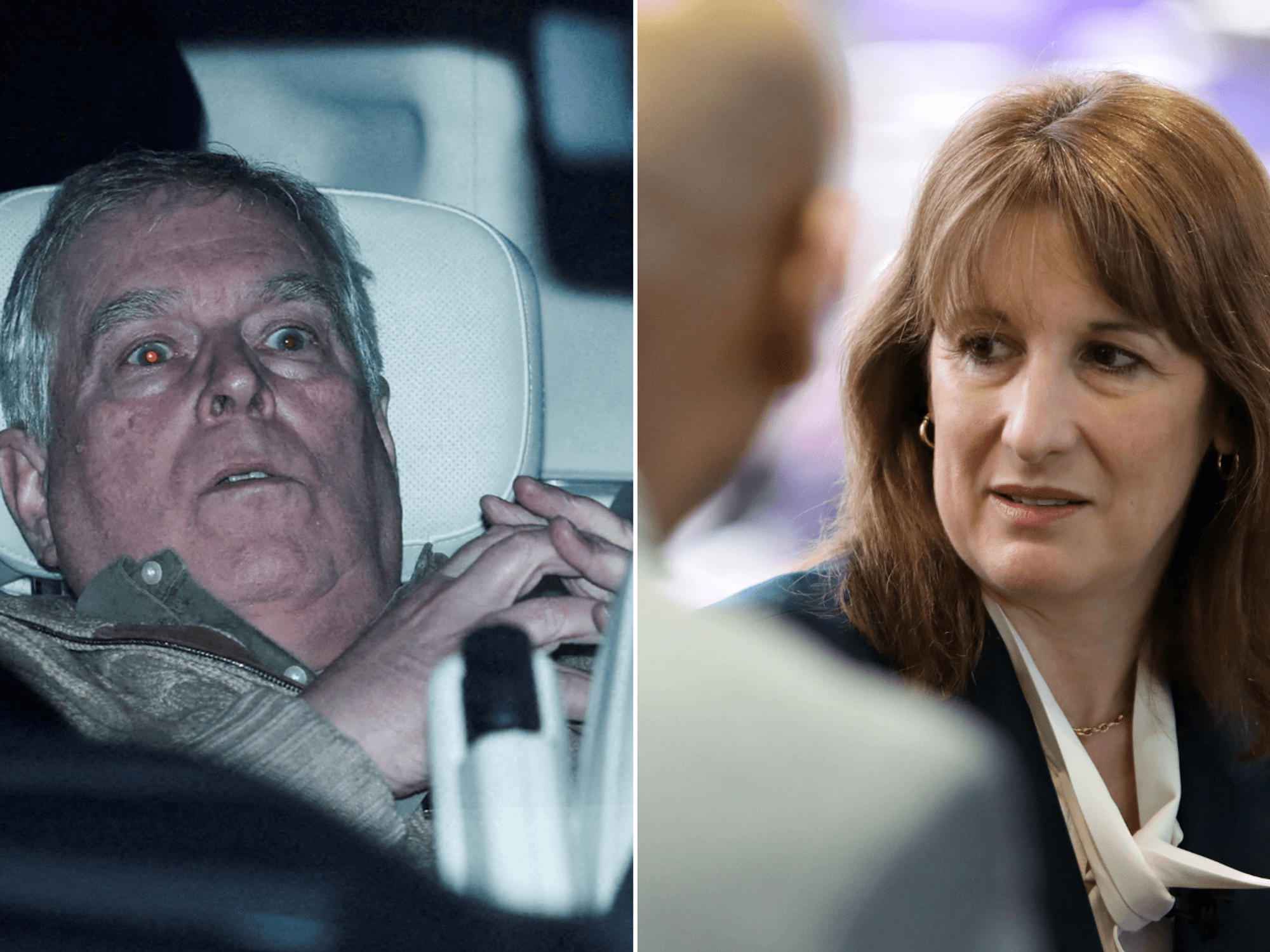

Coventry Building Society to raise mortgage rates in ‘another blow to aspiring homeowners’

British public react to interest rate being kept at 5.25 per cent

|GB NEWS

Various lenders have raised mortgage rates again recently with Coventry Building Society being the latest to announce hikes

Don't Miss

Most Read

Coventry Building Society has become the latest high street lender to raise mortgage rates in “another blow to homeowners” and those hoping to get on the property ladder.

The building society confirmed that interest rates would be hiked from tomorrow for all new residential and buy-to-let products.

This decision comes after similar moves from other lenders, including Santander and Nationwide, which have opted to hike rates amid changes to the property market.

Over the past two years, homeowners have been forced to deal with high mortgage repayments following the Bank of England’s decision to hike the base rate in its fight against inflation.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

The building society is set to raise mortgage rates tomorrow

|GETTY

Darryl Dhoffer, an adviser at The Mortgage Expert, described the building society’s action as “another blow to aspiring homeowners”.

He explained: “This latest increase comes on the heels of previous upward adjustments, painting a concerning picture of an institution seemingly prioritising profit over the dreams of potential property owners.

“While Coventry cites economic factors as justification for their decision, it’s crucial to recognize the cumulative effect of these repeated hikes.

“Each increase chips away at affordability, pushing the goal of homeownership further out of reach for many. This disproportionately impacts young people and those on lower incomes, exacerbating existing inequalities in the housing market.”

Since August 2023, the Bank of England’s base rate has remained at 5.25 per cent after numerous rate hikes to ease inflation.

Interest rates have remained at this level since then with the UK’s Consumer Price Index (CPI) floating around four per cent in recent months.

Despite recent decisions by lenders, the average interest rate across multiple mortgage products has dropped slightly over the weekend.

According to Moneyfacts, the average two-year fixed residential mortgage rate today is 5.73 per cent which is down from an average rate of 5.74 per cent on the previous working day.

LATEST DEVELOPMENTS:

The Bank of England base rate is at a 15-year high of 5.25 per cent | GB NEWS

The Bank of England base rate is at a 15-year high of 5.25 per cent | GB NEWSFurthermore, the average five-year fixed residential mortgage rate is sitting at 5.30 per cent, in a slight jump from 5.31 per cent from last Friday.

For buy-to-let products, the average two-year mortgage rate is 5.51 per cent in a drop from 5.53 per cent.

Furthermore, five-year BTL residential mortgage rates are at 5.50 per cent in a small dip from 5.52 per cent last week.

Currently, the average two-year tracker rate is 6.14 per cent which is unchanged from the previous working day’s interest rate.