Pound projected to plunge to ALL-TIME LOW as Sterling could slip to Great Recession-era level, bank predicts

GB NEWS

UniCredit is warning the pound could be fall to levels not seen since the 2007-08 financial crash

Don't Miss

Most Read

Latest

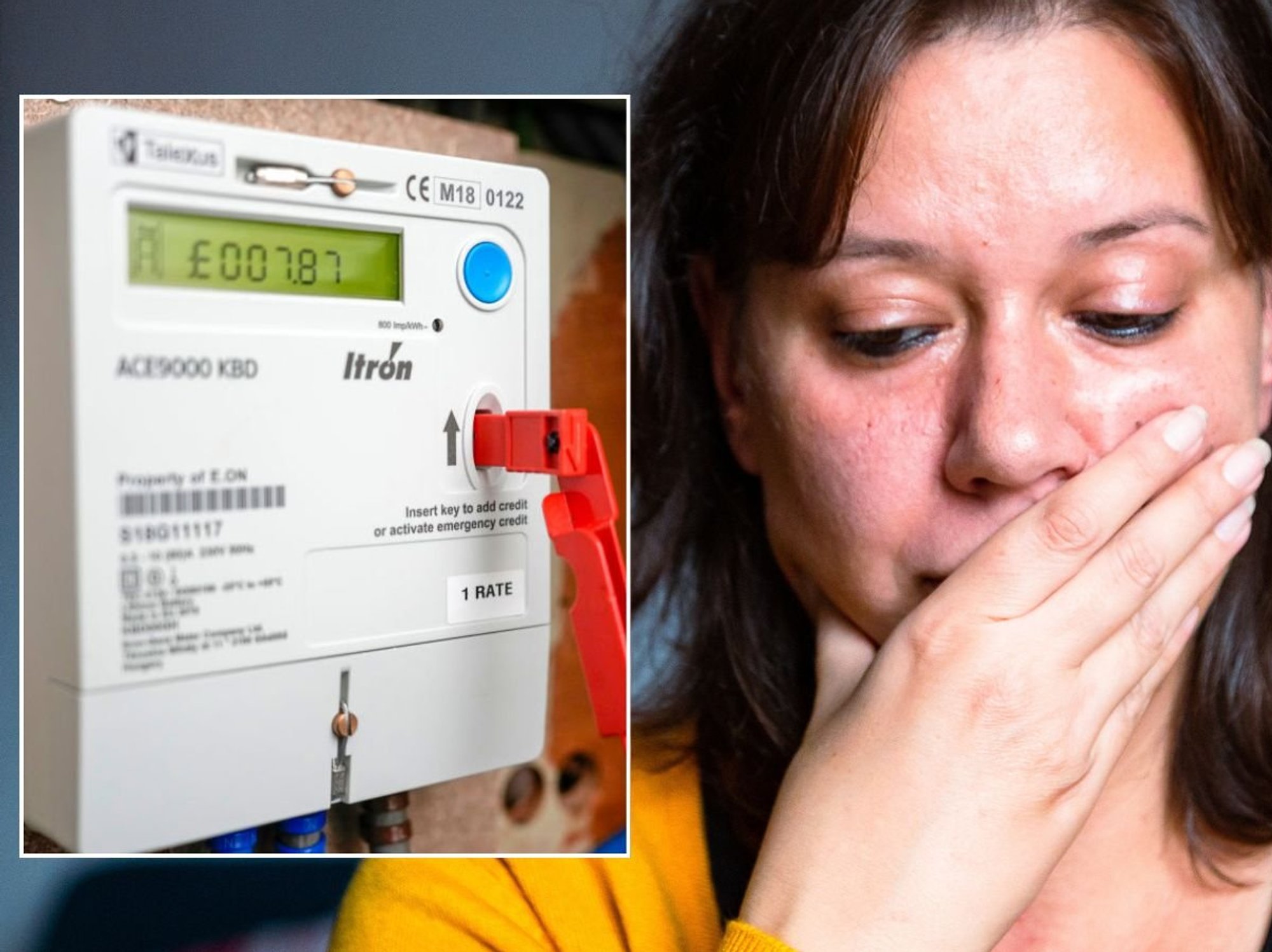

The British pound is projected to collapse to levels not seen since the Great Recession in the late 2000, according to a shocking new prediction from a European financial institution.

