Relief for Rachel Reeves as UK public borrowing costs PLUMMET to lowest level in three years

GB NEWS

The Chancellor has been attempted to bolster the economy while tackling soaring borrowing costs

Don't Miss

Most Read

Latest

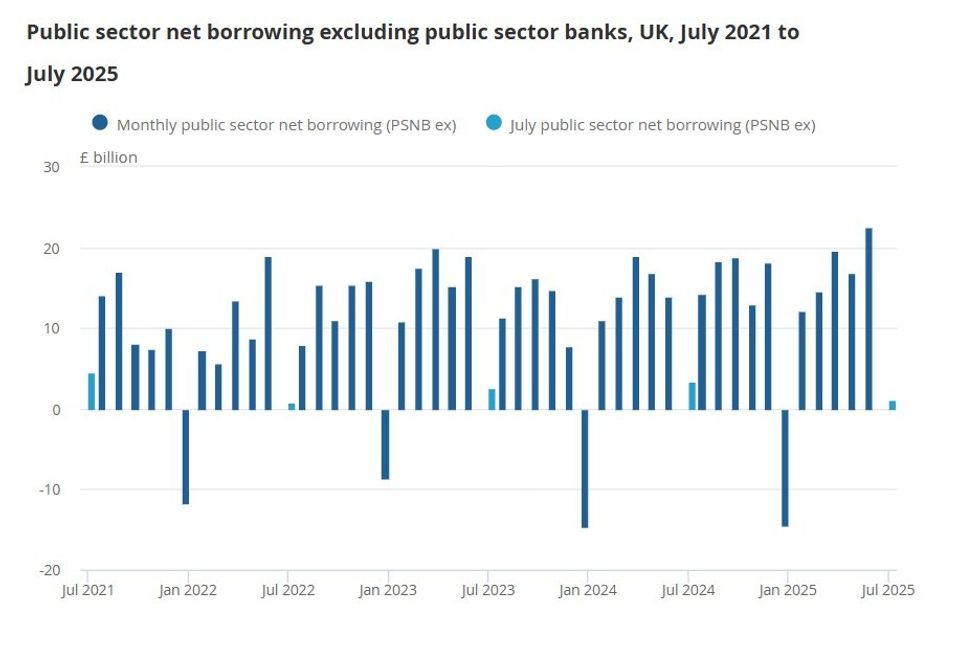

The UK's public borrowing costs has plummeted to its lowest level in nearly three years for July, according to the latest figures from the Office for National Statistics (ONS).

Public sector net borrowing excluding public sector banks was £1.1billion in July 2025, which is £2.3billion less than in July 2024.

This is a much-needed win for Chancellor Rachel Reeves, who was dealt a disappointing blow after inflation for the 12 months to July 2025 jumped to 3.8 per cent.

According to the ONS' figures, initial estimates found that the public sector spent more than it received in taxes and other income in July 2025, which saw the Government borrow £1.1billion.

**ARE YOU READING THIS ON OUR APP? DOWNLOAD NOW FOR THE BEST GB NEWS EXPERIENCE**

Rachel Reeves

|GETTY

Notably, this was £2.3billion less than in July 2024 and £1.1billion less than the £2.1 billion forecast in March 2025.

These figures from the ONS came after an increase in Self-Assessed income tax payments helped boost tax receipts for the month.

Overall, July borrowing was higher than the £2 billion figure predicted by a consensus of economists.

Borrowing for the first four months of the financial year stood at £60 billion, £6.7 billion more than during the same period last year.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

How much did Britain borrow?

|ONS

ONS deputy director for public sector finances Rob Doody said: "Borrowing this July was £2.3billion down on the same month last year and was the lowest July figure for three years.

"This reflects strong increases in tax and national insurance receipts. However, in the first four months of the financial year as a whole, borrowing was over £6billion higher than in the same period in 2024."

Chief secretary to the Treasury Darren Jones added: “We’re investing in our public services and modernising the state, to improve outcomes and reduce costs in the medium term.

"Far too much taxpayer money is spent on interest payments for the longstanding national debt.

MEMBERSHIP:- Interactive map reveals how many migrants have entered on Keir Starmer's watch - find out the number in YOUR area

- Labour's property tax is about to wipe out the middle classes in London and the South East - Kelvin MacKenzie

- Trigger warning: What I have to say about Notting Hill Carnival will deeply upset the woke - Peter Bleksley

- Reform UK faces eight pivotal tests in 24 hours as Nigel Farage gears up for battle following shock resignation

- POLL OF THE DAY: Following the Epping win, should we close all migrant hotels? VOTE NOW

"That’s why we’re driving down Government borrowing over the course of the parliament – so working people don’t have to foot the bill and we can invest in better schools, hospitals and services for working families."

Professor Joe Nellis, an economic advisor to MHA, noted: "Despite this improvement, borrowing for the financial year to date remains £6.7bn higher than the same period last year.

LATEST DEVELOPMENTS:

Darren Jones claimed the Government is "driving down Government borrowing"

| GB NEWS"National debt is hovering close to 100 per cent of gross domestic product (GDP), keeping fiscal discipline in sharp focus for investors and lenders.

"The current trajectory of spending on the ever-enlarging welfare state is unsustainable, and elevated gilt yields continue to push up the cost of servicing the debt (estimated at almost £20billionn in June), eating into the Chancellor’s fiscal headroom ahead of a tricky Autumn Budget.

"While July’s figures may offer the Chancellor some limited flexibility, market conditions remain critical. Sticky inflation could upset the financial markets and push up UK gilt yields even further, quickly making the cost of servicing the debt even higher.

"Fiscal stability will continue to be under close scrutiny at the Autumn Budget — there will undoubtedly be tighter control from the Treasury over spending than we’ve seen so far under Reeves’ leadership, but we are almost certainly going to see tax rises."