Ftse 100 surges to record-high as 'massive' US trade deal confirmed by Donald Trump

The UK stock market continues to rally despite yesterday's higher-than-expected borrowing figures from the ONS

Don't Miss

Most Read

Latest

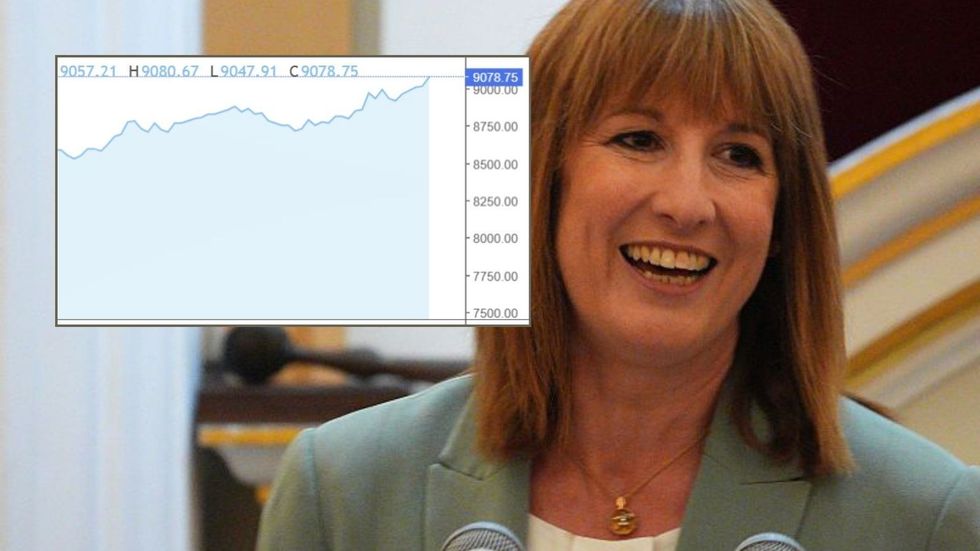

The FTSE 100 has surged to a record-high in a much-needed win for the Labour Government as traders celebrated confirmation of a "massive" trade deal between the US and Japan, the Philippines and Indonesia

This rally comes despite figures from the Office for National Statistics (ONS) revealing that UK borrowing soared higher-than-expected for June 2025. Public sector borrowing totalled £20.68billion over hte period, exceeding an FXStreet-cited consensus estimate for £15.6billion.

Yesterday, the FTSE 100 index closed up 10.82 points, 0.1 per cent, at 9,023.81. It had earlier hit a new all-time high of 9,035.37. This is despite the potential threat of higher taxes from Chancellor Rachel Reeves to pay off the UK's hiked borrowing costs.

This market continued into today as traders appear to be optimistic at the prospect of a trade deal between President Donald Trump and the US' Asian trading partners after months of tariff threats.

The FTSE has soared to a record high in a much-needed win for Rachel Reevees

|GETTY / INVESTING

On Truth Social, Trump shared: "We just completed a massive deal with Japan, perhaps the largest deal ever made. Japan will invest, at my direction, $550bilion into the United States, which will receive 90 per cent of the Profits.

"This deal will create hundreds of thousands of hobs — There has never been anything like it."

Corporate results helped bolster the stock market index, which jumped 42 points or 0.5 per cent, to 9,066.31 this morning.

Informa, the international events group, saw a rise of four per cent after it raised its growth guidance for the year, despite the impact of currency fluctuations.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

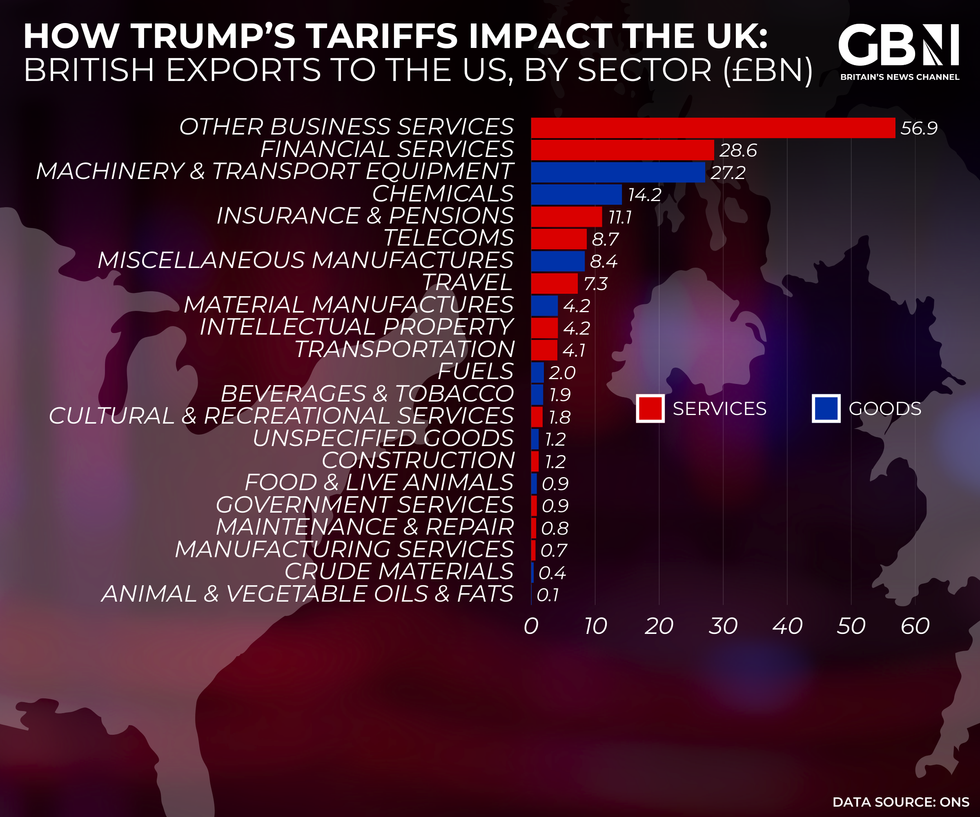

IN DEPTH: How could Trump's tariffs impact Britain? British exports to the US ranked | GB NEWS

IN DEPTH: How could Trump's tariffs impact Britain? British exports to the US ranked | GB NEWSFurthrmore, pharmaceutical gained AstraZeneca gained 2.99 per cent a day after announcing plans to invest $50billion in the US.

Housebuilder Persimmon was 1.65 per cent higher on hopes for an interest rate cut from the Bank of England next month.

European stocks have also been buoyed by the prospect of a new trade deal with the US following recent comments from the Trump administration.

The US President confirmed yesterday that representatives from the EU "were coming for trade negotiations on Wednesday".

Markets have previously been worried about European Union's plans for tariff countermeasures if a deal is not reached by the White House's August deadline.

This has placed additional pressure on the UK as the backdrop of Trump's tariffs has led to a volatile marketplace which has spooked investors.

LATEST DEVELOPMENTS:

The FTSE's rally offers much-needed relief for the Chanellor

| PADespite economic concerns, UBS thinks UK equities continue to trade at “attractive valuations both in absolute and relative terms”.

"Low multiples, combined with high dividend yields underline the UK market’s appeal, and there is room for further re-rating if earnings prove resilient and political risks abate.

"For now, UK equities offer cheapness with a catalyst, the fundamental discount is well known, and any improvement in macro or clarity in policy could help close the gap further,” strategists at the Swiss bank commented.

More From GB News