Italian bank UniCredit has forecast sterling could slip to just 1.05 against the euro, which would be a comparable to falls experienced by the currency seen during financial crisis.

Notably, the 2008 global financial meltdown saw the pound hit an all-time nadir of 1.02 as international markets took a hit from the real estate bubble bursting.

Following the British public vote to leave the European Union (EU) in 2016, Brexit resulted in the currency plunging to a slightly higher level of 1.0573.

**ARE YOU READING THIS ON OUR APP? DOWNLOAD NOW FOR THE BEST GB NEWS EXPERIENCE**

Banks are warning the pound could tumble to levels not seen since the Great Recession

|GETTY / TRADING VIEW

Similarly, the market turmoil originating from the Covid-19 pandemic in 2020 saw sterling slip to around 1.0526 as the majority of countries went into lockdown.

Roberto Mialich, UniCredit's senior global currency strategist, anticipates the euro-pound rate climbing to 0.95, which translates to this dire sterling forecast.

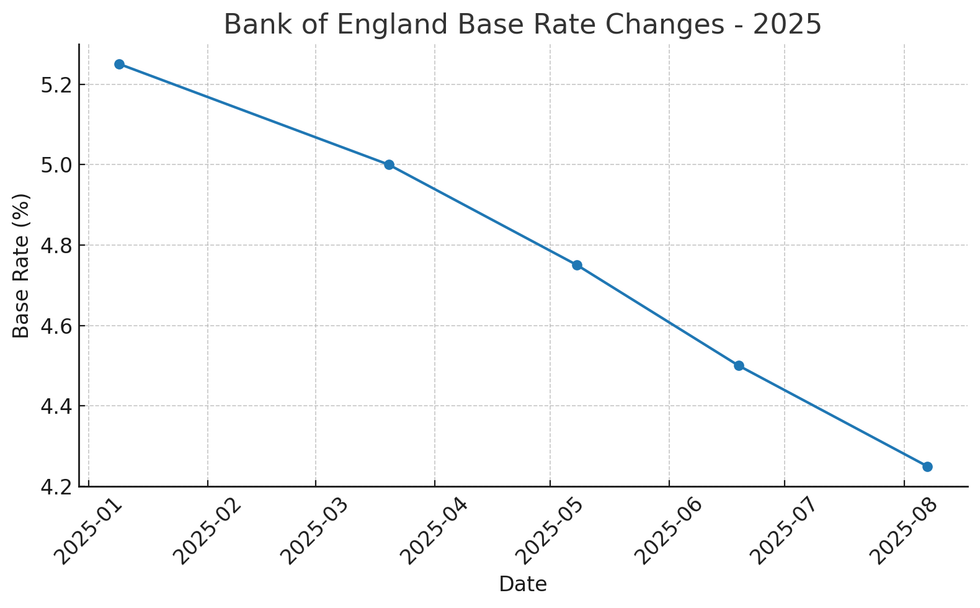

The decisions from the Bank of England's Monetary Policy Committee (MPC) regarding interest rates lie at the heart of UniCredit's pessimistic sterling forecast.

According to the investment bank, they expect the financial instition to reduce borrowing costs more aggressively than financial markets currently anticipate.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

The Bank of England base rate has fallen dramatically this year | CHAT GPT

The Bank of England base rate has fallen dramatically this year | CHAT GPT "If we are right, clearly this will have a more negative impact on sterling," Mialich stated during an interview. He believes the Bank "will probably continue to move on a quarterly basis".

UniCredit's economists project a November rate reduction, defying market expectations that have ruled out such a move due to persistent inflation.

Daniel Vernazza, the bank's Chief International Economist in London, forecasts two additional cuts in 2025, bringing the bank rate to 2.75 per cent by year-end.

