State pension targeted by HMRC as Rachel Reeves 'pushing more pensioners into paying tax'

Analysts are sounding the alarm over the coming collision between the state pension triple lock and frozen tax thresholds

Don't Miss

Most Read

Latest

Chancellor Rachel Reeves is "pushing more pensioners into paying tax" with her Budget reforms, analysts warn. The Chancellor's November 26's fiscal statement confirmed that the current freeze to tax thresholds will be extended until 2031.

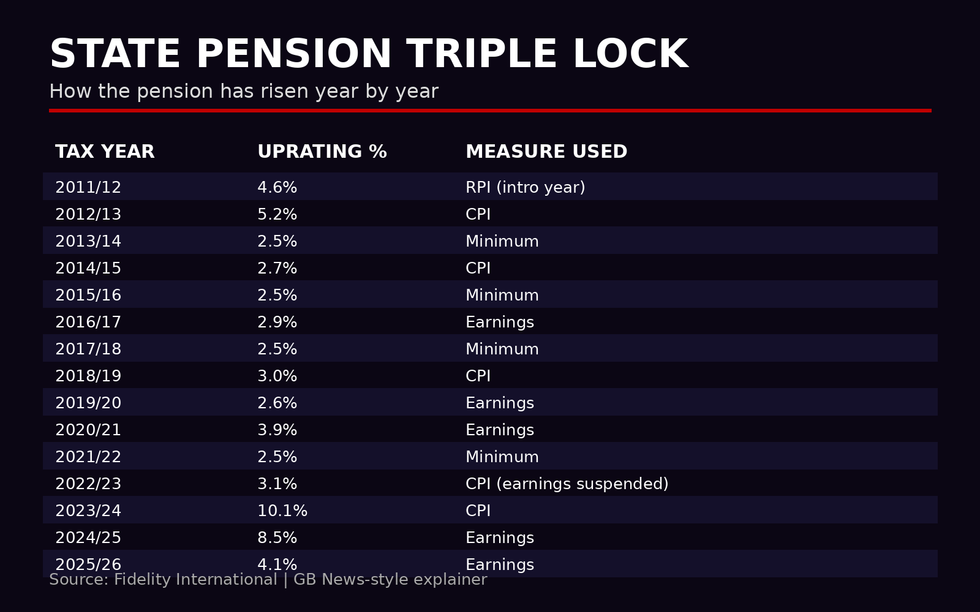

During her speech, Ms Reeves reaffirmed the Labour Government's commitment to the triple lock which determines annual rate hikes to the state pension but economists not this will make retirees pay more to HM Revenue and Customs (HMRC).

Thanks to the triple lock, pension benefit payment rates from the Department for Work and Pensions (DWP) rise every year by either the rate of inflation, average wages or 2.5 per cent; whichever is highest.

