unused portion of the £2.5million allowance to pass to a surviving spouse upon death.

Crucially, the deceased partner need not have owned qualifying assets themselves for this transfer to apply. Business owners should begin by mapping precisely which assets qualify for relief, scrutinising company structures, balance sheets and activities with professional advisers, Mr Matthews advised.

Common pitfalls include excessive cash reserves, investment activities that have gradually accumulated within the business, and group structures combining trading and investment entities.

LATEST DEVELOPMENTS

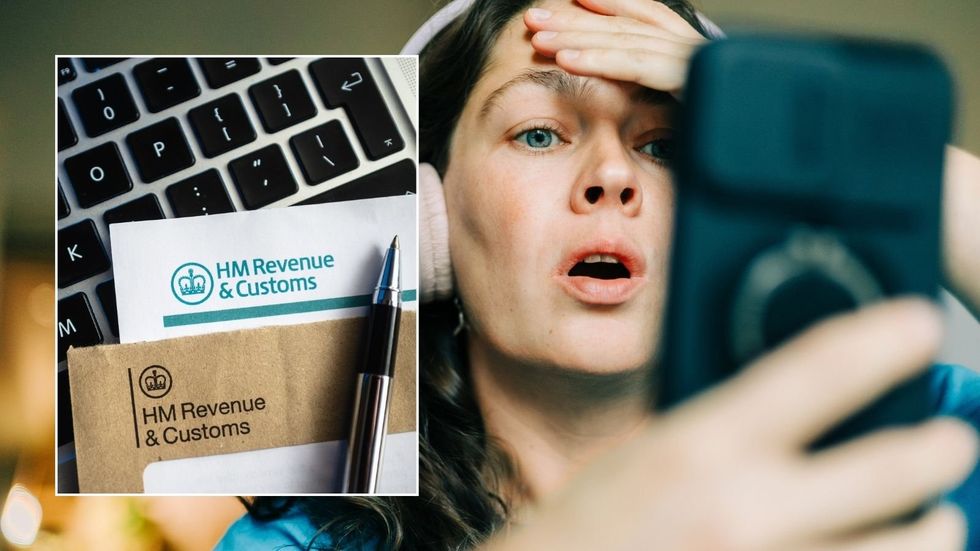

Following the Budget, valuable inheritance tax reliefs for agricultural and business assets will be removed | GETTY

Following the Budget, valuable inheritance tax reliefs for agricultural and business assets will be removed | GETTYGifting strategies require urgent attention, as transfers of BR-qualifying shares into discretionary trusts can currently proceed without immediate tax charges regardless of value, but this flexibility ends on April 6.

Share reorganisations, including spousal equalisation and creating new share classes, frequently take longer than anticipated due to legal processes, valuations, and shareholder approvals.

Mr Matthews warned that poor sequencing of these steps can inadvertently breach relief conditions or trigger unexpected tax liabilities.

Life insurance underwriting should also commence immediately, as medical assessments and documentation can cause delays stretching weeks or months.

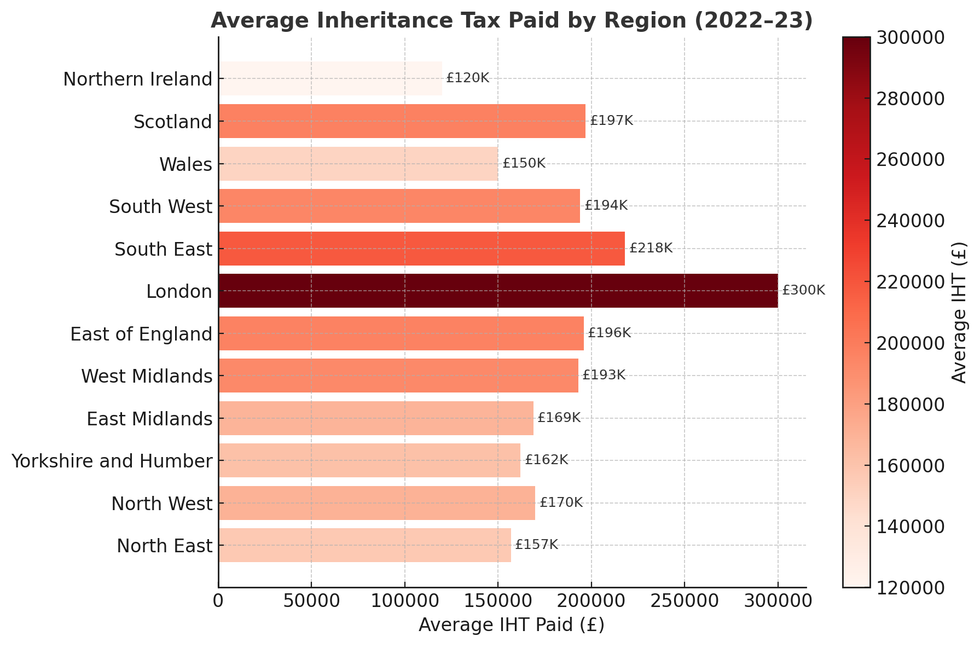

Average Inheritance tax paid by region | CHATGPT/ONS

Average Inheritance tax paid by region | CHATGPT/ONSCorporate restructuring and personal estate planning must proceed in tandem, as business owners frequently prepare for sales or refinancing without considering how these actions interact with wills, trusts, and succession arrangements.

Establishing a new holding company, for instance, may alter business relief status, while changes to voting rights could affect inheritance intentions. Wills may require updating to maximise the new BR allowance or direct assets appropriately into trust structures.

Mr Matthews emphasised that legal, tax and investment advisers should coordinate closely, noting that "a short misalignment at the wrong moment can jeopardise years of planning".

Following any sale, owners should have a clear strategy for managing proceeds, including whether a family investment company or personal investment company structure is appropriate, to avoid immediate IHT exposure during the reinvestment period.

More From GB News