State pension age rises 'doubled poverty' as older Britons must 'keep working', Lords warn

The state pension age is regularly reviewed and raised depending on life expectancy data

Don't Miss

Most Read

State pension age rises have contributed to an "increase in financial hardship" for older Britons as the absolute poverty rate among 65-year-olds "doubled", a damning House of Lords' report has heard.

The Economic Affairs Committee has accused successive Governments of neglecting the profound challenges posed by Britain's rapidly ageing population with the cross-party committee of peers warning the fiscal consequences will be severe.

The Office for Budget Responsibility (OBR) projects that public debt could soar beyond 270 per cent of gross domestic product (GDP) by the early 2070s under current policy settings. Borrowing would simultaneously climb above 20 per cent.

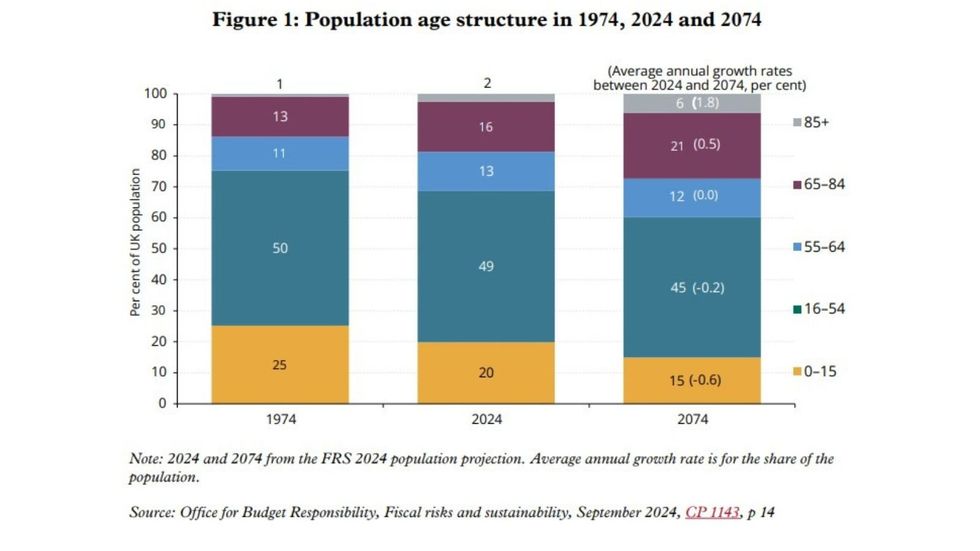

Lord Wood of Anfield, the committee's chair, said: "People are having fewer children and living longer and successive Governments have simply not focused on the seismic effects a rapidly ageing population will have on our economy and society."

The absolute poverty rate for 65-year-olds doubled when the state pension age was raised, a House of Lords report has found

|GETTY / HOUSE OF LORDS

The committee dismisses increasing the state pension age as an ineffective response to the crisis with officials from HM Treasury describing the policy as a "blunt lever" to tackling the problem.

Lord Wood described this approach as "a red herring" that "saves the Government money, but increases pensioner poverty as many people have already stopped working by their sixties".

According to the report, the real priority of future Government should be encouraging those aged between their mid-50s and mid-60s to remain in employment or re-enter the workforce.

Furthermore, the committee recommends examining the tax system and removing abrupt thresholds in public sector pension arrangements that may discourage continued work.

The committee is sounding the alarm over Britain's population crisis

|HOUSE OF LORDS ECONOMIC AFFAIRS COMMITTEE

Evidence presented to the the House of Lords committee found no systematic productivity differences between older and younger employees across most occupations.

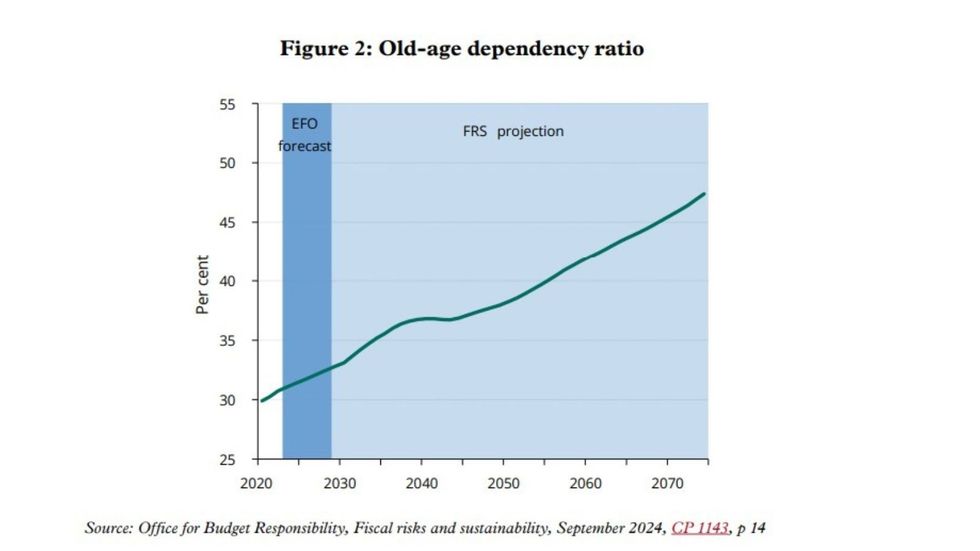

Notably, the OBR forecasts Britain's dependency ratio will rise from 31 per cent to 47 per cent of the population over the coming half-century without significant policy changes.

Analysts note this creates mounting pressure on funding state pensions, healthcare and welfare for older citizens from taxes collected from a shrinking proportion of working-age people.

The committee concludes that neither increased immigration nor efforts to boost birth rates offer viable solutions. Even immigration levels that would prove politically unpalatable would be insufficient to meet the challenge, while attempts to raise fertility in other nations have largely proved unsuccessful.

The committee emphasises that today's young people will bear the brunt of these demographic changes. Those born recently face the prospect of significantly longer lives than previous generations, meaning they must prepare to work longer and accumulate greater savings to avoid financial hardship in old age.

Lord Wood stated: "The lack of a published strategy or forum for discussion on this topic demonstrates that this serious, but long-term, issue is not be taken seriously enough. The Government needs to begin addressing the impact of ageing now so that all age groups can live better and longer lives."

Economics professor Andrew Scott from the London School of Business, who provided evidence to the committee, said: "At age 50, around 80 per cent of people are in work in the UK.

"At age 65, which is two years before the state pension Age, it is down to around 25 per cent cent or 30 per cent. If you have only that many people working at 65, increasing the state pension age does very little."

How will Britain's ageing population change in the years to come/

|HOUSE OF LORDS ECONOMIC AFFAIRS COMMITTEE

On solutions to address Britain's ageing population, Mr Scott added: "From a macro public finance point of view, everything has to be focused on how to keep people working from 50 onwards."

Dr Emily Andrews, then deputy director for Work at the Centre for Ageing Better, added: "When the state pension age went up from 65 to 66, the rate of absolute poverty among 65-year-olds doubled … If someone is still working before state pension age, they just do another year, but most people are not working at that age."

Following the publication of today's report, the Labour Government's response to its findings is due by February 19, 2029.

GB News has contacted the Department for Work and Pensions (DWP) for comment.

More From GB News