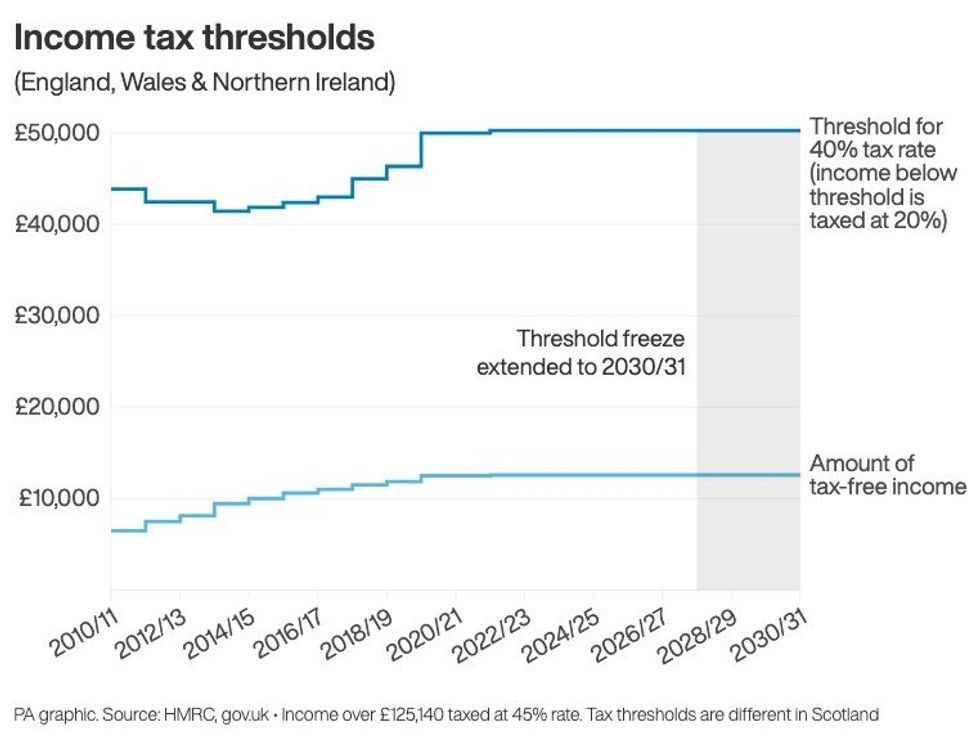

The combination of the triple lock hike to state pension payments and frozen tax thresholds results in fiscal drag, which results in people being pulled into higher tax brackets.

The Chancellor is being accused of 'pushing pensioners into paying tax'

|GETTY

With the income tax personal allowance stuck at £12,570 since 2021 and set to remain frozen until at least 2028, the full new state pension is edging ever closer to breaching the tax-free limit, raising the prospect that many pensioners will soon pay income tax on their payments for the first time.

This shift is particularly significant because the state pension is intended to provide a basic foundation of income in retirement, not a taxable top-up.

As annual increases continue to push payments higher while allowances stand still, more older people are quietly being pulled into the tax system without any formal rise in tax rates.

George Williamson, the CEO of probate lending firm Level Group, warned that while the state pension "doesn’t add to your estate itself, as payment stops when you die," it nevertheless "does highlight a fiscal drag problem and have an indirect impact on inheritance tax, as more people are dragged into higher tax bands and thus have a higher estate value".

How will the income tax threshold freeze impact you? | PA

How will the income tax threshold freeze impact you? | PA Mr Williamson explained that frozen thresholds combined with rising income mean "more retirees will pay income tax, and if they save rather than spend, their estates could grow, increasing future inheritance tax exposure".

As well as this, the Chancellor previously confirmed pension assets would considered part of someone's estate for inheritance tax (IHT) purposes from 2027. IHT is levy charged on the estate of someone, including their money, possessions and property, once they pass away.

It is current charged at 40 per cent on estates valued above £325,000 but relief is available in certain circumstances. Notably, the inheritance tax threshold is also frozen.

Caroline Abrahams, the charity sirector at Age UK, said the Government’s decision to freeze the personal allowance for a further three years will "drag more older people into paying income tax, including some on low and modest incomes who need all the help they can get to sustain a decent standard of living at a time when prices for essentials are constantly rising".

Ms Abrahams described the move as "deeply regrettable," particularly because it will last for a full three years, even if some of the impact may be partially offset by higher state pension payments under the triple lock.

She stressed that the triple lock is “more important than ever for pensioners now,” as it provides vital protection at a time when food, energy and housing costs remain elevated.

However, Ms Abrahams warned that allowing fiscal drag to erode pension increases risks undermining the policy’s core purpose.

The pension expert welcomed the Government’s announcement that it will explore ways to ensure people receiving only the old basic state pension or the new state pension do not have to submit a simplified tax return, calling it an important recognition that many older people are digitally excluded.

LATEST DEVELOPMENTS

How much has the state pension risen by thanks to the triple lock? | GB NEWS / FIDELITY INTERNATIONAL

How much has the state pension risen by thanks to the triple lock? | GB NEWS / FIDELITY INTERNATIONAL Furthermore, she warned that simply issuing tax bills and expecting immediate payment from low-income pensioners “would be unthinkable.”

Critics note those most affected by fiscal drag are likely to be pensioners with modest supplementary income from small private pensions or part-time work, rather than the wealthiest retirees.

In practice, frozen thresholds combined with rising state pension payments allow the Treasury to reclaim a portion of headline increases through taxation without formally raising rates.

More From GB News