Savers flood £5.1billion into ISAs amid Rachel Reeves tax raid rumours

Bank of England data shows November surge before ISA rule changes

Don't Miss

Most Read

Latest

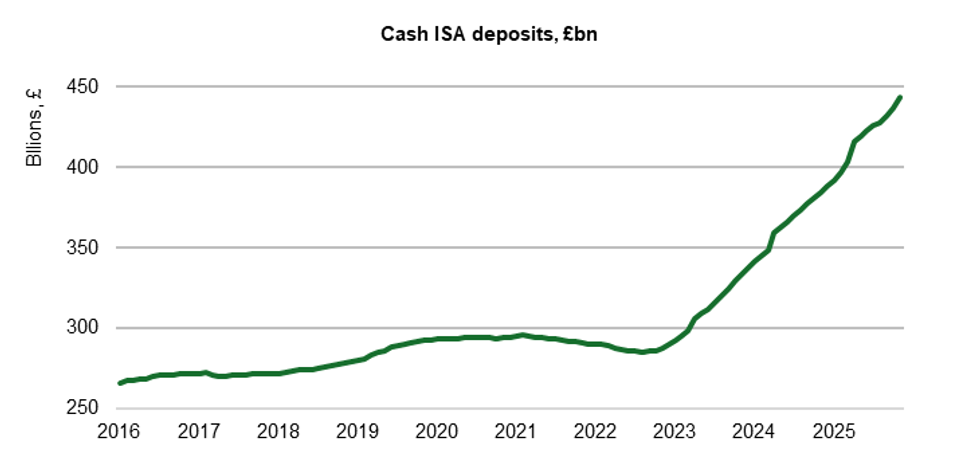

British savers poured a record £5.1billion into cash ISAs before the November Budget, according to Bank of England figures released this morning.

The total for the month was around four times higher than the typical amount deposited in recent years.

The surge pushed total cash ISA holdings across the UK to £443billion.

The increase in tax-free saving activity came as speculation intensified ahead of the Autumn Budget, with savers anticipating possible changes to ISA rules.

Households appeared to accelerate deposits in order to use allowances before any restrictions were announced.

The Bank of England data shows the spike occurred during a period of heightened uncertainty over future savings policy.

In the weeks leading up to the late November budget, reports circulated suggesting the Government was considering reforms to cash ISA limits.

As a result, many savers moved funds into tax-free accounts before the Chancellor set out her plans.

Those actions came ahead of Chancellor Rachel Reeves confirming that the cash ISA allowance will be reduced to £12,000 from April 2027 for savers under the age of 65.

The announcement followed widespread debate about how the savings system could be reshaped in future budgets.

For younger savers, the planned change will limit the amount of money that can be sheltered from tax each year.

Savers poured a record £6.7billion into cash ISAs during November 2025

|GETTY

The November figures indicate that savers acted before the policy position was made clear.

Ian Futcher, financial planner at Quilter, said: "The rumour mill surrounding the Chancellor's ISA changes seemingly spurred more people to pile money into their savings."

He analysed the Bank of England’s Money and Credit data, which also showed households deposited £8.1billion with banks and building societies during November.

That figure marked an increase from £6.7billion recorded in October.

"The latest Money and Credit data from the Bank of England show £5.1billion was ploughed into ISAs ahead of the late November budget as savers pre-empted the Chancellor's plans," Mr Futcher said.

LATEST DEVELOPMENTS

Deposits spiked as savers rushed to beat Rachel Reeves's Budget changes

|Simon French

Net mortgage approvals fell to 64,500 during November, down from the previous month.

Mortgage borrowing by individuals increased slightly to £4.5billion.

That followed a £1billion fall to £4.2billion in October.

The Bank of England said the data reflected subdued activity while households waited for clarity on fiscal policy.

Remortgaging approvals moved in the opposite direction, rising by 3,200 to 36,600.

The increase came as falling swap rates reduced mortgage costs for some borrowers.

The figures suggest some homeowners opted to refinance existing loans rather than take on new borrowing.

Consumer credit use rose as the Christmas period approached.

Net consumer credit borrowing climbed to £2.1billion in November, up from £1.7billion in October.

Credit card borrowing accounted for most of the increase.

Credit card lending rose to £1billion from £700million the previous month.

Mr Futcher said the overall picture reflected temporary caution rather than a collapse in demand.

The Bank said their data reflected subdued activity while households waited for clarity

| GETTYHe said: "These figures demonstrate the impact of Budget uncertainty rather than an overall lack of demand."

The Bank of England data provides a snapshot of how households adjusted their finances during a period of policy speculation.

It shows savings rising sharply at the same time as borrowing decisions were delayed.

The figures also highlight how closely savers respond to signals about future changes to tax and savings rules.