This projection sits well below market expectations of 3.6 per cent, suggesting traders must significantly reprice their outlook if UniCredit's analysis proves accurate.

MEMBERSHIP:

- They went to the police. Tried to shut my pub. But Epping won. The genie is out of the bottle - Adam Brooks

- Interactive map reveals how many illegal migrants have entered on Keir Starmer's watch - find out the number in YOUR area

- MAPPED: The councils that could now take legal action after Epping ruling torpedoes Labour's asylum plans

- REVEALED: The 32 seats that could parachute Nigel Farage into No10 as General Election petition hits 800k

- Reform UK faces eight pivotal tests TODAY as Nigel Farage gears up for battle following shock resignation

Based on UniCredit's forecast, investors will "aggressively reprice more easing" in 2026 under the belief that the UK labour market will weaken and prompt a meaningful retreat in inflation.

Mr Vernazza added: "The labour market has deteriorated, wage growth has eased, and economic growth remains subdued with downside risks. In time, this margin of slack would put downward pressure on inflation."

However, not all financial analysts share UniCredit's gloomy sterling outlook. London-based QuantMetriks Advisory presents a different perspective, forecasting appreciation for the British currency.

Dr Savvas Savouri, QuantMetriks' managing director, previously shared his prediction that British sterling will strengthen against both major currencies.

LATEST DEVELOPMENTS:

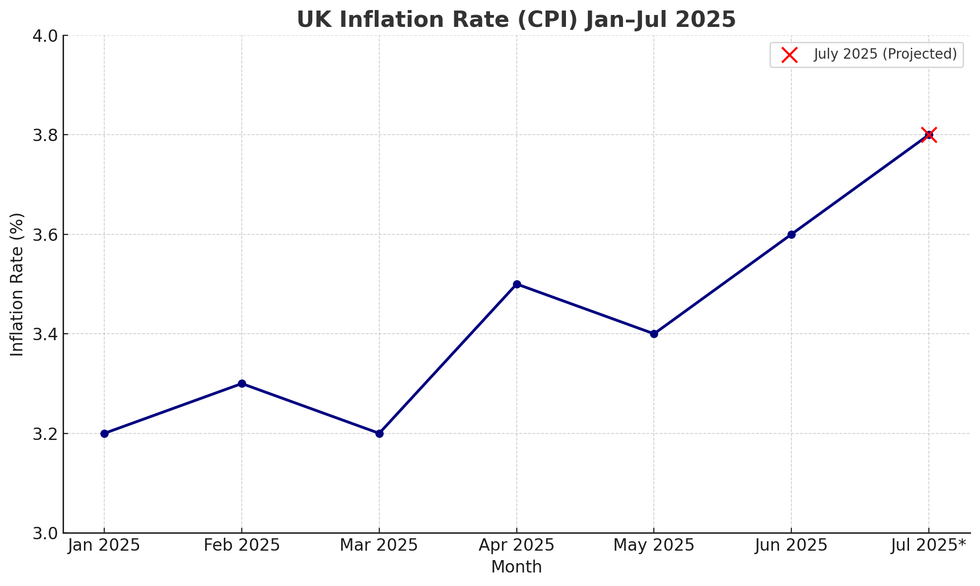

How has inflation changed this year | CHAT GPT

How has inflation changed this year | CHAT GPT "Yes, having languished for so long, the pound will rise against the dollar... the pound will also rise relative to the euro," Dr Savouri explained.

The boutique research firm's analysis centres on anticipated US dollar weakness under the Trump administration. Savouri suggests the White House will employ tariff strategies that historically triggered dollar devaluation, creating opportunities for sterling gains.

Sterling's prolonged weakness becomes evident when considering its pre-crisis peak of 1.60 against the euro in 2007. The currency has failed to recover the ground lost during the 2007-2008 financial turmoil.

Recent inflation data adds complexity to the outlook. July's UK inflation climbed to 3.8 per cent annually from June's 3.6% per cent with services inflation reaching five per cent.