Coventry Building Society issues ISA tax warning as 'it's now more important than ever to protect savings'

The tax-free allowance attached to ISAs is being reduced from next year in a blow to savers

Don't Miss

Most Read

Coventry Building Society has issued a stark warning to Britons, stating that "it’s now more important than ever to protect savings" ahead of a looming tax raid from HM Revenue and Customs (HMRC).

During last year's Budget, Chancellor Rachel Reeves confirmed changes to ISA rules, with the tax-free allowance for under-65s set to fall from £20,000 to £12,000 from April 2027.

This latest intervention from the building society comes after the Bank of England found that savers deposited £ 5.1billion into cash ISAs ahead of the Chancellor's fiscal statement.

Notably, the spike in Britons prioritising tax-free savings represents the highest amount placed into the product outside the traditional April ISA season in more than 10 years.

Coventry Building Society has launched a savings warning

| COVENTRY BUILDING SOCIETYThe central bank's figures found that money placed into cash ISAs accounted for 76 per cent of all deposits for the month, with Ms Reeves's delivering her Budget on November 26.

Analysts note this suggests that many savers in the UK rushed to use up their tax-free allowance before any anticipated changes to cash ISA rules could be announced.

Jeremy Cox, the head of Strategy at Coventry Building Society, broke down why bank customers need to be proactive in ensuring their savings are protected by the taxman.

He said: "The thought of paying more tax than necessary on hard-earned savings is a strong incentive to open a cash ISA. It’s why these accounts have had enduring appeal with savers over decades – and it’s why we’ve seen a rush to save tax-free in November.

ISAs are useful tools for those looking to save more than the personal savings allowance threshold without having to pay tax | GETTY

ISAs are useful tools for those looking to save more than the personal savings allowance threshold without having to pay tax | GETTY"We usually see a flurry of ISA deposits in March and April as people make the most of their allowances before the end of the tax year.

"Speculation that the cash ISA or tax-free pension limits would be reduced prompted many to act sooner. We’re still expecting another strong ISA season this year but it’s unlikely we’ll see another spike like this.

"While the Chancellor has confirmed that cash ISA allowances for under-65s will fall to £12,000, savers still have time to maximise their allowances, with the full £20,000 cash limit remaining available this tax year and again before it reduces in April 2027.

"But it’s now more important than ever to protect savings within an ISA, particularly for younger savers – those over 65 retain the higher £20,000 limit for now.

LATEST DEVELOPMENTS

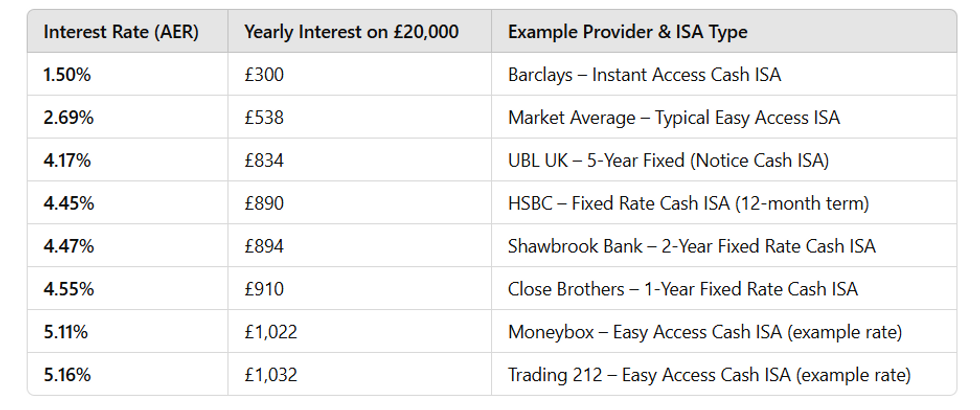

Examples of tax free Isa earnings in the UK if you had £20,000 in the Isa | GBN

Examples of tax free Isa earnings in the UK if you had £20,000 in the Isa | GBN"The further two per cent tax hike on savings interest and frozen income thresholds will drag more people into higher tax bands, where the Personal Savings Allowance is reduced or removed entirely.”

To mark the New Year, savings experts are urging households to grapple with their finances and find ways to make their money go further in the months ahead.

Matthew Blakstad, the deputy director of Strategic Policy and Research, at Pensions UK, added: "The start of a New Year is the perfect time to reset financial goals.

"While everyday needs often take priority, it is encouraging to see people increasingly willing to take action on pensions. However, experience shows that our best-laid plans for our pensions don’t always translate into action.

"Almost a third of savers told us they would increase their contributions if they reviewed their pensions - a significant rise on last year.

"This demonstrates that the appetite is there and reinforces why Government should revisit Automatic Enrolment contribution levels. Many savers are already prepared to pay more, which would help them achieve the lifestyle they want in retirement."

Adrian Murphy, CEO of Murphy Wealth, added: "The UK is a nation of cash savers and the reduction of the cash ISA limit to £12,000 per year from April 2027 won’t change everyone’s attitudes on that front.

"But the Chancellor evidently wants people to invest more of their savings and is going to reduce the attractiveness of holding cash, or better incentivise investing in stocks and shares, to make that happen."

More From GB News