State pension EXPOSED: How much would your payments be without 'expensive' triple lock?

The triple lock guarantees state pension payment rates rise by at least 2.5 per cent but critics have suggested this mechanism should be scrapped

Don't Miss

Most Read

New analysis is shining a light on how much state pension payments would be worth without the triple lock, the mechanism used to determine annual rate hike from the Department for Work and Pensions (DWP).

Under the triple lock, state pension payment rates increase every year line with either the rate of consumer price index (CPI) inflation, average wage growth or 2.5 per cent; whichever is the highest.

Concerns have been raised over the long-term sustainability of the triple lock with the Office for Budget Responsibility (OBR) sounding the alarm the uprate mechanism will cost the Government £10billion more than initially forecast by 2029-30.

Critics have suggested an alternative "double lock" for determining annual payment hikes, which could see the minimum 2.5 per cent yearly boost to state pensions scrapped.

State pensions rise by at least 2.5 per cent under the triple lock

|GETTY / FIDELITY / CHAT GPT / GB NEWS

Ed Monk, an associate director at Fidelity International, answered a question from one of the financial firm's clients about what the state pension would look like with this change.

The client asked: "The triple lock on pensions has been kicked hard of late, but no one that I have read has ever stated just how many times the 2.5 per cent parts has been used. My question is how many times it has been activated, and what effect would have been felt by pensioners had it not been available?"

Mr Monk replied: "It [the triple lock] guarantees the state pension will never lag any of these measure, not just over extended periods but in each and every individual year as well. But, it’s getting increasingly expensive to fund, hence the kicking it tends to get from its critics.

"You ask a very interesting question about the 2.5 per cent element of the lock, because that’s the part those critics usually say should be scrapped.

The Chancellor has committed to the state pension triple lock

| GETTY"This is on the basis that it is fair the state pension should rise by at least the rates of inflation and wages so that it doesn’t a) lose value in real terms or b) leave pensioners getting poorer relative to working people. The 2.5 per cent element is not necessary to achieve these aims.

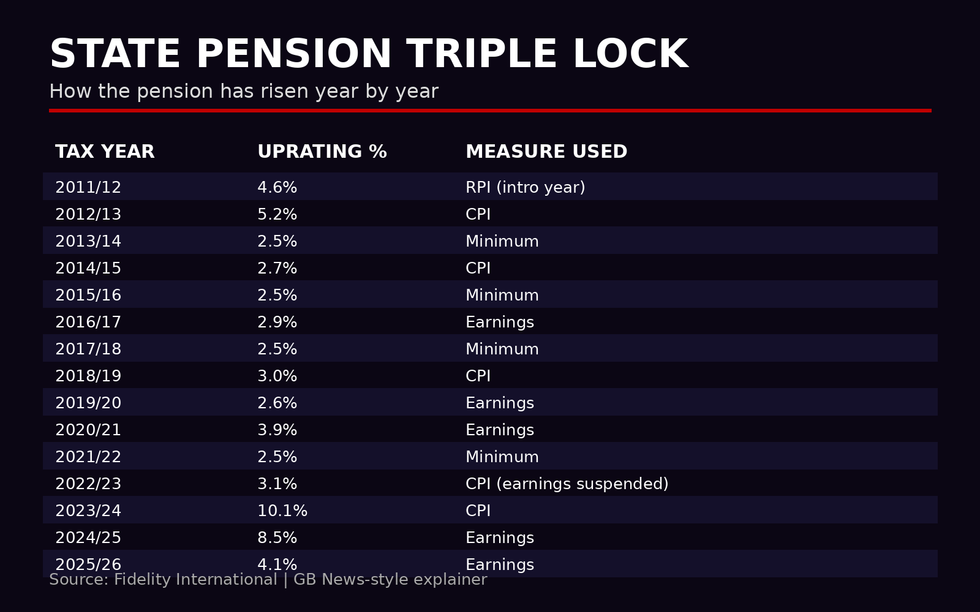

The pensions expert cited that state pension payment rates have only jumped by 2.5 per cent four times since the triple lock's introduction in 2011-12.

He also noted the biggest jump in retirement benefits the element has awarded pensioners came in 2021 when the highest alternative was inflation at 0.5 per cent and the triple lock was temporarily suspended.

"In other years it has been applied the effect has been less dramatic. However, as with the triple lock generally, it is the accumulative effect of slightly higher rises year after year that can add up to a big difference over the long term," Mr Monk added.

How much has the state pension risen by thanks to the triple lock?

|GB NEWS / FIDELITY INTERNATIONAL

In order to determine the impact on state pension payments if the 2.5 per cent element was axed, Mr Monk instead applied the next highest measure in the years it was used.

He shared: "To do this I’ve worked out the effect on £100 of state pension income from 2011 until now, rather than the actual value of the benefit, because what counts as a full state pension has changed in that time."

"With the full triple lock in place £100 of the state pension in 2011/12 will have grown to £180.70 in 2025/26. Had a "double lock’" of just the highest of wages or CPI been applied, the figure in 2025/26 would stand at £174.24.

"The difference will clearly grow if more years arrive when the 2.5 per cent measure is used. That won’t be next year when a 4.8 per cent rise based on wages will be applied but with inflation and wages headed downwards the 2.5 per cent promise could prove valuable again very soon."

LATEST DEVELOPMENTS

How much will the state pension triple lock cost the British taxpayer? | OBR

How much will the state pension triple lock cost the British taxpayer? | OBR Ahead of her Budget on November 25, Chancellor Rachel Reeves reaffirmed the Labour Government's commitment to the triple lock despite growing opposition to the policy.

The Chancellor said: "Whether it's our commitment to the triple lock or to rebuilding our NHS to cut waiting lists, we're supporting pensioners to give them the security in retirement they deserve."

State pensions are in line to receive a 4.8 per cent rate increase, in line with average earnings growth, in April 2026. Full, new payments will rise £241.30 per week or £12,547.60 a year while the basic state pension, for those reaching pension age before April 2016, will rise to £184.90 per week; the equivalent of £9,614.80 a year.